|

| - | - | - | - | - |

|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Logic implies parents are expected to fill the gap, which can be over £10,000 during a course - tough to fund if unexpected. So this warning isn't about tuition fees, but the less discussed issue of living loans. To help, we've new 'How much to save for my child to go to uni?' calculators, adding the other UK nations to our one for England.

|

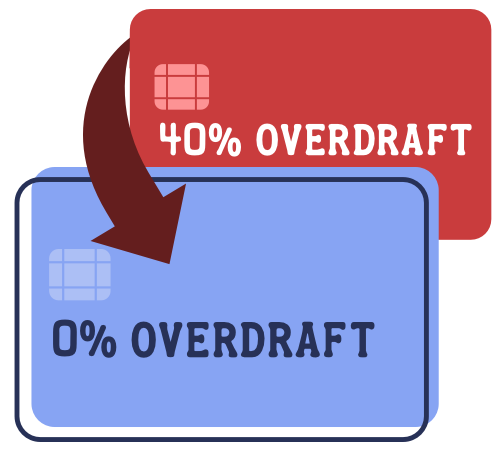

| Jaw drop! A huge 100GB of mobile data for just '£9.50/mth'. Why pay more? MSE Blagged. You get unlimited minutes & texts, and enough data to stream all series of Line of Duty every month with this Three Sim*. It costs £15/mth but until 11.59pm on Fri we've blagged you £67 cashback, automatically paid after 99 days. Factor that in over the 1yr contract and it's equivalent to £9.42/mth - the cheapest of its type we've ever seen. Want a different network / a handset / less data? Use our powerful Cheap Mobile Finder tool. Revealed: Sainsbury's mystery Nectar shake-up. It's made changes to its Nectar scheme incl stopping weekly offers for some but WON'T give full details. Yet we're piecing it together from your feedback... Nectar shake-up. Martin: 'Govt votes down interest rate cap for mortgage prisoners, keeping 250,000 in financial hell - but we won't stop fighting.' See mortgage prisoners' fight continues. 8 Boots hacks (incl new up-to-70% off clearance sale). Full info in Boots bargain bonanza. Three banks now pay a FREE £100+ to switch - but not for long. Choose from... Top service: First Direct* , rated 91% 'great', offers switchers a free £100 and many a £250 0% overdraft. Top for upfront cash (ends 9 May): HSBC offers switchers to its Advance account* a free £125 + a £20 Uber Eats vch. Top for possible monthly cash (ends 4 May): Switch to a Halifax Reward account and you can get a free £100, plus if you spend £500+/mth on its debit card or keep £5,000 in the account you can get £5, 2 movie rentals or 1 cinema ticket each month. Full details, incl crucial bonus eligibility info, in Best Bank Accounts. Student loan interest is currently up to 5.6%, but we think we now know next year's rates. For what we're predicting for the new rates from next term, and how we're predicting them, see Student loan interest rate to be cut? |

|

|---|

| Staggeringly, the Bank of England estimates £180,000,000,000 of extra savings has built up during the pandemic - as many of those still in work (or some on furlough) saw their commuting and other costs slashed. The problem... interest rates are pitiful, so for those who want to put money away in total safety, returns are poor. We can't do too much to change that, but can at least show you how to maximise every penny in Top Savings. All accounts here have the full £85,000 savings protection...

|

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL Which stores do you LOVE or LOATHE? Retailers love us to have a relationship with them. Indeed, many people feel an almost intimate connection with some brands, but wouldn't be seen dead crossing the threshold of others. So this week we want to know how you feel about some of the biggest names on the high street and online. Most MoneySavers say it's acceptable to borrow for a new home or car - but not for Christmas. Last week, we asked what you think it's appropriate to borrow for - over 4,000 of you responded. Almost everyone - 97% - said it's OK to borrow for a new home, and 87% for a new car, but only 6% said the same for Christmas - and most were also against borrowing for football season tickets, hobby equipment and holidays. See the full poll results. |

| |

|---|

| MONEY MORAL DILEMMA I sold the books my brother didn't want - should I share the money with him? For the last four years, I've stored various things given to me and my brother at my house. My brother's made it clear he doesn't want any of them, so I've begun to sell some to free up space - I got £50 online for a couple of books. Now my brother says I should give him half the money, even though I stored them, listed them for sale, paid the listing fees and posted them off. Enter the Money Moral Maze: I sold the books my brother didn't want - should I share the money with him? | Suggest an MMD | View past MMDs |

| MARTIN'S APPEARANCES (WED 28 APR ONWARDS) Wed 28 Apr - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Thu 29 Apr - TalkRadio, Early Breakfast with James Max, personal finance news review with Steve Nowottny, from 5.35am |

| HOW TO GO GREEN WITHOUT IT COSTING THE EARTH That's all for this week, but before we go... last Thursday was Earth Day, an annual global event to show support for environmental protection, so we asked you what eco-friendly things you do which also save cash. Top tips included buying a second-hand sofa and investing in a water butt, while one MoneySaver simply said: "Washable everything - wipes, nappies, cloths, hankies, napkins." See the full list of tips and add your own on our Earth Day Facebook post , and for more inspiration, see our 26 quick ways to go green and save guide. We hope you save some money, stay safe, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin Lewis What is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email lloydsbank.co.uk, bank.marksandspencer.com, ratesetter.com, theaa.com, virginmoney.com, tescobank.com, cahoot.com, mbna.co.uk, affordablemobiles.co.uk, firstdirect.com, hsbc.co.uk, marcus.co.uk, saga.co.uk, santander.co.uk, moneysupermarket.com, confused.com, comparethemarket.com, gocompare.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |