July 17, 2025

Washington’s Whirlwind Crypto Week Sparks Volatility and Hope

Dear Subscriber,

|

| By Jurica Dujmovic |

Picture this …

Bitcoin (BTC, “A-”) hits a record $120,000.

In response, crypto investors pop champagne. And Congress decides to dedicate an entire week to legitimizing digital assets.

What could possibly go wrong?

Well, as it turns out, quite a lot.

What was supposed to be crypto's coronation on Capitol Hill instead became a masterclass in political self-sabotage.

And it proved once again that even when politicians are on your side, they can't resist making things complicated.

Welcome to "Crypto Week."

The Setup: Three Bills to Rule Them All

Going into July 14-18, the crypto community was practically giddy with anticipation.

That’s because it was the first time in history that a branch of Congress dedicated an entire week to crypto legislation. Three landmark bills were teed up to provide the regulatory framework that investors had been begging for since, well, forever.

They are:

1. The GENIUS Act, which we’ve covered before.

As a reminder, this bill tackles stablecoin regulation with the kind of common-sense approach that makes you wonder why it took this long.

It allows banks and other entities to launch their own stablecoins. But these dollar-backed cryptos would need full backing in liquid assets like cash or short-term Treasurys, plus regular, audited disclosures.

This legislation aims to legitimize stablecoins as part of the mainstream financial system. Which could potentially be huge for adoption by banks and payment providers. And it would be a solid step in keeping the dollar as the default fiat for stablecoins across the crypto market.

For investors, this is significant. Companies like Circle — issuer of USD Coin (USDC, stablecoin) — have already embraced the framework. In fact, Circle even moved to obtain national trust bank charters.

Meanwhile, foreign issuers like Tether (USDT, stablecoin) would face new transparency hurdles that they've historically avoided.

Translation: Cleaner, more trustworthy stablecoins that could drive institutional adoption.

2. The CLARITY Act, which addresses the trillion-dollar question: When is a crypto token a security versus a commodity?

The bill introduces "digital asset commodities" and defines criteria for CFTC versus SEC oversight. In short, if a cryptocurrency is sufficiently decentralized with a transparent ledger, it could be deemed a commodity under CFTC jurisdiction.

This could finally end the regulation-by-enforcement era that saw the SEC sue multiple exchanges during the previous administration.

3. The Anti-CBDC Surveillance State Act, which is refreshingly straightforward.

it would prohibit the Federal Reserve from issuing a central bank digital currency.

If you’ve read my updates before, you’ll know how I feel about those.

Championed by House Majority Whip Tom Emmer and aligned with President Trump's opposition to a "digital dollar," this bill is about preserving financial privacy by preemptively blocking government-controlled digital currency.

The Plot Twist: When Your Own Team Tackles You

Just when everything seemed aligned for a crypto victory lap, the Republican Party decided to get in its own way. Or at least, that’s how it looked from the outside.

On Tuesday, July 15, what should have been a routine procedural vote turned into a stunning setback when a faction of conservative Republicans joined all Democrats to block the crypto bills from advancing.

The final tally was 196 in favor to 223 against, a rare defeat for the GOP-controlled House on a rule vote that left crypto proponents stunned.

The rebellion came primarily from the House Freedom Caucus, including Reps. Marjorie Taylor Greene, Andy Biggs and Chip Roy.

Their gripe? The GENIUS Act didn't include an explicit ban on a Federal Reserve digital currency. These lawmakers feared passing stablecoin regulation without simultaneously enacting the CBDC ban would "create a 'backdoor' to a Central Bank Digital Currency."

Enter the Dealmaker-in-Chief

Faced with the derailment of his crypto agenda, President Trump did what he’s best known for: He made a deal.

