*Key U.S. regional manufacturing sentiment indexes have surged passed expectations in early 2020, reflective of the easing of trade tensions that spiked uncertainty over the last two years, and are seemingly resilient thus far to the threat of the coronavirus (COVID-19). It is too early to determine the spillover effects from the coronavirus via disruptions in supply chains and trade, and drop-off in demand from China, but the improvement in sentiment thus far is worth noting (China’s economy: after the fall, what kind of recovery?, February 19, 2020).

*The Philadelphia Fed manufacturing index more than doubled in February to 36.7 from 17.0 previously, the highest level since February 2017 and seven of its nine underlying subindexes increased, and the Empire State manufacturing index increased by 8.1pts to 12.9 in February, the highest level since May 2019 (Chart 1).

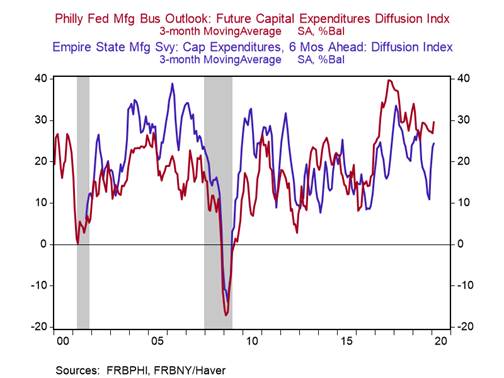

*The surveys provided a mixed picture on future manufacturing activity -- the six-month-ahead general business conditions index in the Philadelphia Fed manufacturing survey jumped by 7pts to 45.4, the highest level in two years, but declined in the Empire State manufacturing survey by 0.7pt to 22.9 (Chart 2).

The ISM-adjusted Philadelphia Fed manufacturing index (average of new orders, shipments, employment, supplier delivery times, and inventories indexes), which better reflects current underlying manufacturing conditions than its headline sentiment index, increased by 3.3pts to 58.0 (>50 = expansion territory), due to sizable increases in its news orders (+15.4pts to 33.6) and inventories indexes (+14.1pts to 11.8). Its shipments index increased to 25.2, the highest since June 2018, but its average workweek index remained fairly low, despite doubling to 10.3. See Chart 3.

The ISM-adjusted index for the Empire State manufacturing survey increased by 4.8pts to 56.9 due to large increases in four of its five underlying indexes: new orders (+15.5pts to 22.1), shipments (+10.3pts to 18.9), supplier delivery times (+11pts to 8.3), inventories (+13.6pts to 12.9).

Growth in manufacturing employment (totaled a slight 26k over the last 12 months) likely remained weak in February despite the marked improvement in sentiment. The Empire State manufacturing’s number of employees index declined by 2.4pts to 6.6, a six-month low, and the Philadelphia Fed’s employment index declined by 9.5pts to 9.8 (Chart 4).

Respondents to the Philadelphia Fed manufacturing survey marked up expectations for six-month ahead new orders (+12.1pts to 54.0), shipments (+9.5pts to 51.9), and the average workweek (+13.6pts to 26.8), while the capex index (-3.1pts to 29.8) – reliable leading indicator for business fixed investment –declined but remained fairly elevated. The details of the six-month-ahead section of the Empire State manufacturing survey were softer than the current conditions section, with 10 of 11 subindexes declining, but its future capex and technology spending indexes remained at solid levels (Chart 5).

Taken together, the details of these two regional manufacturing sentiment surveys suggest that a rebound in U.S. factory floor activity is well under way.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Roiana Reid, [email protected]