Plus... 50p Costa, 0% borrowing win, 18 beers £23  THE TOP TIPS IN THIS EMAIL

|

| Holidays & day trips are back on the agenda...

Martin: 'Covid uncertainty means booking's a risk. I've 19 need-to-knows to cut costs and protect your pocket in the UK and abroad'

Incl... cheap PCR tests, free Blue Peter badges, days out, 2for1s, cancellation help, cheap flexible flights, £29 hotels and more

The rules on holidaying are changing radically. Right now, in England, only stays away in self-contained accommodation are allowed, but from Mon hotel stays and sleepovers at friends are back. The rules on holidaying are changing radically. Right now, in England, only stays away in self-contained accommodation are allowed, but from Mon hotel stays and sleepovers at friends are back. And it'll then no longer be illegal to leave the country for a holiday, though in practice, for most that'll need wait a month or two. So whether you're hoping for fish & chips in Biarritz or moules-frites in Blackpool, here are my mammoth travel need-to-knows...  Even after Mon, it's still unpracticable for most to go abroad. Yet many are considering BOOKING now for late summer or autumn trips, or for further ahead. So let me run through what to consider. Even after Mon, it's still unpracticable for most to go abroad. Yet many are considering BOOKING now for late summer or autumn trips, or for further ahead. So let me run through what to consider. The rules below are for Eng, but while I was writing, it was announced similar will now apply in Scot from Mon as well. We await info for Wales and NI. 1. There are only 12 'green list' destinations (it'll be reviewed every three weeks), but most won't actually let holidaying Brits in yet. The Govt has divided the world into traffic lights - the system's in place from Mon and will be updated every 3wks (or sooner in emergencies). - 43 RED destinations: 10-day hotel quarantine on return (£1,750 for a solo traveller), basically a no-go. Includes India and Turkey.

- 186 AMBER destinations: Up to 10 days self-isolation at home on return. Includes most of EU and USA.

