Avoided Costs? Opportunity Costs?

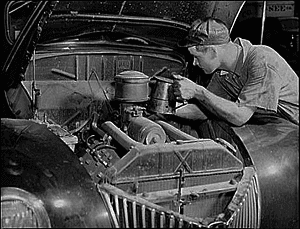

A routine oil change is a familiar example of cost avoidance. Small investments in preventative maintenance avoid the much larger cost of engine replacement later.

A routine oil change is a familiar example of cost avoidance. Small investments in preventative maintenance avoid the much larger cost of engine replacement later.I spoke recently with a project manager whose project funding proposal had just failed.

The Project Management Office—and the company CFO in particular—turned thumbs down on the manager's Stage-0 business case. Why? Where was the red flag? Avoided costs!

The manager's case came with attractive profitability (ROI) and minimal risks for the proposal project. In the CFO's view, however, there was just one problem: the manager showed how to avoid costs. Profitability and other business benefits depended heavily on projected avoided costs. For this CFO, cost avoidance simply was not a legitimate business case benefit. The project manager was trying to decide whether to abandon the case, or to challenge the CFO's reasoning and appeal the decision.

In fact, avoided costs, opportunity costs, and cost savings, can all play an important role in business planning, budgeting and decision support.

Most business people readily accept cost savings as a legitimate concept. However, the terms avoided cost and opportunity cost can be a problem for some. That is unfortunate because all three terms carry useful information for business analysis and decision support.

One reason for the confusion sometimes surrounding these cost concepts is that all three are relative terms. They have reality, that is, when you measure one scenario business outcome and compare it to outcomes under another scenario.

Very briefly, these terms mean the following:

Cost Savings

Cost savings refers to a cost (expense) for which payments are already underway. If a driver trades the current vehicle for a more efficient vehicle, while keeping the same driving habits, the driver can expect a savings in fuel costs.

Avoided Cost

Avoiding a cost is also a real cost savings, but it refers to an expense for which payments are not yet underway. Preventative maintenance for the vehicle (e.g., regular oil changes) avoids the future cost of replacing an engine. Without the oil changes, the engine cost is certainly coming. This certainty—absent oil changes—legitimizes the avoided cost.

Opportunity Cost

Opportunity cost refers to a foregone gain that follows from choosing one action instead of another. Suppose for instance, a collector of classic automobiles offers a very large sum to purchase the driver's car. The driver must choose between two outcomes:

- Continuing to own and drive the car.

- Selling the car to the collector.

The driver may see many other gains under option 1 (turning down the offer), but option 1 also brings a very large and real opportunity cost.

Legitimate Cost for the Business Case?

In brief, all three cost concepts can have meaning in the business case. However, legitimacy results only when everyone understands the unique relative nature of each concept. These costs exist only when comparing one business case scenario to another.

Take Action!

Learn and practice proven methods for building your cases at a Building the Business Case Seminar. Learn more about business case design from one of our books, the Business Case Guide, or the best selling business case authority in print, Business Case Essentials.

By Marty Schmidt. Copyright © 2004-2016.

Solution Matrix Limited, Publisher.

Find us on Linkedin Google+ Facebook