January JOLTS report reaffirms strong labor demand and supply shortages

*Despite the wave of COVID-19 infections associated with the omicron variant, and an associated withdrawal from high-contact, in-person activity, January’s JOLTS data suggests labor demand remained robust in January, while labor markets continue to be historically tight. We expect continued labor market tightness, amid strong demand, and rising inflation and inflationary expectations to continue to exert upward pressure on nominal wages.

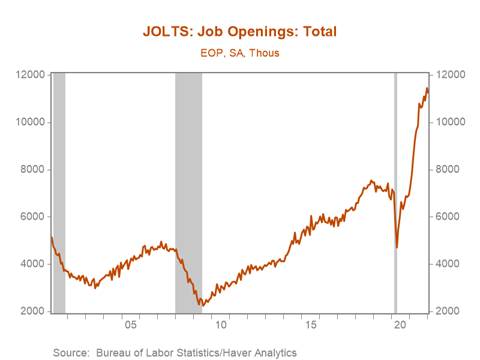

*Job openings edged down 190k from December’s upwardly revised and record-high 11.5m to 11.3m in January, while the job opening rate declined 0.1pp to 7% (Chart 1). The fall in job openings partly reflects the impact of the omicron variant with the decline in job openings concentrated in the leisure and hospitality (-314k) and trade, transportation and utilities (-110k) sectors, that have typically been more sensitive to public health conditions. Notably, job openings in manufacturing jumped 110k to 885k, and are more than double their pre-pandemic level, reflecting continued strong demand for manufactured goods. Respondents to manufacturing sector purchasing manager surveys consistently highlight labor shortages and the difficulty attracting and retaining workers as factors that have constrained output over the course of the pandemic.

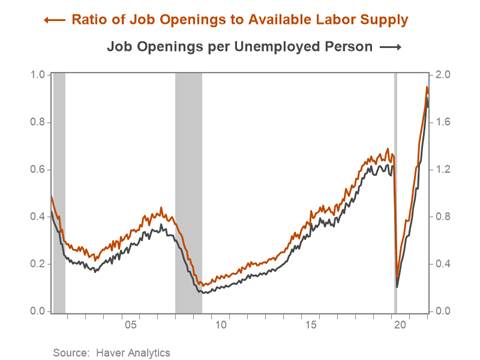

*The number of job openings per job seeker, a measure of labor market tightness tracked closely by the Fed and is measured by the ratio of job openings to unemployment, remains historically high at 1.73, despite falling modestly in January driven by the decline in job openings and a 190k increase in unemployment. An alternative measure of labor market tightness, the number of job openings relative to the available labor supply (total unemployment + number of people not in the labor force but report they want a job now) is also near historically high levels at 0.9. These gauges of labor market tightness are well above the levels they attained at the end of the prior expansion, and factors including early retirements, caregiving burdens, and declines in immigration suggest labor markets are likely to remain tight through 2022.

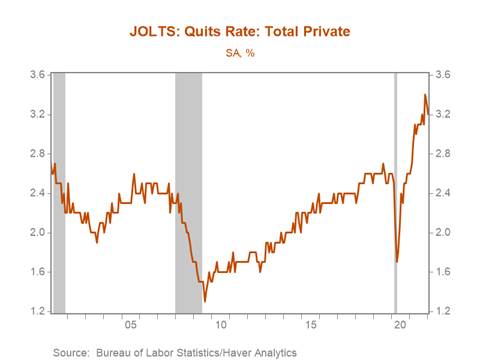

*The heightened degree of labor market tightness has tilted the balance of power in wage negotiations towards workers who are confident in their ability to secure alternative employment. Workers’ confidence in labor market conditions is reflected in the quits rate which ticked down 0.2pp to 2.8%, but remains near its all-time high (Chart 3). Total quits also remain near record highs, but have declined in December and January falling 110k and 150k, respectively. The quits rate ticked down but remains elevated in the leisure and hospitality (5.6%) and trade, transportation and utilities (3.6%) sectors, with the quits rate in both sectors approximately 1pp above their 2019 averages.

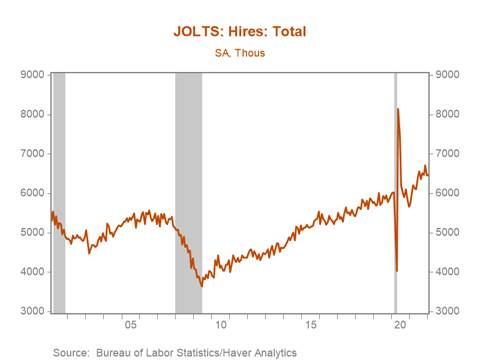

*Hiring was flat in January at 6.5m, with a significant variation in hiring patterns across industries (Chart 4). Hiring in construction fell 60k relative to December, likely reflecting adverse winter weather and material shortages that held up construction. The hires rate was flat at 4.3% and remains 0.4pp above its 2019 average. The gap between job openings and hires ticked down to 4.8m from an all-time high of 5m in December, and is indicative of the difficulties businesses have had attracting and retaining workers, despite solid payroll employment growth through the latter half of 2021. As a consequence, businesses continue to hoard labor and despite edging up 0.1pp to 1%, the layoff and discharges rate remains near an all-time low.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Mickey Levy, [email protected]

Mahmoud Abu Ghzalah, [email protected]

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.