|

|

To investors,

The Federal Reserve cracked the market in 1971 when we went off the gold standard and America’s central bank finished the job by breaking the market in 2008-2009 with the undisciplined use of quantitative easing. Prolonged bear markets have been outlawed and anyone saving in dollars is punished annually with 5% or more debasement of their economic value.

Not exactly a rosy picture for millions of Americans.

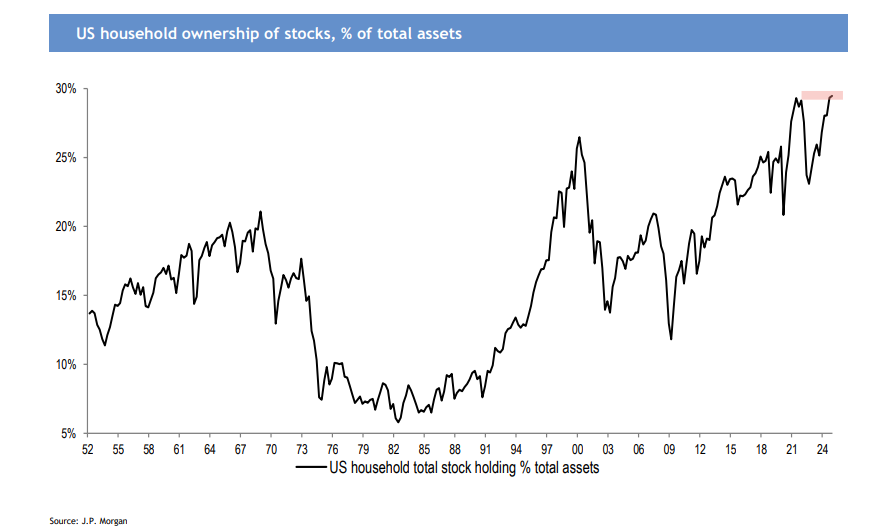

But this trend of debasement has slowly convinced more citizens to allocate their hard earned money to public equities as a percentage of their portfolio. Mike Zaccardi highlights recent JPMorgan data that shows US household stock ownership as a percentage of total assets is now at an all-time high.

As we close in on 30% in that metric, it is important to remember only 62% of Americans own stocks, according to Perplexity. This includes ownership of individual stocks as well as stocks held indirectly through mutual funds, 401(k) plans, IRAs, and other retirement accounts. Here is a breakdown of who owns those stocks:

By Income:

87% of adults in households earning $100,000 or more own stocks.

Only 28% of those in households earning less than $50,000 own stocks.

Among those with less than $30,000 in annual income, ownership drops to 25%.

By Education:

84% of college graduates own stocks.

42% of those with a high school education or less own stocks.

By Race/Ethnicity:

70% of White adults own stocks.

53% of Black adults own stocks.

38% of Hispanic adults own stocks.

By Marital Status:

77% of married adults own stocks, compared to 49% of unmarried adults.

Now we know that stock ownership, and broadly asset ownership, is a major driver of wealth in this country. But more than 30% of Americans don’t have any stocks in their portfolio, so we are seeing a big push from the private sector to improve the situation and ensure more Americans have exposure to the US economy through the stock market.

The initiative is called Invest America and the idea is to have every newborn receive $1,000 in a special account that gives them exposure to the US stock market. The concept calls for the child to hold that money until they are at least 18 years old, which would let compounding work in their favor and deliver economic value to a young adult thanks to the US government setting them up in a good position at birth.

Here is Invest America founder Brad Gerstner talking about the program at the White House yesterday:

The idea of Invest America is very popular for obvious reasons. Comedian Andrew Schulz shared yesterday “I didn’t buy a stock until I was 35 bc I was financially illiterate (still am) and it seemed too risky. Let’s get as many Americans as we can invested in the success of American industry EARLY.”

Here is Andrew talking about Invest America a few months ago:

I would love to see Invest America become the law of the land. Give every newborn child $1,000 exposure to capitalism and lets ensure we have the system working for our people, rather than against them. The Federal Reserve and politicians are never going to stop printing money, so lets not operate in some charade.

Get the kids exposure to the 500 best American companies. They will be very thankful a few decades from now. Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Anthony Pompliano on CNBC’s Squawk Box Yesterday Morning

Anthony Pompliano joins CNBC and Squawk Box to talk about bitcoin, stablecoins, Gemini filing for IPO, traditional finance meeting crypto, retail continues to buy dip, and why the world wants bitcoin and US dollars.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

EightSleep - Recently launched The Pod 5, a high-tech mattress cover you can easily and quickly add to your existing bed. Use code Anthony for $350 off your Pod 5 Ultra

Bitizenship - Get EU residency through Portugal’s Golden Visa while maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp..

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.