| Bloomberg Evening Briefing Americas |

| |

| Amid the geopolitical and economic maelstroms of 2025, diversified investors may end up remembering the first six months for something altogether less dangerous or dramatic. In the face of bloody conflicts stretching from Europe to the Middle East and Africa, a chaotic trade war and America’s deepening domestic crises, the year has still managed to see the strongest stretch of synchronized market gains in years. Rather than spelling a slow-motion disaster for bulls, months of whiplash across equities, fixed income and commodities have rewarded strategic indifference while punishing overconfidence. Strategies that spread risk across assets are outperforming by near-historic margins, a shift from the concentrated bets that favored the likes of Big Tech stocks in recent years. A Societe Generale multi-asset portfolio tracking equities, government bonds, corporate credit, commodities and cash is on pace for its strongest first-half performance since at least 2008. Even the classic 60/40 stock-bond mix—written off during the pandemic-era disruption as obsolete in a world of uncertain inflation—has proved relatively resilient. In a market this divided, perhaps the only reasonable stance is to refuse to take a side, favoring instead a principled neutrality in portfolios built for all-weather conditions. “For every indicator out there that shows the economy is strong, I can give you one that shows it’s slowing,” said John Davi, chief executive of Astoria Portfolio Advisors. “Uncertainty is definitely higher.” —David E. Rovella |

|

What You Need to Know Today |

|

| The US Supreme Court handed Trump a fresh win in his effort to prosecute a global trade war, refusing to put a challenge to his sweeping tariffs on an ultra-fast track. Two family-owned businesses are seeking to invalidate many of the Republican’s import taxes in one of several lawsuits calling his use of emergency powers to levy tariffs illegal. A federal judge agreed with educational-toy makers Learning Resources Inc. and hand2mind that Trump lacked authority under the 1977 International Emergency Economic Powers Act to issue the import taxes. A federal appeals court in a separate case said the tariffs could stay in effect at least until it hears arguments July 31. |

|

|

| With Trump making daily headlines about the timeframe in which he would ostensibly decide whether to join Israel in its strikes on Iran, European officials are becoming the main voice of diplomacy, emerging from talks Friday sounding hopeful about de-escalation. But while his own top intelligence advisers say Iran is not (despite claims by Prime Minister Benjamin Netanyahu) working on a nuclear bomb, Trump has (without providing evidence) repeatedly disagreed.  Israeli emergency services wheel an injured elderly woman in Holon, Israel, on June 19. Photographer: Dima Vazinovich/AFP/Getty Images Trump threw out a nuclear deal with Iran during his first term, and was seeking to resuscitate such an accord when Israel attacked. Oil prices fell earlier Friday following a report from Reuters that Iran is ready to discuss limitations on uranium enrichment, but won’t consider stopping entirely while it’s under attack. Before negotiations with the US were suspended, Tehran had signaled its willingness to accept some restrictions on its enrichment activities. French and German ministers who participated in talks this week said their Iranian counterpart expressed willingness to continue negotiations. Israel, whose strikes have killed more than 600 Iranians according to the Associated Press, has rejected calls for a ceasefire. Israeli government officials said 24 Israelis have been killed in the war. |

