Good stuff is happening.

GDP is up 3% over last year. Unemployment is low at 3.7%. Inflation has dropped from 7.11% this time last year to 3.14%. And the S&P 500 is up 23% year to date.

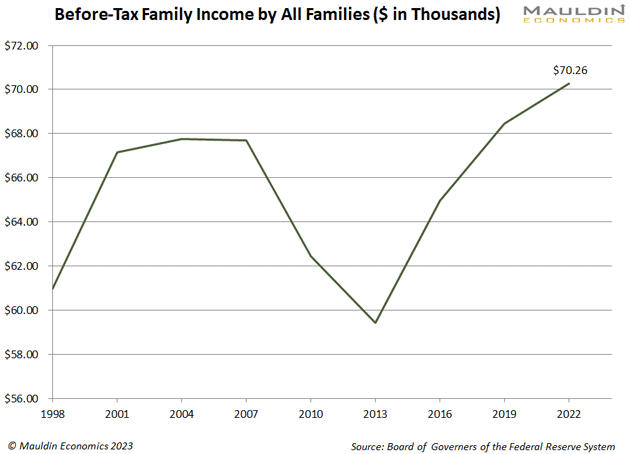

Meanwhile, families are bringing in more money than they have in years.

And yet, people seem miserable. They feel like the economy is in terrible shape. The kids on TikTok are even calling it a “silent depression.” (One more reason to stay off TikTok.)

Today’s guest on Global Macro Update, former Fed economist Claudia Sahm, sheds some light on the disconnect between the rosy economic data and how people perceive things.

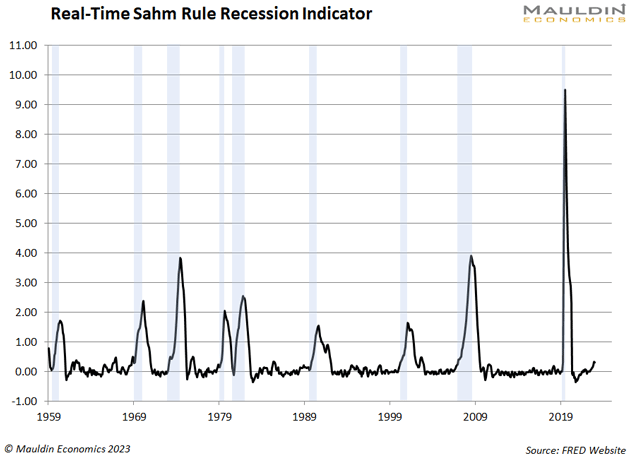

Claudia is known for developing the Sahm Rule, a real-time recession indicator that’s held since 1970. The Sahm Rule signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

The idea is that job losses beget more job losses. As people get laid off, they spend less, which leads to more layoffs.

As for the current dissonance between economic reality and sentiment, Claudia points to residual feelings from the pandemic, which made people angry.

She also blames social media, and I have to agree with her here. Whether it’s Facebook or Twitter or TikTok, the nature of social media is to amplify and reinforce negative sentiment.

I would say the same is true of traditional media. But social media lacks the built-in reality checks of an old-fashioned newsroom. There are no fact-checking interns to remind TikTok what an actual economic depression looks like.

Feelings aside, Sahm expects the US economy to keep humming along, saying we won’t get a recession. We also dig into how the Federal Reserve has distorted the housing market, what that means for first-time home buyers, and how artificial intelligence will affect the job market. I see AI as a productivity tool, and Claudia seems to agree: “We’re growing out of some really bad jobs.”

Sahm also shares:

Why the Fed is going to cut rates slowly

When, if ever, consumer prices will return to “normal”

Why the Fed cares more about inflation than unemployment

You can watch my full interview with Claudia Sahm on YouTube by clicking the image below.

A transcript of my conversation with Claudia is available here. I also encourage you to check out her Substack, Stay-At-Home Macro. Claudia is on LinkedIn.

Best regards,