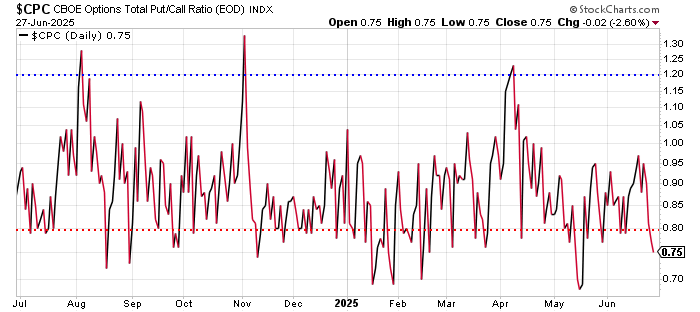

The Last Time This Indicator Flashed, the S&P Dropped 150 Points in Three Days VIEW IN BROWSER By Jeff Clark, Editor, Market Minute The last time option traders were this enthusiastic about the stock market, the S&P 500 lost 150 points in three days. Granted… it has paid off to be bullish. The S&P 500 closed at a new all-time high on Friday. So, my previous assertion that the stock market made its high for the year in February is wrong. But, that doesn’t mean I’m wrong about the risks of chasing stocks higher into an expensive, overbought environment. There are plenty of caution signs flashing – the most recent one coming from the option market. Look at this chart of the CBOE Put/Call ratio…

The CBOE Put/Call (CPC) ratio measures investor sentiment (a contrary indicator) by taking the total volume of put options traded on a given day and dividing it by the total number of call options. Whenever the ratio spikes above 1.20, it indicates traders are rushing to buy put options and make bearish bets – which is bullish from a contrarian standpoint. When the ratio drops below 0.80, traders are aggressively buying call options and betting on an upside move – which is ultimately bearish. For example, in mid-February, as the S&P was posting an all-time high above 6100, the CPC hit 0.70. The S&P 500 dropped 1100 points over the next six weeks. Recommended Link | | Elon Musk says his upcoming innovation could be the “biggest product of all time”… And by the looks of things, it could turn out to be one of the biggest profit opportunities we’ve ever seen… So much so that NVIDIA’s CEO Jensen Huang says it could be the “next trillion-dollar industry”. But if you want a shot at astronomical returns… You have to make this simple move. Because it might be the best way to potentially profit from Elon’s upcoming launch if you’re not an insider. |  | |

In mid-May, the last time we looked at the ratio, the CPC was again showing option traders were enthusiastically betting on more upside to the stock market. The S&P 500 dropped 150 points over the next three days. The CBOE Put/Call ratio closed at 0.75 on Friday. Traders are aggressively buying call options as the stock market is trading at its highest level ever. Folks don’t seem to be paying attention to “risk” anymore. Their focus is on “reward.” And, they’re pressing their upside bets. That is probably a mistake. It’s rare for the stock market to sustain any sort of rally when the CPC is this low. Yes… stocks could go higher. It is the stock market after all. Anything can happen. But, the CPC has an outstanding track record as a contrary indicator. And, traders ought to be looking over their shoulders right here. The CPC indicator is suggesting there’s at least a short-term decline in front of us – if not something even more severe. Best regards and good trading,

Jeff Clark

Editor, Market Minute P.S. This market environment is the perfect playing field for my Bill Payer strategy… Because even when the markets are chaotic and volatile, you can use what I believe is the single best income-producing strategy to make upwards of $400… in just one week. And this isnât a cherry-picked result. Iâll show you how to do it over and over again with one straightforward investment vehicle. To check out how I put this strategy to the test by paying for an entire dayâs worth of purchases around Miami, go right here. |