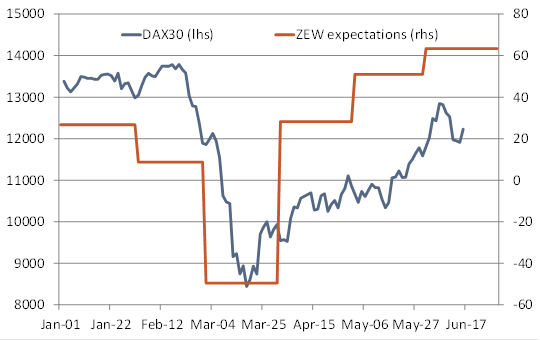

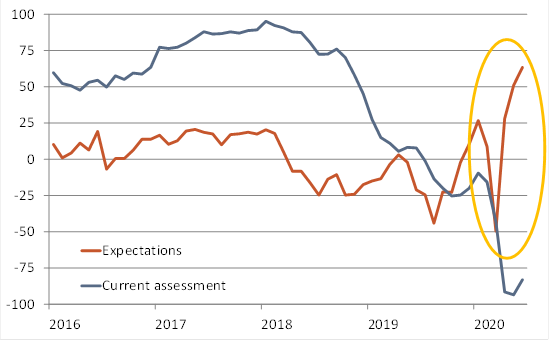

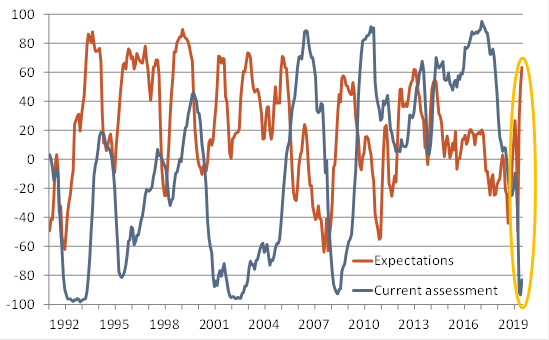

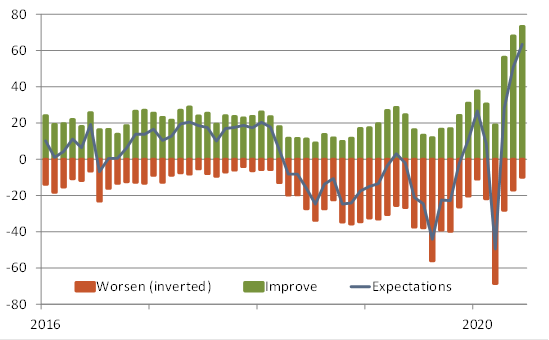

Financial markets heavily shape the expectations of financial analysts – the last couple of months show that more impressively than ever (see Chart 1). On the heels of an unprecedentedly fast rebound in stock indices including the DAX30’s 45% jump since mid-March, with yet another spurt since the last publication of the ZEW on 19 May (+10%), financial analysts surveyed by Germany’s ZEW institute have become much more optimistic about the future again. In the ZEW survey, 6-month-ahead expectations of German economic conditions surged further by 12.4 in June, bringing the total rise since March to 112.9 points. After the -49.5 trough in March, the net balance of optimists vs. pessimists rose from 51.0 in May to 63.4 in June (see Chart 2, 3 and 4).

Too much euphoria? Amid lingering risks to the outlook, financial markets may have advanced too fast, too much. Temporary corrections, like last week’s in markets, may happen again. In the same vein, ZEW expectations may not rise much further in the next few months or may even correct temporarily as the return to pre-crisis activity levels will take years.

On track for a tick-shaped rebound: Still, the hope that the worst is behind us and the economy is recovering seems justified. Central banks have pumped in huge amounts of liquidity. Easier financial conditions in equity and credit markets transmit the monetary impulse to the real economy. Expectations have started to rebound, also thanks to historic fiscal stimuli, especially in Germany. Low- and high frequency data suggest that the economic rebound gathered pace during June. After slipping further from -91.5 in April to a new low since 2003 of -93.5 in May, the ZEW gauge for current economic conditions in Germany rose for the first time since January to -83.1 points (see Chart 2 and 3).

Big risk – second wave in crucial parts of global economy: The biggest risk to our call of a tick-shaped recovery is a major second wave – or in some cases a worsening first wave – in crucial parts of the global economy resulting in renewed national lockdowns there. While the pandemic seems largely under control in continental Europe, and has improved in the UK, the number of daily confirmed cases in some major US states such as California, Florida and Texas is still rising – possibly due to a lax lockdown in the first place, a premature easing of restrictions and/or an acceptance for a higher death rate than in most of Europe. Via trade and confidence channels, a second wave of the pandemic could reverberate to places elsewhere and deal another blow to the global economy. We need to watch the risk. Our base case remains that new virus hotspots may require regional countermeasures but will not lead to new lockdowns that are so harsh and widespread as to disrupt the economic outlook for major economies of the advanced world dramatically.

Chart 1: German ZEW expectations and DAX30 in 2020 |

|

Daily data forDAX30. Monthly data for ZEW. Source: Deutsche Börse, ZEW, Berenberg |

Chart 2: German ZEW expectations versus current assessment since 2016 |

|

Source: ZEW, Berenberg |

Chart 3: German ZEW expectations versus current assessment since 1992 |

|

Source: ZEW, Berenberg |

Chart 4: Hardly any pessimists left |

|

The value for the ZEW sentiment indicators is the ppt difference between the percentage of optimists (“improve”) and pessimists (“worsen”) among panellists. Source: ZEW, Berenberg |

Florian Hense

Economist

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom

Phone +44 20 3207 7859

Mobile +44 797 385 2381

Fax +44 20 3207 7900

E-Mail [email protected]

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html