| Yo Pit Crazies, If some of my Option Volatility Jargon is vexing, our Glossary is here. AG’s alter-ego Vol Man here with my weekly analysis. As usual, I will start with my last forecast… Last Week’s Big call Last Week ending Jul11: Looking ahead to the coming week, I see SPY pushing to 630 or higher. However, an unexpected move by Trump could quickly drag it back toward 600. I expect the VIX to drop significantly after July 9th, which should help ease tariff-related concerns. Realized volatility is at one-year lows, and equity bulls remain eager to buy. Barring surprises, the market looks poised to continue climbing. Weekly Wrap up I’d give myself a B. SPY popped back up to $626 after President Trump kicked the can on the Trade War to Aug 01. VIX did make a new low on Wednesday. At this point, until earnings come out, we have an FOMC meeting on the 29th and an Aug01 reckoning which after Thursday’s Canada pronouncement traders are getting ready to fade. We might be to the point where the USA gets some tariff revenue from other nations just like they do and the market will not care anymore. The Volatility Premiums right now are nuts, so let me spell it out, read on. If this kind of volatility is creating headaches, here is a solution. Every Friday, The Options Insider Radio Network’s Vol Views offers bonus volatility insights with either Mark or myself—free of charge!

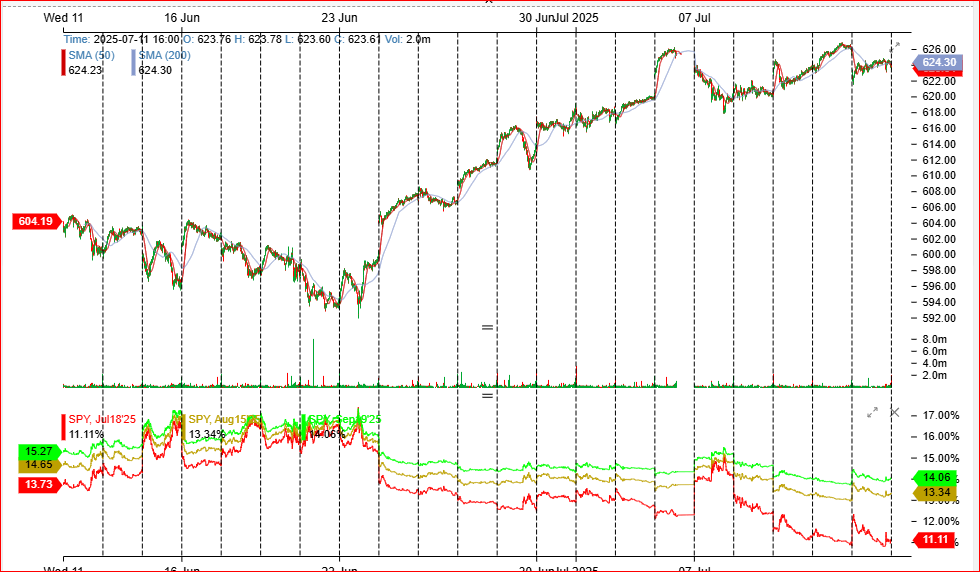

SPY daily price action over the last 30 days with 1 day candles SPY Sigma (volatility per term) for Jul, Aug, Sep Stocks made new highs but without a certain trade policy, they went no higher. New highs are new highs and the DOD going in on Drones and Rare Earths was mildly bullish and to my mind better US Gov policy. SIGMA volatility has dropped to new one-month lows, but contango remains unusually wide. This is usually a bullish SPY pattern in the IV complex because traders simply will not pay anything for short term options. That is usually accompanied by very bullish SPY sentiment.

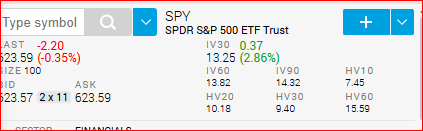

SPX realized volatility snap on Jul 03 2024 10-day realized volatility (HV10) sits at 7,45%, reflecting a low-volatility bull market—though you wouldn’t guess it with the VIX still hovering above 16%. The VIX Aug futures are still over 19 so a full 11.55 points over on the expectation for movement. That is a crazy high premium. If all this volatility has you feeling nutty, consider a strategy that's directionally neutral and doesn't rely on which way the market moves. VIX Volatility Curves