|

|

| |

|

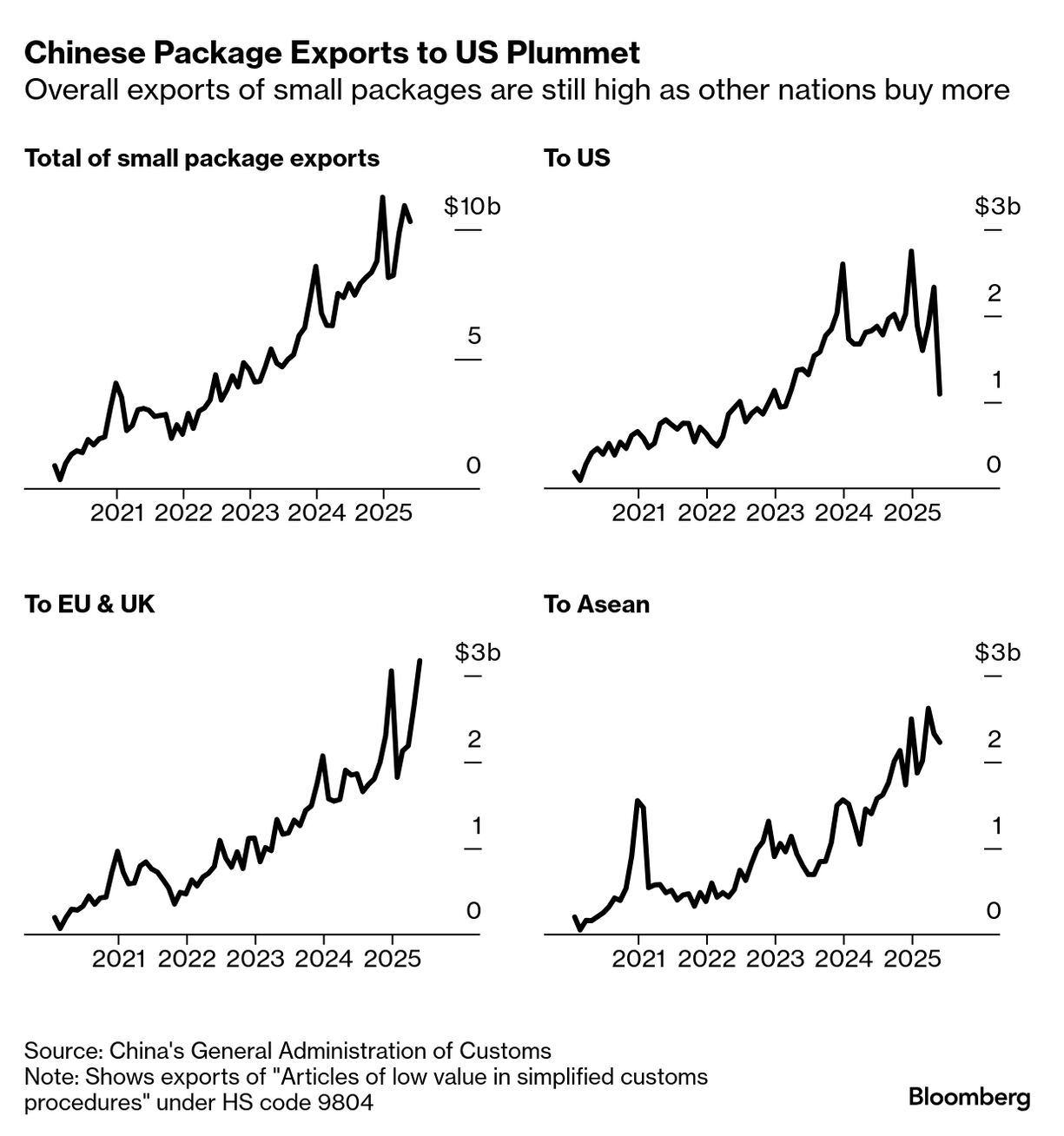

| US tariff hikes on small packages from China triggered a slump in shipments last month, contributing to a huge drop in bilateral trade and roiling exporters like Shein Group. The value of small parcels sent from China to the US fell to just over $1 billion in May, the least since early 2023. The 40% plunge from the same month last year, coming just as the US government eliminated a long-standing tariff loophole, marks a sharp reversal for a booming trade route.  The source of the disruption is the end of the “de minimis” rule exemption for Chinese and Hong Kong shipments. Previously, packages valued under $800 could enter the US duty-free. Since May 2, those parcels face tariffs as high as 54%. The shift is upending the business models of fast-fashion titan Shein and rival Temu, which relied on the exemption to send goods directly to US customers free of tariffs. It’s also squeezing thousands of small merchants who used the model as a low-cost entry into the world’s largest consumer market. |

|

|

| |

|

| If you come home early from vacation and find robbers ransacking your house, you could call the police and try to stop the crime. But the true alpha move, Mark Gongloff writes in Bloomberg Opinion, would be to help the robbers load your valuables onto the truck and then tell them which of your neighbors are also on vacation in exchange for a cut of the profits. Banks are choosing the alpha option, basically abetting theft from themselves by backing new projects to extract and burn fossil fuels, Gongloff writes, thus stoking the planetary heating that stunts economic growth and their own insurance and mortgage businesses. |

|

|

| |

What You’ll Need to Know Tomorrow |

|

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. |

|

| This newsletter is just a small sample of our global coverage. For a limited time, Evening Briefing readers like you are entitled to half off a full year’s subscription. Unlock unlimited access to more than 70 newsletters and the hundreds of stories we publish every day. | | |

|

|

| |

Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. |

|

| You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. |

|

|