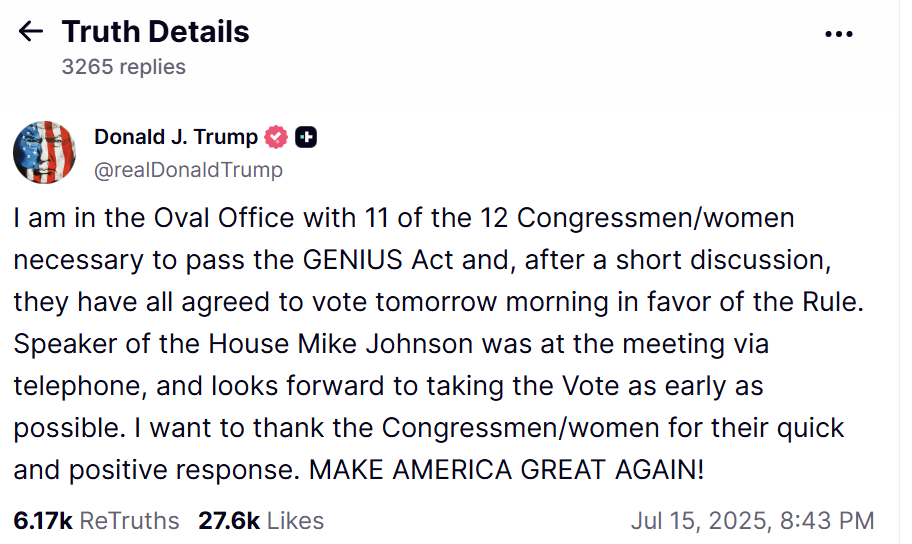

In a dramatic twist worthy of a political thriller, Trump invited the key GOP holdouts to the Oval Office late Tuesday night for what he described as a "frank discussion."

According to ABC News, Trump met with "11 of the 12" Republican members whose votes were needed and secured their agreement to support the procedural rule.

Source: Truth Social

House Speaker Mike Johnson quickly thanked Trump for intervening to "lock down the necessary votes."

And by Wednesday morning, the House reconvened to pass the procedural rule with the necessary votes.

Market Whiplash: When Politics Meets Price Discovery

For crypto investors watching from the sidelines, the Congressional rollercoaster produced predictable market volatility.

Bitcoin had hit record highs above $120,000 heading into Crypto Week, reflecting investor optimism about regulatory clarity.

But news of the House's unexpected stumble on July 15 put a temporary chill on the rally. CoinDesk reported that BTC and Ethereum (ETH, “A-”) knee-jerked lower by roughly half a percent when word broke that the crypto bills were stalled.

More dramatically, Circle — fresh off of its IPO on the New York Stock Exchange — saw its stock drop nearly 5% after the House vote failed.

However, the downturn proved short-lived.

Once Trump signaled a deal with Republican holdouts, market sentiment quickly rebounded. By Wednesday, Bitcoin climbed back above $118,000-$119,000, roughly where it started the week.

The quick recovery reflected the market's underlying bullishness and belief that legislative momentum would ultimately carry through. Institutional inflows into crypto investment vehicles remained strong throughout the week, with U.S.-listed spot Bitcoin ETFs reportedly seeing over $400 million of net inflows on Tuesday alone.

Wednesday’s inflows surged even higher to almost hit $800 million.

The Investor's Takeaway: Clarity Is Ahead … Eventually

As Crypto Week concludes, there’s a key lesson investors should walk away with.

And that is that while U.S. crypto policy is advancing … we’ll still see some Washington-style drama.

As usual, the politicians tend to muddy the waters before we can hit smooth sailing. This week was a reminder that even in the most crypto-friendly political environment in U.S. history, democracy is messy and markets hate uncertainty.

But it also proves that crypto has gained enough legitimacy to command a full week of Congressional attention.

And prompt a presidential intervention.

For crypto investors, the message is clear: Buckle up for more volatility as these bills work through the legislative process … but keep your eyes on the prize.

When regulatory clarity finally arrives, it could unleash a new wave of institutional investment and innovation on American soil.

Best,

Jurica Dujmovic

P.S. While crypto navigates the rough process of improving regulations, there’s another alternative market that’s already paved over its bumps in the road …

The private equity market.

My colleague Chris Graebe is an expert at navigating the pre-IPO space. And he’s recently found a little-known company that’s about to disrupt one of the most lucrative industries on earth.

Successful deals in this sector offered returns as high as 900% … 19,942%, 53,423% and more.

Those are returns that can rival what was available in the early days of crypto!

Naturally, when Chris reveals this deal, he expects it to fill up fast.

So, he’s giving you the chance to learn more about it now. And get on the list to be one of the first to know when the time is right to dive in.

He’ll do all that this coming Tuesday, July 22, in his Summer 2025 Private Investment Summit.

It’s free for Weiss Members to attend. All you need to do is RSVP to save your seat now.