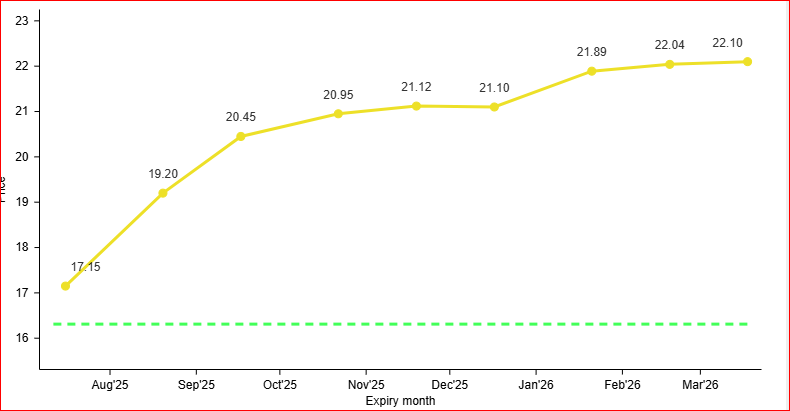

Closing VIX curve, Jul 10, 2024

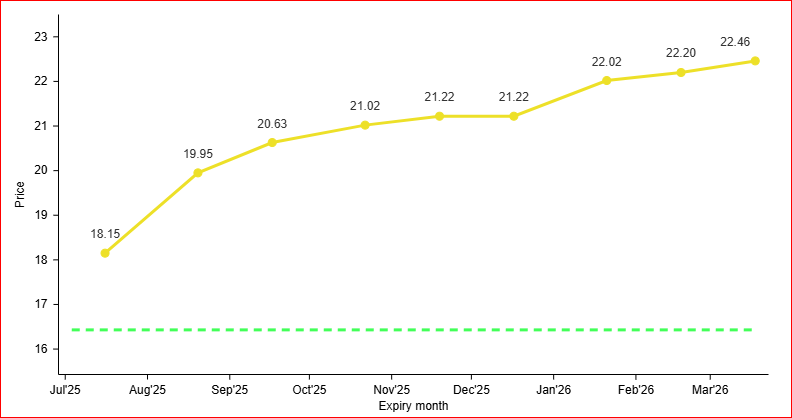

Closing VIX cash and curve, Jul 03, 2025 The VIX curve remains in steep contango, near a $1.00 drop in the front end post Jul 9. My VIX Bomb turned out to be a fire cracker but still a VIX drop and profits for Ripzoners. This is very bullish SPY. You can check out Volatility 101 basics on ourOption Pit YouTube channel - now streaming. OP VIX Zone Watch VIX ZONE 1 9-13 VIX ZONE 2 13.01 TO 17.99 ← We are here VIX ZONE 3 18-23.99 touched here VIX ZONE 4 24 VIX was in Zone 2 all week, stocks got nervous around the 9th, then did not care anymore until the Tweet Bomb Thursday. I have a great trade set up for that already.

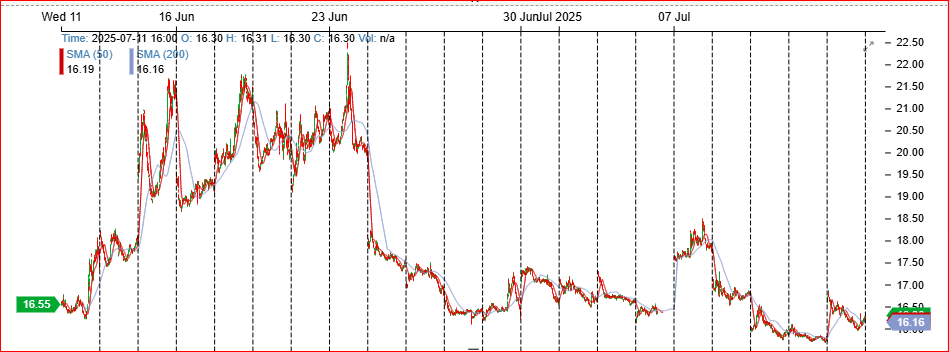

VIX 30 day chart with 1 min candles The VIX remains near lows and is priced for a $18 move in SPY for the next 30 days. The Big Call The issue now is do we go anywhere in the absence of news? With earnings starting to drop next week any good surprises will give us new highs. Remember the 2nd quarter where all companies were cautious? That caution is baked into pricing and if they have 3 months of clarity now stocks could go much higher. 635 SPY next week but VIX may tickle low 15s after the bank's report. To Your Trading Success, |