Hey Traders,

Andrew here – it’s time for our weekly “1 stock I love, 1 stock I hate” analysis. Ahead of our Ticker Highlight Show every Monday at 10 a.m. ET, the Option Pit trading team gathers their favorite and least favorite stocks of the week. Then during our live show, Mark Sebastian uses his cheap options scanner to find an easy, directional options trade for one of these stocks – and we give it away for FREE. On Monday, we entered a trade short in Apple Inc (Ticker: AAPL) via put. The trade has potential, as AAPL appears to be missing out on the current AI-driven momentum. You can view the trade in our free portfolio here. If you don’t want to miss out on next week’s trade, be sure to add it to your calendar here! Anyway, here are my picks for the week. My Short Pick: ADBE At this point, I believe there are going to be some AI losers. Hans is tracking this closely, but ultimately, price is what matters—and Adobe Inc. (Ticker: ADBE) is struggling. I recently sold all my ADBE shares above $400 and have no plans to re-enter the position.

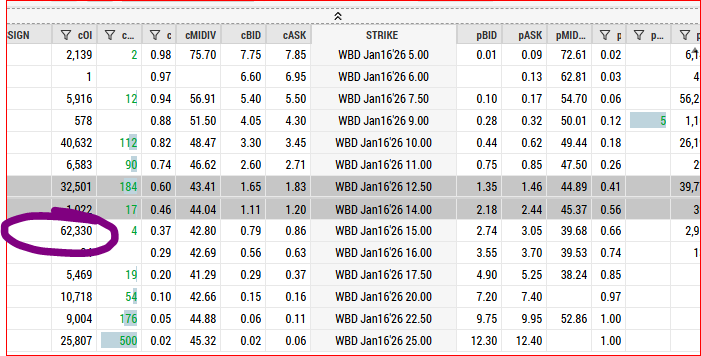

3 month ADBE chart with 1 day candles 20 day realized volatility (blue) with 30 day implied volatility (red) for ADBE Realized volatility in ADBE is currently quite low, indicating that traders are gradually exiting rather than rushing out. However, selling pressure could accelerate if the stock breaks below $350. With options prices also remaining low, it’s clear that in a market where tech and AI are soaring, ADBE is being left behind. My Long Pick: WBD This week, my top pick is Warner Bros Discovery Inc. (Ticker: WBD), which has just reached a six-month high following an extended and challenging restructuring of its media assets. I anticipated WBD’s rebound after they shifted their content strategy toward more mainstream appeal and away from niche areas. It’s a featured stock in my Flash 10 portfolio, currently up around 30% since inception. I continue to hold both shares and call options in WBD. This surge in open interest came out of nowhere. Since April 21st—the bottom for WBD—traders have aggressively bought the longer-term January 2026 $15 calls. Open interest jumped from 19,000 to 60,000, with nearly every other strike also seeing increased OI. That’s a 50% plus jump in OI in 3 months.

Option Fingerprints for WBD I’m targeting $18 by year-end as the turnaround gains momentum. Curious if we’ll be trading my picks this week? Join me Monday at 10 a.m. ET to find out Add the Ticker Highlight Show to your calendar here.

To your Trading Success, |