|

To investors,

Bitcoin hit a brand new all-time high yesterday. The digital currency has been on a tear since falling to approximately $75,000 just a few weeks ago. This means bitcoin is up over 25% in the last month, nearly 60% in the last year, and more than 1,100% over the last 5 years.

I continue to tell people — if you can’t beat it, you have to buy it. I don’t make the rules. And there are not many people who can outperform the best performing asset of the last 15 years.

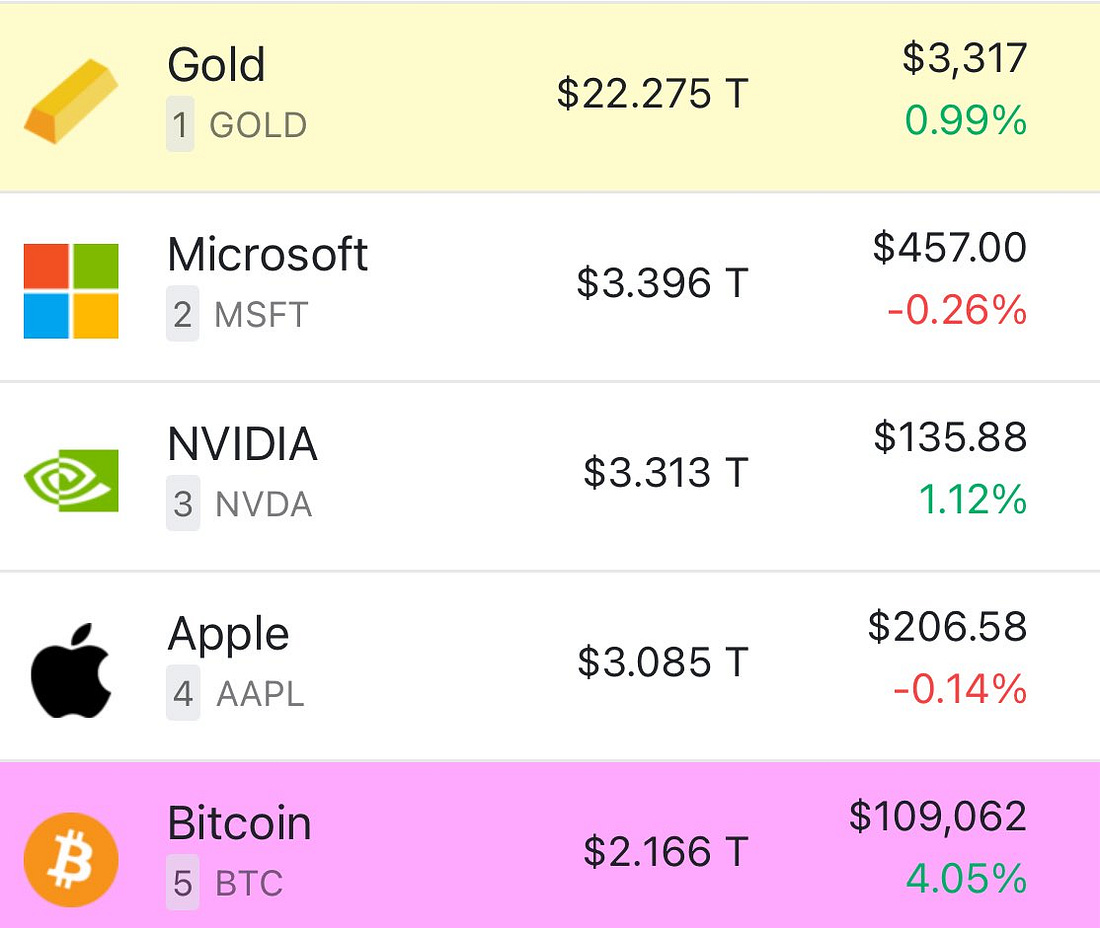

Just take a look at this chart. This is what total domination of financial markets looks like.

So why is bitcoin rising so aggressively in recent weeks? Simply, the market is pricing in tough times ahead, which makes bitcoin an attractive safe haven from the chaos. Take the latest spending bill coming from Washington as one example. As the market has learned more about its impact on the national debt and annual deficit, bitcoin started climbing higher. Peter Schiff, everyone’s favorite bitcoin hater, put it perfectly:

“The bond market is sending a clear signal that the Big, Beautiful Bill may be big, but it's anything but beautiful. 10-year Treasury yields are up to 4.62% & 30-year yields are up to 5.14%. Rates are going much higher, compounding the cost of financing the soaring national debt.”

If you dig even deeper into what is happening in the bond market, the picture gets even less fun. Adam Kobeissi explains:

“For the first time since October 2021, the US 5-Year to 30-Year bond spread has steepened to 1.00%. What does this mean? Markets are pricing-in stronger growth, higher inflation, and "higher for longer" interest rate policy. The last time this happened, CPI inflation was at 6.2%.”

