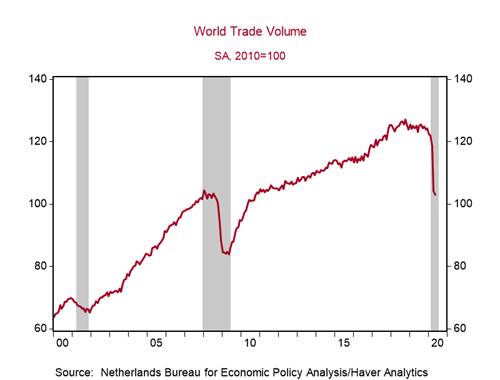

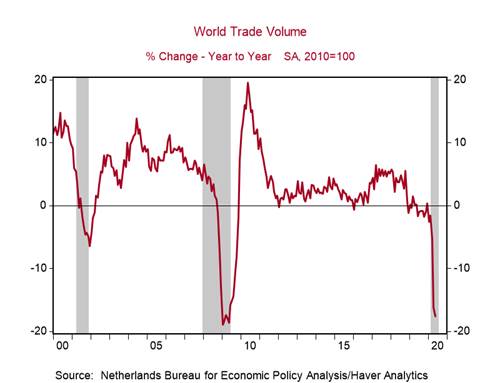

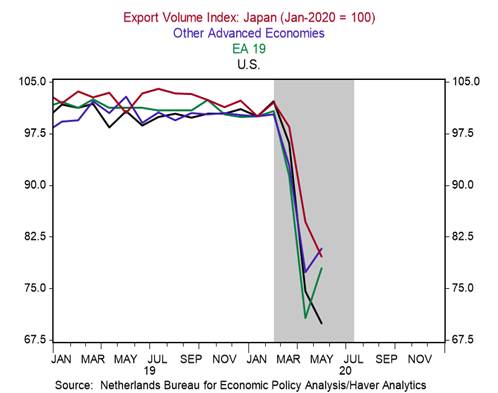

*The Netherlands Bureau for Economic Policy Analysis (CPB) estimates that the volume of world trade declined by 1.1% m/m in May, its fifth consecutive monthly decline, lowering its yr/yr change to ‑-17.7% from -16.2%, similar in magnitude to the declines observed during the Great Recession of 2008-2009 (Charts 1 and 2). Exports declined in the U.S. (-6.2% m/m) and Japan (-5.9%) but increased in the Euro Area (+10.2%) and other advanced nations (+4.4%). See Chart 3.

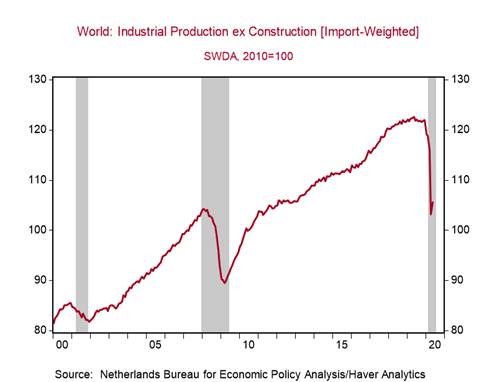

*The CPB estimates that world industrial production (IP) ticked up by 2.3% m/m in May, a small recovery following the 15.4% cumulative decline in production between January and April, leaving IP down by a sizable 13.8% yr/yr (Chart 4).

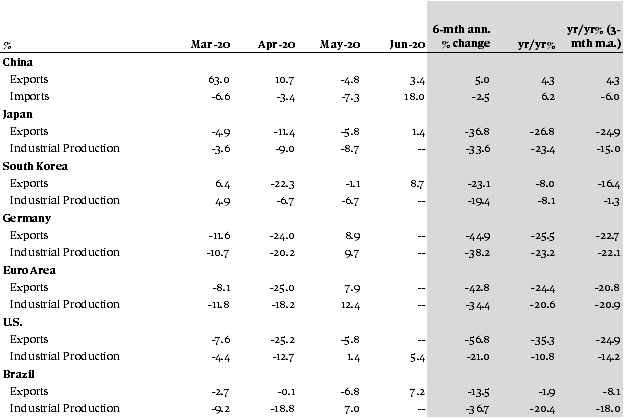

*Global trade appears to have increased (m/m) in June for the first time since December 2019. Key Asian economies (first to publish trade data) have reported gains in exports in June â China (+3.4% m/m), Japan (+1.4%), and South Korea (+8.7%). Brazil has also reported a pick-up of 7.2% m/m. The pick-up in U.S. IP growth to 5.4% m/m in June from the 1.4% m/m in May bodes well for global IP (Table 1). The initial rebound in global trade and IP will be solid as countries emerge from lockdown and as businesses unclog supply chains. However, following this initial spurt, gains will moderate, reflecting sluggish underlying global demand.