- 12 GREEN destinations: No need to self-isolate on return. Includes Portugal and Israel. Yet permission to go doesn't mean they'll let Brits in. Most green destinations have stringent entry requirements, eg, Israel says from 23 May it'll start letting vaccinated tourists in, but only in tour groups. Portugal says no holidays, but an announcement's expected tomorrow (Thu) that may change that. See our list of the top 15 holiday destinations' entry requirements. Do also check Foreign Office country advice, which is about safety when away, so slightly different from the green list. 2. The best bets to book for future are likely to be the USA, Europe and other developed countries. The Govt's traffic light list is based on four factors - vaccinations, infection rates, variant prevalence, and how reliable the scientific data is. No one has a crystal ball to predict future green destinations, but in my (non-scientist's) view, it's likely developed countries will fare better, as they are ahead in the vaccination timetable, which will hopefully feed into other factors too - though variants can happen anywhere. If you're booking for future months, the World Health Organisation's country vaccinations stats gives a decent, but not foolproof, view. Again though, UK rules are only half the story - you also need to consider if you'll be allowed in. Some countries with consistently low cases have used tight borders as a part of it, and may continue to. 3. Travel insurance is crucial, but WON'T cover cancellations due to future UK or foreign govt no-travel rules. No mainstream policies that we know of cover cancellations due to official Covid travel restrictions or a need to quarantine at your destination or on return, which means in reality you can't go. Nor will they cover you for cancelling if rules will let you travel, but you don't feel safe. Though many (not all) will cover cancellations if you catch Covid pre-travel or are told by the NHS to self-isolate, and will cover medical treatment for Covid abroad. Yet frankly all the normal reasons to get travel insurance still apply, especially if you're ill while away (Covid is just one health risk). So get it ASAB - as soon as you book. Full options in Cheap Travel Insurance - in brief though, MSE's top no-frills picks (ie, those that meet our min cover levels, but we can't vouch for the service) are... - Annual policies: These cover all of a year's trips, within reason. Try Coverwise (Bronze)* and Axa (Silver). Prices range from £13 for a 30-yr-old in Europe to about £70 for a family worldwide. - Single trips: Try Coverwise (Bronze)* and CoverForYou (Bronze)* as they tend to come up cheapest, eg, from £10 for 7 days in Europe to £50ish for a week's family worldwide cover. - Over 65 or had a past medical issue? Check our Over-65s' Travel Insurance or Pre-Existing Conditions Travel Insurance guides. And do note, if you get insurance and your claim is unfairly rejected, you can take the provider to the free Financial Ombudsman. 4. As travel insurance won't protect you for Covid cancellations, bookings with flexibility are key. Look for those that let you easily change your mind or the date, or cancel. a) Package holidays are cheap and give extra protection. This is where you pay for two or more travel services as one thing (ie, flight + hotel, or flight + car rental) via a travel agent / firm. For how to find the top deals, see Cheap Package Holidays. Under the Package Travel Regulations, you're legally due a refund if the travel agent / firm or an airline / hotel / car firm etc goes bust. That also applies if you can't go because your destination has closed its borders to Brits, or you don't get the holiday you paid for. This is strong protection, worth having, though not all firms have offered the swiftest remedy, so check our firm-by-firm travel refunds survey (Dec 2020) info to see how past customers feel they've been dealt with. Do note you're not due a refund if you're unable to go because you'd need to self-isolate on your return. So an extra step is to look for firms that offer free changes or easy cancellation when booking. b) Many cheap flights now offer free date changes. Our full How to bag cheap flights guide takes you through ways to get cheap deals. You've a legal right to a full refund if the flight's cancelled, yet many airlines now offer flexibility if YOU choose to change too. For example, Easyjet and BA let you make changes for free, nearly up to the last minute (though you'll pay the difference if it's to a more expensive flight). See airline-by-airline cancellation policies. c) Hotels, even cheap ones, often give free cancellation until a couple of days before. Many give you until 24-48 hours before your booking to change your mind - some don't require payment until then too. Even forgetting Covid, this is useful as if you find the same room cheaper just before you go, check availability, rebook, and then cancel. See Cheap Hotels Tips for full info. d) Self-catering is getting more flexible too. If you're booking your own accommodation, Airbnb for example now offers free cancellation up to 24hrs before on many properties (though do check). Far more help in Cheap Self-Catering Accommodation. 5. Flexible bookings protection may be useless if a firm goes bust, so pay via plastic for extra protection. Paying by credit card offers the strongest protection, as Section 75 refund rules mean the card provider is jointly liable for items costing £100+. So using a credit card (repaid IN FULL of course, so there's no interest) is best practice, and also helps if the travel firm were to go bust. All credit cards, as well as debit cards, also get the lesser protection of the chargeback refund rules. So this is also a decent protection if you don't pay on a credit card, or if you do but go via a travel agent (when Section 75 rules don't usually count). 6. Holiday abroad and you'll need Covid PCR tests - these can add £1,000 to a family trip, but some can get them from £20. Head abroad and you will need at least one full PCR test - not the quick lateral flow ones used in schools etc. The following table is based on England's regulations (others likely to be similar):

| Green

| Amber

| Red | | Before departing UK | No test needed to leave, but the country you visit may require a test - some also test on arrival

| | Up to 3 days pre-return to UK | Test needed (lateral flow or PCR) | 2 days after return to UK

