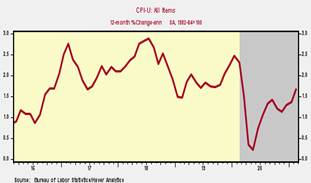

*The headline CPI increased 0.4% in February, lifting its yr/yr rise to 1.7%, while the core CPI inflation excluding food and energy increased 0.1%, lowering its yr/yr rise to 1.3% from 1.4%. While the headline CPI inflation is retracing its pandemic-related decline, the core CPI inflation remains close to its recent lows (Charts 1 & 2).

*Energy prices increased 3.8%, their third consecutive sizable monthly increase, as higher oil prices are pushing up retail energy prices. This trend is expected to continue in the coming months.

*Most categories of the CPI show relatively tame inflation, as the economy recovers from its deep contraction. Categories like apparel and motor vehicle sales registered monthly declines. Shelter, including rents and owner occupied rental equivalent, is up 2% yr/yr, despite double-digit increases in home prices.

Inflation is expected to jump in the coming months, as monthly increases will replace declines in March and April 2020, and higher oil prices work their way into retail energy prices. The Federal Reserve will emphasize that these anticipated increases will be temporary, due to one-time events.

Whether inflation pressures subsequently mount critically depends on the magnitude of the pickup in the economy, its sustainability, and how the economic environment affects product pricing. Business decisions on product pricing and wages depend on a host of factors, including operating costs, product demand, and inflationary expectations. Operating costs are rising for many businesses. Inflationary expectations are already on the rise in anticipation of a reopening of the economy and the unprecedented pipeline of fiscal and monetary stimulus.

If strong economic growth unfolds and is sustained, as we have forecast (Strong U.S. Growth, Inflation, and the Fed’s Challenges, February 11, 2021), then businesses will have flexibility to raise product prices, which will be reflected in higher inflation.

We are entering a very interesting period. But, for now, the CPI inflation remains modest.

Chart 1.

Chart 2.

Mickey Levy, [email protected]