|  | Latin America, India and women’s health: Key takeaways from Vitafoods | Vitafoods Europe was last week in Geneva, the show’s 26th appearance in the city. Next year, Barcelona. This was, I believe, NBJ’s second data presentation at the event, but not likely the last, as the presentation, “Inconsistent Growth: The Global Dietary Supplement Market by the Numbers,” was among the top attended sessions of the show. In it I shared numbers from both NBJ’s recent Global Supplement Business Report and upcoming Supplement Business Report.

The event was four full days, including Monday’s science-forward Future of Nutrition Summit, exploring, among other things, technological opportunities in personalized nutrition and health care. From these presentations, a future of precision diagnostics that informs nutritional needs and opportunities comes into focus. But it’s still a future vision, as the industry has not yet realized such capabilities at any notable scale.

So, what is happening today? Here are some key takeaways, both from what I shared and what I saw at Vitafoods:

- We’re looking at a $183 billion global dietary supplement market, on 4.7% growth into 2023. Just over one-third of those dollars transacted in the U.S. and just under one-third happened in combined Asian markets. Western Europe, when combined, comes in third, at 11.8% of the global market.

- My presentation focused first on the top five countries/regions before moving to key trends in the U.S. market. The regional presentation focused on Latin America and India because these two regions fall not just in the top 5 on volume but also on growth. Latin America, in the fourth position in size, led global growth at 10%. India, No. 5 in size, grew the second-fastest at 7.7%.

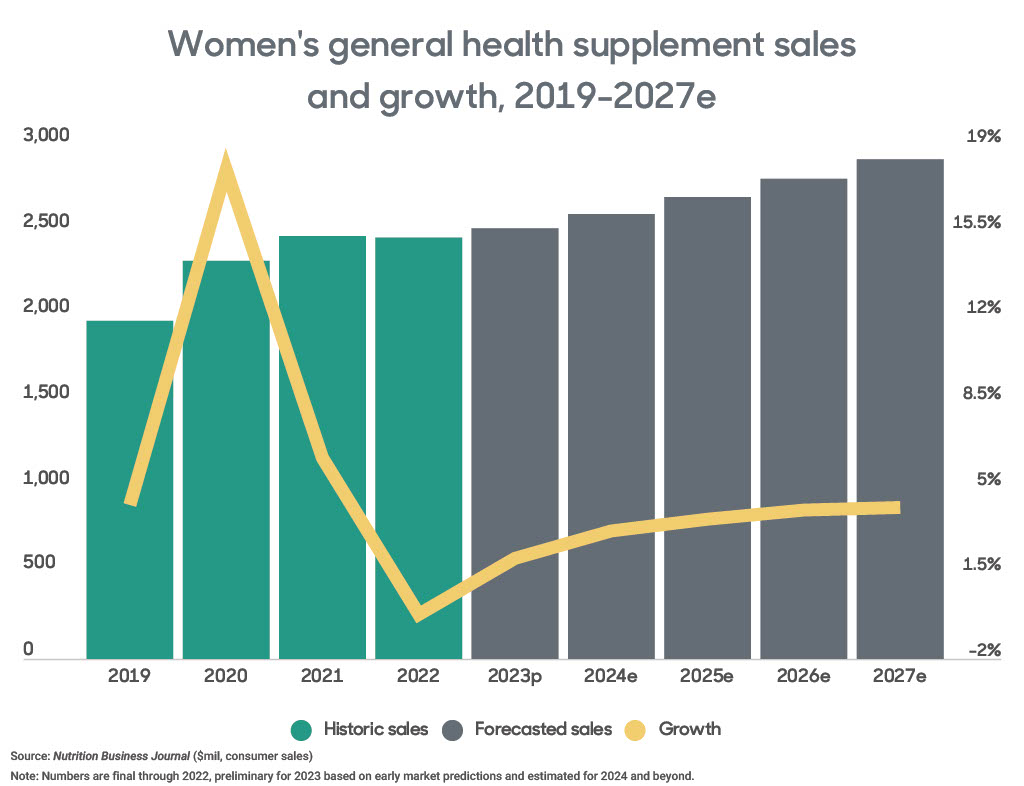

- The geography of growth, however, is not seen just by maps and political boundaries. The where of supplements can also be viewed by health condition. My presentation focused on the top 3 conditions, both by size and growth, but the Vitafoods aisles returned my attention to the sixth-largest condition: women’s health.

Women’s general health, a condition larger than men’s and children’s general health combined, is poised to continue such significance.

And that understates it. If combined with pre- and post-natal and menopause, the group of women’s health conditions commands 6.6% of the market. Flowing in hair, skin and nails, a category dominated by women consumers, we approach nearly 10% of the total U.S. finished products market targeting women. This was evident on the show floor, where I saw an ingredient tailored to PCOS; a healthy aging “for her” collagen boosted with ashwagandha, buckwheat-sourced Bs and acerola-sourced C; an oral probiotic for vaginal health; many beauty-from-within ingredients; and several sexual health products (both for men and women)—and even one product aimed to strengthen both libido and hair!

This focus on women’s health aligns with the Women’s Health Report we released at the beginning of the year and the content we’re presenting at NBJ Summit. It’s a trend we’re seeing from demand both inside supplement companies, as more women fill leadership positions, and from consumers who are hungry to be recognized, studied and formulated for.

It's not exactly personalized, but it’s a refinement of the industry’s slow shift toward personalization. And it was a welcome sight at Vitafoods. | | | | |

|

|

|

| | An award-winning writer and seasoned natural products industry veteran—with decades of experience in food and supplement retail, lifestyle mail order and textiles product development—Nutrition Business Journal Content & Insights Director Bill Giebler manages the NBJ business with a keen focus on the what, where and why of the dietary supplement market. |

|

|

|

| | Looking for More Industry-Leading Insights? | Follow us on LinkedIn for bite-size market stats and exclusive sneak-peeks into our reports and NBJ issues. |  | | | | |  |

|

|

|

|