| PCR test needed

| 8 days after return to UK

| No test | PCR test needed

|

You can't use the Govt 'Test and Trace' system for the tests needed in the UK if you're holidaying, so you'll need to use a private test firm. These can be costly. Our new cheapest Covid tests info will take you through the options, including travel firm discounts (eg, Tui is offering all tests for £20 to some custs), special airport prices and a comparison of UK private test firms. I am worried though, that once overseas travel really opens up, I'll be writing here about a lack of private testing capacity, and people unable to get tests. There's currently less capacity than people who (pre-Covid) went abroad. 7. Check if you've a valid EHIC or GHIC. If not, get one FREE. If you plan to travel to the EU, these cards give you access to state-run hospitals or GPs at the same price as a local. So if it's free for them, it's free for you. Important right now. If you have a European Health Insurance Card (EHIC), do check it is still valid - 6.4m expire this year alone. If not, or if you don't have one, since Brexit it's been replaced for new applicants by the Global Health Insurance Card (GHIC) and you can get one of these free. 8. Does your passport have at least six months left? Since Brexit, many EU countries have joined those requiring you to have at least 6mths of passport validity left (in some cases more) to be allowed in. So check yours now, as the Passport Office has warned of possible applications backlogs. See Passport rules and renewals. 9. The CHEAPEST way to spend abroad is on the right plastic - apply now. And breathe... I'm relaxing writing this bit, it's like the old pre-Covid days. As I've said many times before, the easiest and cheapest way to spend abroad is on the top specialist travel cards - you get the same near-perfect rates the banks do, smashing bureaux de change. If you can't get a top credit or debit card, or prefer cash, our Travel Money comparison tool compares 14+ bureaux to show the best rates. This is fewer providers than usual, as many travel money services are paused - we'll add them back when they resume. 10. Vaccinated? Download the free NHS app (separate to the Test and Trace one). The Govt says holidaymakers will be able to use the existing NHS health app to show their vaccination status when abroad. Alternatively, you can request paper validation. 11. You CAN still roam like at home in the EU, but check your allowance. The legal guarantee of free mobile roaming in the EU ended with Brexit in Jan, but 10 of the biggest providers have told us they've no current plans to bring charges back. Travel outside Europe and costs rocket though - see Cheap Mobile and Data Roaming help. PS: Also read our Cheap Car Hire | Cheap Airport Parking | 65+ Overseas Travel Tips.  Travel for those in England is back from Monday, as "minimise travel" changes to "travel safely". Travel for those in England is back from Monday, as "minimise travel" changes to "travel safely". You're allowed to go to hotels, and stay at friends' homes (max 6 people, or more if it's only two households in one home - see full UK nations' travel rules). So whether you plan a UK holiday or to stay at home and do days out, here are some tips for you: 1. Booking a stay away? Flexible terms are key. We all hope, possibly pray, that 'no more lockdowns' comes true. Yet there is sadly always the risk of a vicious variant, and change. So, much like with travelling abroad, hedge towards bookings which, in order of preference: - Allow free cancellation (preferably with no or low deposit)

- Allow cancellation for a low fee, or loss of small deposit

- Allow free change of booking to a different date The competition watchdog says providers should give refunds for cancellations where you're legally unable to travel, but that's untested in court, and not all firms are following it. 2. But flexible-booking protection can be useless if a firm goes bust, so pay via plastic for extra protection. No apology that this is exactly the same as I've written for travelling abroad, as it's a crucial tip... Paying by credit card offers the strongest protection as Section 75 refund rules mean the card provider is jointly liable for items costing £100+. So using a credit card (repaid IN FULL of course, so there's no interest) is best practice, and helps if the travel firm were to go bust. All credit cards, as well as debit cards, also get the lesser protection of the chargeback refund rules. So this is also a decent protection if you don't pay on a credit card, or if you do but go via a travel agent (when Section 75 rules don't usually count). 3. How to find cheap UK hotels. We take you through it in our full 23 Cheap UK Hotel Tips guide. Here's just a taste... Speedily use a comparison site to benchmark the best price. The same hotel room can be sold at a huge range of different prices, so check via Skyscanner*, Kayak* and TripAdvisor*. Then call 'em up to see if you can beat that by booking direct with the hotel - it may offer you a better deal because it doesn't need to pay commission. Also check if you can get cashback, possibly of 10%, booking via hotel cashback deals. And a final thought: don't think of hostels as dirty, think dirt-cheap - you could stay in a 19th century shooting lodge from £29/night. See MoneySavers' top UK hostel picks. 4. Travelodge 2m+ rooms £29. For stays between 17 May 2021 and 14 Mar 2022, incl coastal destinations such as Cornwall, Brighton and Great Yarmouth. See Travelodge sale. 5. Want to go self-catered? How to find 'em and keep costs down - eg, £400/wk cottage in Cornwall. Holiday rental sites have seen a surge in UK bookings this year, and it's harder to nab a peak school holiday bargain on the coast or in the country (cities are easier). Yet using the tips in our Cheap Holiday Rentals guide we did find a two-bed cottage in north Cornwall for £402/wk in mid-June. 6. Days-out discounts - 2for1, kids go free and more. If you're day tripping, our Cheap Days Out listing has latest deals incl: - 2for1 on theme parks - eg, Alton Towers, Legoland

