U.S. CPI inflation rises to a 39-year high in November

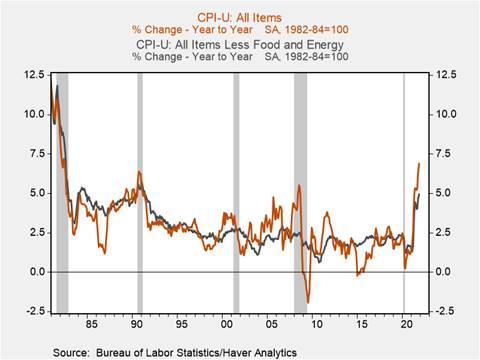

*The U.S. Consumer Price Index (CPI) increased by 0.8% m/m in November, lifting its yr/yr increase to 6.8%, a 39-year high, reflecting robust increases across a wide range of the CPI’s components that has contributed to sustained and broadening price pressures (Chart 1). November’s CPI data and the strength of the employment report’s household survey in which the unemployment rate dropped to 4.2% will likely prompt the Fed to accelerate the pace of tapering of its asset purchases following the FOMC meeting next week. Core CPI (which excludes food and energy) rose 0.5% m/m and 4.9% yr/yr supported by an increase in commodities less food and energy which rose 0.6% m/m and 9.4% yr/yr.

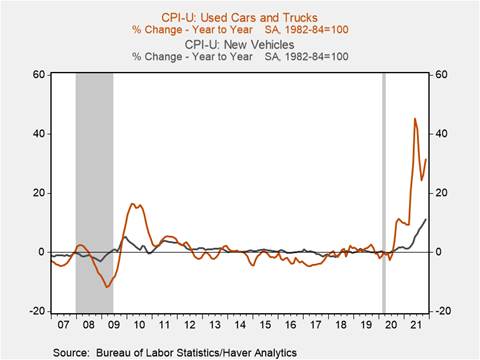

*New vehicle and used car and truck prices, which were heralded by the Fed as a sign of the ‘transitory’ nature of inflation have continued to increase. New vehicle prices rose 1.2% m/m, while used car and truck prices rose 2.6% m/m and 31.4% yr/yr (Chart 2). Surging vehicle prices reflect heightened demand and the ongoing semiconductor shortage that has crimped auto manufacturing, and continue to contribute substantially to headline measures of inflation: used vehicles contributed 0.9 pp to this month’s yr/yr increase in the CPI.

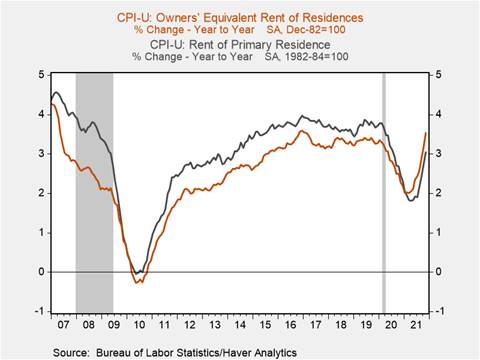

*Shelter costs have begun to accelerate reflecting the surge in home prices and their lagged impact on measures of rent and owner-equivalent rent. Owner’s equivalent rent (OER) rose 0.5% m/m, the third consecutive month in which it rose 0.4+ pp, lifting its yr/yr increase to 3.5%, while rent of primary residences rose 0.5% m/m and 3.1% yr/yr (Chart 3). Home prices have risen 19.5% yr/yr according to the S&P CoreLogic Case-Shiller home price index, while rent has risen 14.3% according to Zillow’s Observed Rent Index, and we expect a continued acceleration in the OER and rent components of the CPI through 2022-23. Increases in OER and rent, which together comprise roughly one-third of the CPI, will add substantially to headline and core measures of inflation in the near term.

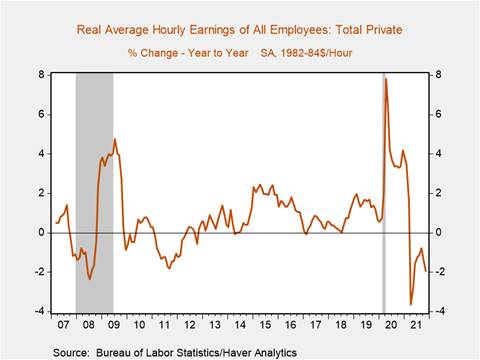

*Supply shortages, disruptions to product distribution, and strong aggregate demand supported by rising employment and nominal wages have contributed to rising goods prices. The price of commodities less food and energy rose 0.9% m/m and 9.4% yr/yr, while services less energy services has risen a more moderate 0.37% m/m and 3.4% yr/yr. Elevated inflation has contributed to a fall in real average hourly earnings of 0.5% m/m following October’s 0.6% m/m decline, leading to a yr/yr drop in real average hourly earnings of 1.94% (Chart 4). Amid a tight labor market in which labor demand significantly exceeds supply nominal wages should accelerate in a ‘catch up’ to inflation.

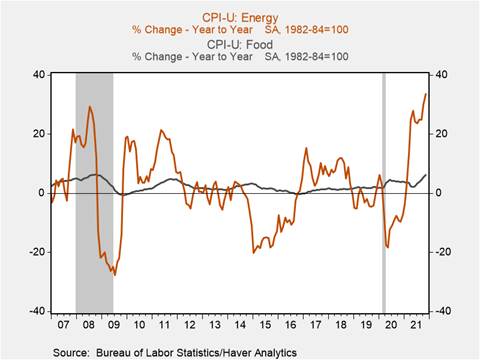

*Food and energy prices have surged, rising 0.5% and 1.5% m/m respectively, lifting their yr/yr increases to 6.1% and 33.3% (Chart 5). Together, these components contributed 2.8 percentage points to November’s yr/yr increase in the CPI. Rising food and energy prices, which are purchased relatively frequently by consumers have an outsized impact on consumer inflationary expectation formation and could contribute to elevated near-term measures of inflationary expectations. These components of the CPI also represent a large proportion of low-middle income households’ consumption baskets, and outsized increases in these CPI components have a disproportionate negative impact on their purchasing power. Recent decreases in energy commodity prices are yet to be reflected in November’s CPI data and could contribute to a moderation of the energy component of the CPI.

Chart 1. CPI and Core CPI (%, yr/yr)

Chart 2. Used and New Vehicle Prices (%, yr/yr)

Chart 3. Owner’s Equivalent Rent and Rent of Primary Residence (%, yr/yr)

Chart 4. Real average hourly earnings (%, yr/yr)

Chart 5. Food and Energy (%, yr/yr)

Mickey Levy, [email protected]

Mahmoud Abu Ghzalah, [email protected]

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.