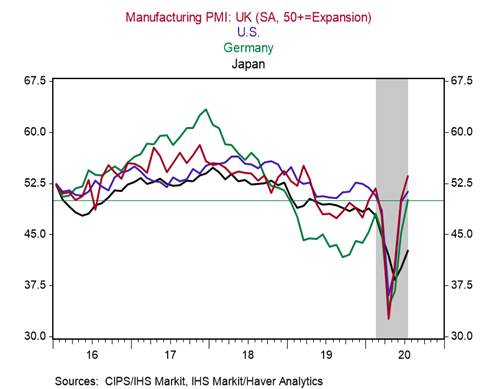

Manufacturing PMIs reflected a continued expansion in activity across Europe in July, though at a subdued pace. In France, the manufacturing index edged slightly lower to 52.0 from 52.3 in June. In Germany, output was apparently unchanged in July (50.0), although up from the weak 45.2 in June. The UK fared better, with a reading of 53.6 in July, up from 50.1 in June (July PMIS - solid gains across Europe, Kallum Pickering, July 24, 2020). Japanâs manufacturing PMI on the other hand remained deep in contraction territory in July, at 42.6 (Chart 5).

The U.S. manufacturing PMI entered expansion territory in July, increasing to 51.3 from 49.8 in June. Over the summer months, U.S. manufacturing activity and exports may actually outpace consumer activity, as factories in states experiencing spikes in incidence of COVID-19 are allowed to remain open and certain high-risk retail activities are shut down. Moreover, countries that are ahead of the U.S. in slowing transmission of COVID-19 will continue to buy U.S. manufactured goods (the weaker U.S. dollar will also help).

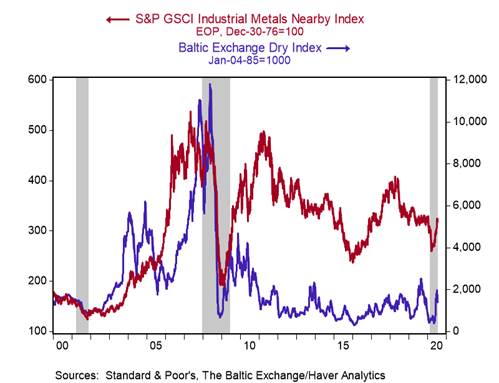

Although the magnitude of the declines in the spot commodity price index for industrial metals and the Baltic Exchange Dry Index were not nearly as large as the magnitude of the declines in global IP and trade (reflecting the impact of the lockdowns), their increases over the last couple of months suggest that a recovery is well under way (Chart 6). Emerging market economies, which have been hit hard by the pandemic, will benefit from the higher commodity prices and weaker U.S. dollar.

Following the initial stage of the recovery of global trade, the experiences of the pandemic will exacerbate the decelerating trend in global trade growth from the last decade. Business investment will be weak. Reliance on domestic services are rising as a share of GDP in many advanced Western nations. Trade protectionism will continue to rise (both Biden and Trump support âBuy Americanâ policies). Critical manufacturing industries and supply chains will be moved closer to home. Any lasting impact from the pandemic on air travel will weigh on shipments of aircrafts and parts, a heavy component of global trade, exacerbating the impact from the slowing global demand for autos.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Table 1: Trade and production for key economies

Source: China Customs, Japan Ministry of Finance, Japan Tariff Association, Japan Ministry of Economy, Trade & Industry,

Korea Customs Service, Statistics Korea, Deutsche Bundesbank, Eurostat, Census Bureau, Federal Reserve Board,

Banco Central do Brasil, Instituto Brasileiro de Geografia e Estatistica, and Berenberg Capital Markets

Chart 5:

Chart 6:

Mickey Levy, [email protected]

Roiana Reid, [email protected]