- Tesco Clubcard 3x value at Eden Project, Longleat Safari etc

- Free tennis coaching sessions for ages 12+

- 2for1 entry to 340+ gardens with £8.50 mag

- Edinburgh Zoo kids go free with ScotRail 7. You can get cheap UK travel insurance from £8/wk - but is it worth bothering? With many more people booking longer holidays in the UK this year, this has become a more common question. Full info is in our UK Travel Insurance guide, but briefly: - What does UK travel insurance cover? It's usually for booked stays of 2+ nights at least 25 miles away from home. Though unlike foreign holidays, medical treatments in the UK are free as we have the NHS (or private medical cover), so medical cover, which is the key consideration when travelling abroad, is less of an issue. - Are you covered for Covid cancellations? In a nutshell... yes if it's personal, even Covid personal, no if you need to cancel due to a lockdown. More details in UK Travel Insurance. - OK, OK, Martin, just tell me if I should get it. Er, well, there's no right answer, but as many push me on this, let me tell you what I'd do. If it's a cheap weekend away, travelling without any valuables, with easy cancellation, I probably wouldn't bother. Yet if I'd booked a week away, as a full holiday - especially with excursions - and I could get some cheap peace of mind, I likely would. - Already got an annual overseas policy? You're covered. It likely already includes UK travel (do check) - so you're set. If not and you may go abroad within the next year too, use our Cheap Annual (UK & Abroad) Travel Insurance guide to find yourself some cover. - Cheapest no-frills UK single-trip policies from £8/wk. The full MSE top picks are in our Cheap UK Insurance guide. But in brief, for no-frills (ie, those providers that meet our min cover levels, but we can't vouch for the service) there's no one cheapest, so try Coverwise*, LV* and Allianz Assistance*. If you're over 65, add in Tesco Bank. Also see our cheapest UK cover for those with pre-existing conditions. And do note - if you get insurance and your claim is unfairly rejected you can take the provider to the free Financial Ombudsman. 8. How kids can earn a Blue Peter badge to get FREE entry to zoos, castles, aquariums etc. They can get free access to 200+ UK attractions via a Blue Peter badge. Find out how to earn one in time for summer and how it compares with other deals. PS: As you've got to get there too, see Cheap Train Tickets | 50+ Motoring MoneySaving Tips | Cheap Breakdown Cover. |

|

|---|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. |

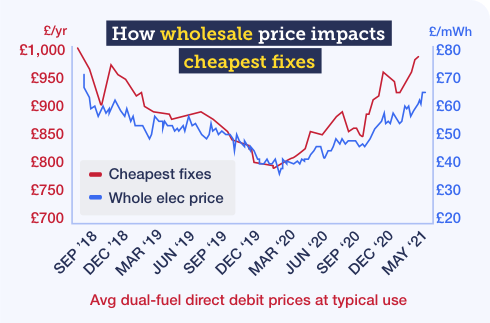

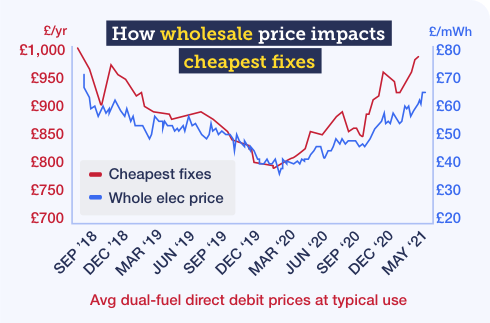

Warning. Energy prices hit 3yr high and "strong upward pressure continues" - check NOW if you can save £100s as cheap deals are disappearing fast Wholesale prices - those that energy firms pay for gas and elec - have surged to their highest levels since 2018 due to post-lockdown demand, outages at ageing power plants and low levels of gas in storage. Sadly this has meant the prices of the cheapest fixed tariffs have rocketed (see graph, below). Ominously, expert energy analysts Cornwall Insight told us: "There is strong upward pressure, which isn't going anywhere yet". While nothing is certain, even today's cheapest could get costlier. So if you've not done one in the last year, do a Cheap Energy Club comparison now.  - Find choosing confusing? Most now prefer to let us help them through it. We can pick your winner for you with our speedy MSE Pick Me A Tariff tools. Tell us your preferences and we'll find your winner from the whole market (incl deals below) - perfect for those unsure or nervous about switching.

- Cheap fixed rate tariffs have soared, but variable rate deals are still cheap - what should you do? Fixes give you rate certainty, but currently you pay a premium for them. Variable deals are much cheaper right now, but you risk prices rising. For those willing to switch again if they rise, they're a decent bet, as there are no early exit penalties - the main risk is the choice being worse when you compare again.

On the other hand, if you want simplicity, then fix for certainty and you needn't do owt again for a while. In fact, some longer fixes are worth looking at as you get certainty for longer without paying much more.