One way to think about this situation is “the bond market is talking and bitcoin is listening.” That is exactly how it should be. Add in the fact that a structural setup in the last few weeks had primed bitcoin for a strong upward movement and you get the magic we are watching play out right now. Jordi Visser, a fan favorite weekly guest on my podcast, explained this short squeeze situation perfectly:

Jordi pretty much nailed it. And Will Clemente highlights bitcoin’s rise has now put it firmly in the top five global assets in the world.

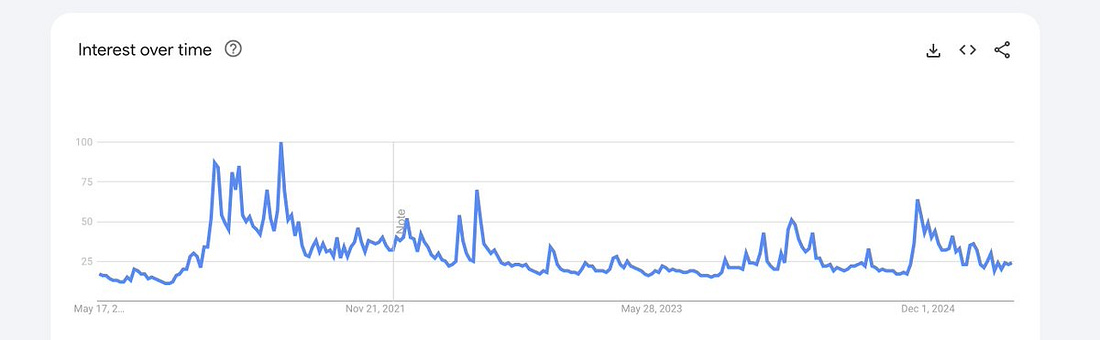

And the most insane part of this rally is that retail doesn’t even seem to notice. Jason Williams, Mr Going Parabolic, shows that Google search volumes are essentially non-existent right now.

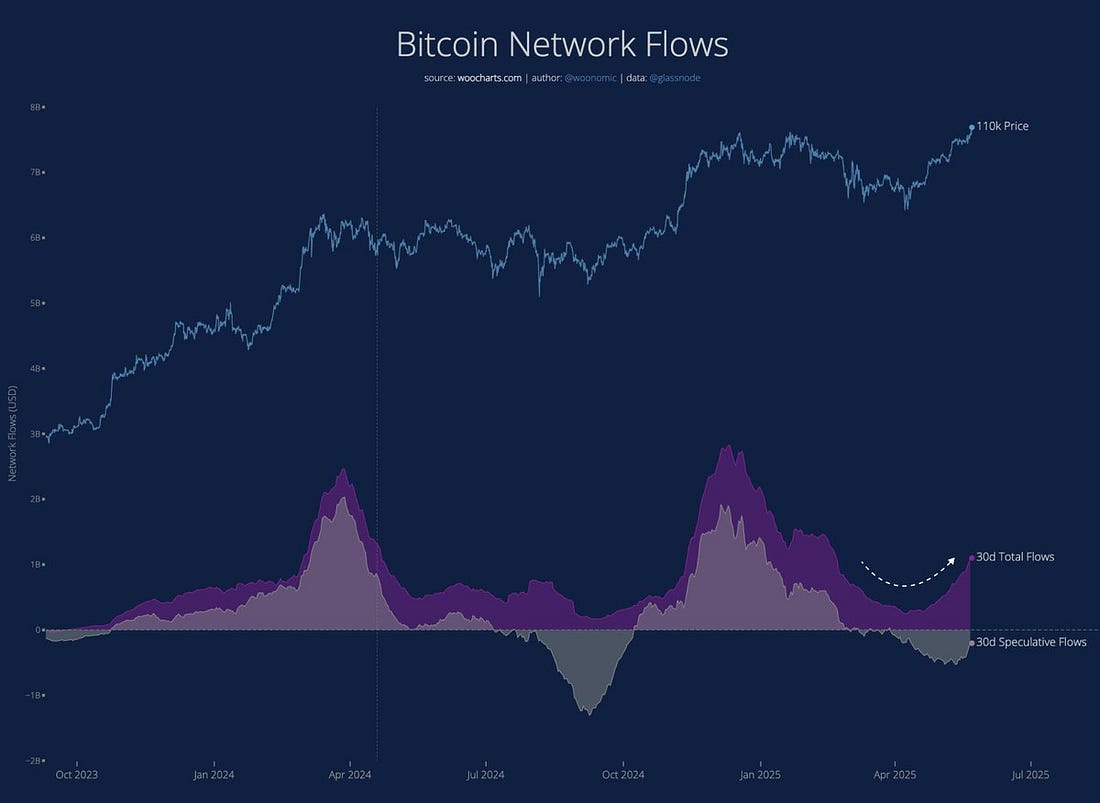

And Willy Woo shows that institutions are not panic buying either yet — he says “I've never seen flows into BTC coming in so smooth. It's like institutions are dollar cost averaging in with their billions.”

