| Week ending October 6, 2017 |

Economic data last week highlighted emerging weakness, contributing to the patchy movement in commodity prices.

|

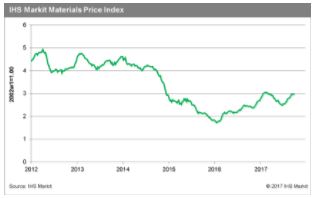

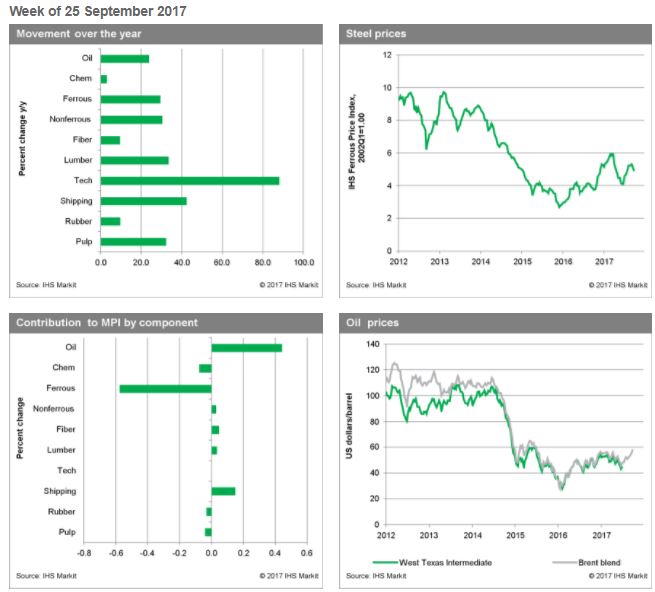

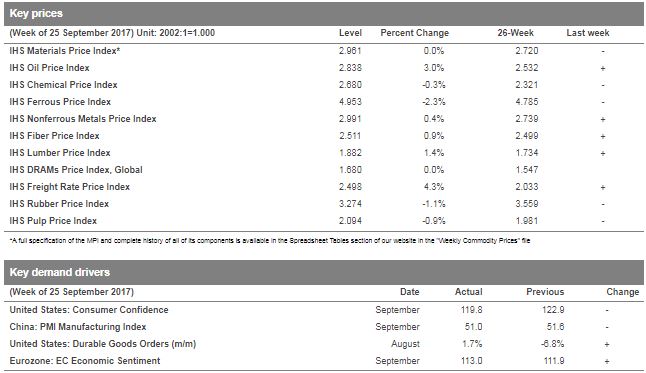

The IHS Markit Materials Price Index (MPI) was flat last week, with oil price gains neutralized by falling ferrous metal prices. Broadly speaking, the strong upward momentum in commodity markets appears to be ebbing, with a flatter profile emerging as we enter fall.

Oil prices continued to move higher on strong demand and with supply worries centered on regional instability in the Middle East. Shipping costs appear to be reacting to a combination of higher fuel costs and good demand from China across the first half of the year. However, matched against these gains was a slight dip in the chemical subindex as the effects of weather-related disruptions in the United States begin to wane, and a strong slip in iron ore prices following a surge over the summer. Rubber prices also continued to decline on high inventory. The net effect of these cross currents was to leave the overall MPI unchanged.

The major economic announcements last week were also mixed and not fully supportive of higher commodity prices. The key release was the slip in the Caixin Chinese manufacturing PMI, which dropped from 51.6 in August to 51.0 in September, denting market confidence. However, in Europe, positive economic sentiment continues to grow, with the manufacturing PMI hitting a six-and-a-half–year high in September. Over the next few months, we believe commodity markets will begin to focus on slower Chinese growth and the gradual tightening in financial markets. These two factors, in combination with flat or falling oil prices, should check the rally in commodity prices.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise to Highest Point in Past Year, IHS Markit says

|

Construction costs rose to the highest point in the last year in September, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 58.4, up from 54.0 in August. Both material/equipment and labor sub-indexes registered rising prices. Ocean freight, both from Asia to the U.S. and Europe to the U.S. were among the largest movers compared to last month.

“Global demand for marine transportation is improving, both in the bulk segment and in the container segment,” said Paul Robinson, associate director, Pricing and Purchasing at IHS Markit. “On the bulk side, the primary driver is food products, on the container side, intraregional trade is driving some of the gain, especially in East Asia. Buyers outside of the United States should avoid locking in rates until prices pull back in 2018.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|