TOP-PICK NEWBIE ENERGY DEALS

Prices are averages based on typical direct debit use. Links go via Cheap Energy Club to see your exact price | What most non-switchers pay (direct debit standard-tariff price cap). 50%+ of homes are on this.

| £1,138/yr

| Cheapest top service deal. Igloo (variable). MSE Blagged. It's £80/yr less than the cheapest fix, so while its price may rise, it'd need to rise a lot for it to cost more. Igloo last upped rates in Jan, and has put them up three times before that in the last three years, and down four times.

Key info: Dual-fuel & elec-only | 100% green elec (not gas) | TOP 4.4/5 MSE service rating | No early exit fee | Price incl £25 MSE cashback & £47 Igloo bill credit we've got it to give you (both halved if elec-only) | £895/yr

Save £243/yr | Cheapest 1yr fix. Avro - 1yr fix. Rate (not price) is locked in for 1yr. Service is decent, but it's not green.

Key info: Dual-fuel only | Not green | 3.9/5 MSE service rating | No early exit fee | £975/yr

Save £163/yr | Cheap longer fix and greener than the others. Pure Planet - 16mth fix. You get a longer fix, but not quite stretching to two winters.

Key info: Dual-fuel & elec-only | 100% green elec & carbon-offset gas | 3.8/5 MSE service rating | £30/fuel exit fees | Price incl £25 MSE cashback (£12.50 elec-only) | £1,001/yr

Save £137/yr | Likely to end this week. Cheapest 2-winter fix & a big name. British Gas Evolve - 2yr fix. If you just want a tariff you can get and forget about, knowing the price can't rise, this is for you. And if things get cheaper elsewhere, you can leave penalty-free.

Key info: Dual-fuel only | 100% green elec (not gas) | 3.4/5 MSE service rating | No early exit fee | 1yr 'free' home insurance | Price incl £25 MSE cashback | £1,028/yr

Save £110/yr |

- Switching is easy - little changes apart from service and cost. Switch firm and it's the same gas, elec and safety. Only the customer service and who bills you changes. Your supply isn't cut off as part of the process, and no one visits your home unless you want or need smart meters. See our Switching FAQs for more help.

- We're aiming for a Big Energy Switch event this month. This is where we try and beat the market's cheapest tariffs, but we don't yet know for sure if it'll happen.

|

New. Cheapest iPhone 11 contract we've EVER seen, with a huge 25GB/mth of EE data. MSE Blagged. The iPhone 11 keeps getting cheaper since the 12 launched. Now EE newbies can get a 64GB iPhone 11* (via that Affordable Mobiles link) with unltd mins, texts and 25GB/mth data for £30 upfront, then £26/mth. The £654 cost over the 2yr contract is £185 saving compared with buying the handset outright and pairing it with a similar data Sim. See Cheap iPhones for more. Note: EE is responsible for your contract, Affordable Mobiles for the handset. More options: MSE's Cheap Mobile Finder tool 16 Ikea hacks, incl new scheme to trade in old Ikea furniture for up to 50% of value. See 16 Ikea MoneySavers. Bag £100 to switch to top service bank First Direct. As we warned last week, some top bank-switch deals have now been pulled, but the mega-popular First Direct free £100 to switch* bribe is still alive and kicking. As well as the cash many get a £250 overdraft, while 91% rated it great for service in our last poll. To get it, open the account and pay in £1,000 within 3mths. You won't be eligible if you've ever had any account with First Direct before, or if you've opened a current account with sister bank HSBC since Jan 2018. Full help in Best Bank Accounts. Hurrah. Car insurance prices tumbling - cheapest since 2014. Can you save big even if not at renewal? If you missed it last week, check out our How to take advantage of car insurance price cuts help. Martin on Queen's Speech: 'Govt's failure to include scams in the Online Safety Bill risks finances and mental health of millions - this must change'. Read the Online Safety Bill news. New. Top 1yr fixed savings 0.85% (highest since Dec) or get 1% for 3yrs. Rates are inching up for those prepared to lock money away. Atom's 1yr 0.85% AER fix (min £50) is the best 1yr rate since Dec, but it is app-only. There's also Zopa's 3yr 1% AER fix* (min £1,000) if you'll fix longer. And via savings marketplace Raisin, FCMB Bank's 2yr fix pays 0.88% and its 3yr fix pays 1% (both min £1,000), while Raisin newbies can get £5-£50 cashback. Full options in Top Savings. New Morrisons loyalty scheme - is it any good? Plus hurry to swap existing points. Morrisons loyalty latest New. Martin's ITV BOGOF: Watch Extreme Savers tonight and Money Show 1hr Live on Tue. Tonight (Wed 8pm) Martin's brand-new 4-part Extreme Savers series launches, incl Katrina 'who won her baby', Tom in his tiny house, and Charlotte who reuses loo roll (can't wait). Then on Tue next week at 8pm, The Martin Lewis Money Show Live is back for a one-off 1hr travel special. PS: You can vote for Martin's Money Show in the TV Choice Awards (p.11) - do then click through to the end. |

