| Gold's Shocking Benefit That Nobody's Talking About | | By Dr. Steve Sjuggerud | | Tuesday, April 5, 2016 |

| Gold has a shocking benefit... One that nobody talks about.

Most people aren't even aware of it. But after I share it with you today, you will wonder why every remotely intelligent investor DOESN'T own gold (at the right time) – simply to capture this massive benefit.

Let me explain...

----------Recommended Links---------

---------------------------------

The goal of every investor should be to maximize returns and minimize risks.

Many "smart" investors have avoided gold because they don't see how it meets that goal. Gold hasn't always delivered big returns.

Investors know that gold has underperformed the stock market over the long run...

This shouldn't be a surprise, actually. It makes sense. Companies make earnings... but gold sits. People are productive... but gold is not.

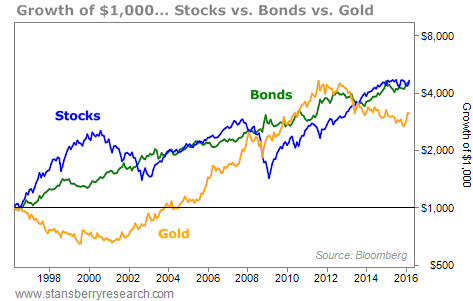

This has led to gold typically underperforming stocks over long stretches of time. Here's what it has looked like over the last 20 years...

As you can see, stocks and bonds are up over fourfold. And gold is up about threefold. (It's a log-scale chart.)

Gold was the loser. No surprise there. However – and this is where gold's big benefit comes in – you can build a simple asset-allocation system among stocks, bonds, and gold – that would deliver dramatically better results – with less risk!

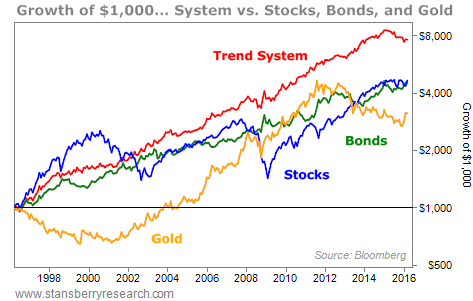

If you had followed this simple, three-asset system, you would be up nearly eightfold over the last 20 years! AND the system is less risky, too. Take a look:

Take a look at the red line... Two things stand out:

| 1. | The three-asset system beats all of the others, by a long shot, and | | 2. | It is dramatically less volatile (more stable) than the others, by a long shot. |

So what's the simple system? You simply own what's going up...

You could be 100% invested in stocks... You could be one-third invested in each asset class... Or you could be 50% invested in two assets. It just depends on how many of the three asset classes are going up. (If none are going up, then you are 0% invested.)

This idea comes from my friend Meb Faber, who first came across the idea from the excellent research firm Ned Davis Research.

Meb ran the numbers from 1971 to mid-2015 (when he wrote about it). The results were similar to the 20-year chart above. Individually over those 40-plus years, stocks did best (returning 9.9%), and gold did the worst. But the simple system crushed them all... Its compound annual gain was 13.1%.

Not only was the return dramatically better, but the risk was dramatically lower...

A simple way to see it is through the "drawdown"... What was the worst loss?

In the stock market, you would have lost half your money in the worst drawdown. In gold, it was far worse – you would have lost two-thirds of your money in the worst drawdown.

But with this simple system, the worst drawdown was 21%.

Meb sums up the powerful system pretty simply:

| Three asset classes: Stocks, bonds, gold. Invest equally in whatever is going up. ["Up" is defined as the 3-month moving average divided by the 10-month moving average.] That's it. Thumps the stock market with less risk. |

|

Own gold in your portfolio when it's in an uptrend. It has the little-known but powerful benefit of jacking up your portfolio returns AND lowering your portfolio's risk.

Don't forget it!

Good investing,

Steve

Editor's note: Gold has ripped higher over the past three months... and as Steve showed, NOW is the time to own it. And Stansberry Research founder Porter Stansberry thinks this is just the beginning. He believes gold and gold stocks will soon be worth as much as 30 times what they are today... On Wednesday at 8 p.m. Eastern time, Porter is hosting a special live "Emergency Gold Briefing" where he'll explain exactly how to protect yourself and make a fortune in the years to come. Reserve your spot – for free – right here. |

THIS LONG-TERM UPTREND SPIKES HIGHER

Good news for housing bulls: One of the sector's major players just touched a new all-time high... We can judge the health of the housing market from a number of different statistics and stock charts. Today, we're checking in on home-improvement juggernaut Home Depot (HD). It's the largest home-improvement chain in America, with more than 2,200 stores. It sells everything you need to fix up a kitchen, build a deck, or make any other kind of home additions. In other words, when people buy houses, they head right over to Home Depot. You can see below that HD shares consistently trounce the market... and they're continuing that trend today. Over the last five years, the stock has soared 250%-plus. And shares are now trading at their highest level ever. This uptrend has shown no sign of slowing... |

|

| A simple way to beat the market... With less risk... It sounds too simple to work. But my friend Meb Faber made a career out of the idea – literally. Here's how it works... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

New rules taking effect April 29 will dramatically impact some seniors' Social Security benefits. Luckily, if you apply and qualify today, you can be grandfathered in, FOR YEARS. Full Story Here. |

| Why Dividend Investing Alone Is Not a Good Strategy | | By Dr. Steve Sjuggerud | | Monday, April 4, 2016 |

| | Does a strategy of buying high-dividend-paying stocks outperform the markets? You might be extremely surprised by the answer... |

| | How Every Decision Can Make You Richer – or Poorer | | By Mark Ford | | Friday, April 1, 2016 |

| | On the surface, this is a minor decision. But in truth, it is one of a million chances you've had, have, and will have to become wealthier... |

| | How I Lived My Dream Four Days Ago... and How You Can, Too | | By Dr. Steve Sjuggerud | | Thursday, March 31, 2016 |

| | "People tell me that I'm so lucky," my friend Alistair from Ireland explained last night, over dinner with our families. "But it's not true. I fully believe that you make your own luck." |

| | Four Keys to Sidestepping This Huge Retirement Risk | | By Alex Green | | Wednesday, March 30, 2016 |

| | This risk can be a serious challenge. Here's what I mean... |

| | You Haven't Missed the Boom in Florida Real Estate | | By Dr. Steve Sjuggerud | | Tuesday, March 29, 2016 |

| | The prices have gone up, a lot. But you haven't missed the boom yet. The values are still here... |

|

|

|

|