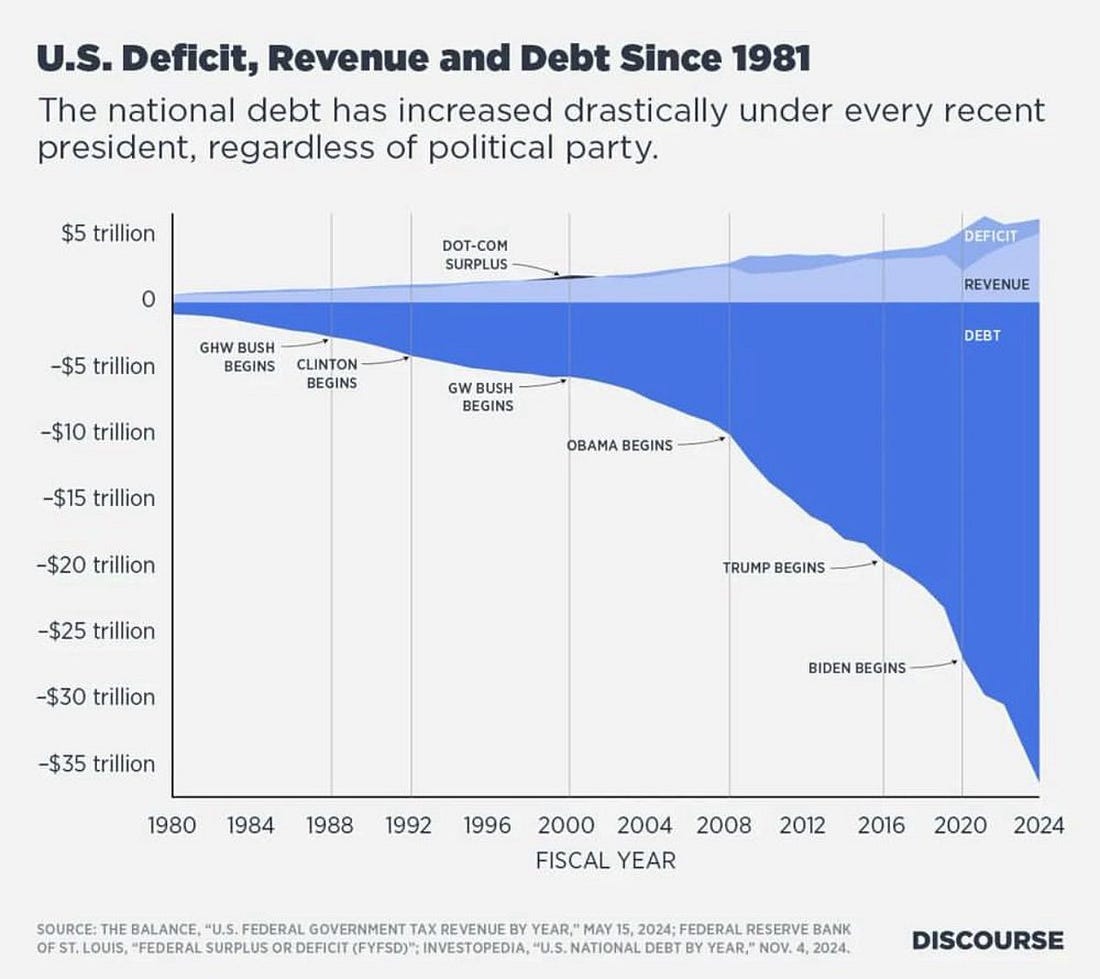

And as a reminder, Marty Bent’s TFTC dropped this chart which opens your eyes to just how significant the US debt situation is. This is the best marketing campaign for bitcoin you could ever have.

The debt is not going to be balanced. The annual deficit seems to be getting worse and worse. And if the dollar is going to be debased, then bitcoin is going to keep going up forever. Bitcoiners have been talking about this for a long time but it seems like the rest of the world is finally realizing what the future looks like.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why Big Banks Are Embracing Bitcoin

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss bitcoin, Jamie Dimon & JP Morgan, inflation, Genius Act, and a mind-blowing story Anthony had with a financial institution.

Enjoy!

Podcast Sponsors

Figure Markets – Bitcoin backed loans so you can buy more Bitcoin with your Bitcoin or earn 8% lending cash to HELOC providers! Learn more about Figure Markets and their Crypto Backed Loans!

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.