'I got a 0% card to pay for a new car - much less cost & stress. Thank you' 'Tog' sent us this email last week and we loved it so much, we wanted to let you read it in full... Only borrow if you need to, but if you do need to, make sure you do it the cheapest way. Hopefully this Success of the Week shows it's possible to borrow right, at no cost (also see How to borrow at 0%, as a card ISN'T right for everyone). | From: Tog

To: [email protected]

Sent: 1 May 2021 18:17

Subject: Massive thank you Dear MSE, Your recent newsletter entitled How to borrow at 0% came at a very opportune time for me. I am disabled and have a Motability car which is due to be changed now after three years. I need a high car with an automatic gearbox, and the one I really wanted this time was the Mitsubishi Outlander PHEV hybrid (139 mpg 😊). Mitsubishi is pulling out of the UK this year, so this was my last chance to get one. However, there's still an advance payment of £2,000 (reduced from £3,000) for the model I want, and I don't have the cash. Then I got your email and immediately applied for a 0% purchase card. I was approved instantly for a card with a limit of £2,500 at 0% for 21 months. This means that I can now have my new car, and because of the massive fuel savings (current car gets 40 mpg) I will be able to pay off the advance payment well before the 0% interest deal runs out. I am so pleased that you sent me the email, otherwise getting my new car would have been much more expensive and stressful. You have definitely helped me a lot and I am extremely grateful. Best wishes, Tog |

|

Tell your friends about us They can get this email free every week |

THIS WEEK'S POLL Are you working from home - and would you like to keep doing so? As the UK gradually emerges from another tough lockdown, we want to know if you've been working from home over the past few months - and, if you have, whether you'd like to keep doing so. Having last asked this in July, we want to see how attitudes may have changed ten months on. Let us know in this week's poll. Two-thirds of MoneySavers have switched energy in the past year. Last week, we asked when you last switched your provider or tariff (and, for those who haven't recently, what's putting you off). Over 3,000 of you responded - and we were pleased to see that 66% have switched in the past 12 months. Though some 6% have NEVER switched, with the most common reason being they're "not sure it really saves money in the long run" (hmmm). See full energy switching poll results. |

MARTIN'S APPEARANCES (WED 12 MAY ONWARDS) Wed 12 May - Martin Lewis' Extreme Savers, ITV, 8pm

Thu 13 May - This Morning, ITV, 10.30am, then phone-in from 11.10am

Tue 18 May - The Martin Lewis Money Show Live - Summer Special, ITV, 8pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Thu 13 May - TalkRadio, Early Breakfast with James Max, personal finance news review with Helen Knapman, from 5.35am

Sat 15 May - BBC Radio Leicester, Mid-morning with Summaya Mughal, investing special with Guy Anker, from 11am

Mon 17 May - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 18 May - BBC Radio Berkshire, Mid-morning with Sarah Walker, from 11.35am (with Guy Anker, subject TBC)

Tue 18 May - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm |

'PLAN AHEAD, PRICE AHEAD & BRING CHANGE' - SELLING TIPS FOR A FIRST CAR BOOT SALE That's all for this week, but before we go... MSE Molly decluttered during lockdown and is selling her stuff at her first-ever car boot sale now they're allowed again. So we asked on social media if you had any MoneySaving tips for her, and... well... we got a car-boot full. They included tips to price everything in advance, ask for £1-£2 more so you've room if the buyer haggles, bring change and set toys out lower down so that kids can see them. Share your tips on our first-time car boot sale Facebook post. We hope you save some money, stay safe,

The MSE team |

|