|

| - | - | - | - | - |

|

|

| ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| January is normally bank switch month, where firms flex their financial muscle to pay you to switch to them. Yet this year the cupboard is bare - in fact, we know of two deals that were due to launch that've been pulled due to the pandemic. We could w(h)ine, but at least one bank is still willing to 'pay' you to switch - however, this deal isn't likely to last much longer, so speed is of the essence. All accounts require you to pass a not-too-harsh credit check to open 'em.

|

| Martin: 'Warning. Are/were you a customer of HSBC, First Direct or M&S Bank? Watch your mail - you may get a cheque. It isn't a scam - one man nearly chucked it.' Full info in Martin's HSBC warning. Ends Thu. 108Mb fibre (ie, MEGA-FAST) b'band AND line from Virgin - '£18.40/mth'. MSE Blagged. This deal for Virgin Media newbies is £23.95/mth, but as you get a £100 AUTO credit on your first bill, you pay nothing for 4mths, making it an equiv £18.40 over the 18mth contract. It also comes with 'free' weekend calls. Only 52% of homes can get Virgin, so the link takes you via our broadband comparison to check your eligibility, and from it you can find other deals. 'Martin, should I buy Bitcoin?' Everyone's asking this, so take a look at how he answered: Martin on Bitcoin. New. Cheapest ever iPhone 11 contract we've seen, incl 25GB/mth EE data. MSE Blagged. The iPhone 11's got far cheaper since the 12 launched. Now EE newbies (via this Affordable Mobiles link) can get a 64GB iPhone 11* with unltd mins, texts and 25GB/mth data for £79 upfront, then £26/mth. The £703 cost over the 2yr contract is £135 less than buying the handset outright with a similar data Sim. More help in Cheap iPhones. Find the cheapest handset or Sim for you: New MSE Cheap Mobile Finder tool. Is M&S's £5 top-up on £15 school meal vouchers in England worth it? The £15 Govt vouchers for those on low incomes can be used at many supermarkets. M&S is pricier but adds £5 on top, so we've investigated if you get more at M&S with the £5 added. Also, free mobile data for online schooling at home: Many on lower incomes can get allowances from EE, Three, O2, Vodafone etc. We've rounded it up in school mobile data help. Ends today (Wed). Ted Baker EXTRA 20% off its 'up to 50% off' sale. MSE Blagged. It's the strongest discount we've seen it offer on a sale - just use our code to get it. Ready teddy go Updated. 20 ways to get free or cheap books, incl free Kindle titles for writing reviews. See 20 free book tricks . |

| |

|---|

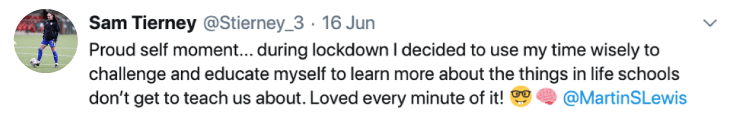

| Our six-part financial education course with the Open University has rave reviews Last May, we launched our joint initiative with the Open University, the MSE Academoney (or more formally the MSE Academy of Money), and since then it's been the OU's most popular free course with 30,000 people enrolling. It's a great way to use your time, especially in lockdown...

|

| Kids' baking ingredients kit for £1.99 (norm £13ish) - makes cakes for 12 people. MSE Blagged. Little Cooks Co is a monthly subscription box for little 'uns. 1,500 kits avail. Little Cooks Co 25% off designer glasses, eg, £45 Calvin Klein specs. MSE Blagged. See glasses code. Shift debt to 15mths 0% NO FEE plus get £20 cashback. If you pay credit or store card interest, a balance transfer card can help you slash debt costs, and Barclaycard* (do check acceptance odds first) gives 15mths at 0% interest for no fee. Plus you get £20 if shifting £2,500 to it within 60 days. There's a raft of other top deals now too - full help in Balance Transfers ( APR Examples). Golden rules: 1) Pay at least the monthly min. 2) Pay it off within the 0% or transfer again, or Barclaycard is 21.9% rep APR. 3) Don't spend/withdraw cash. The MSE Forum's '1p Savings Challenge' - can you save £665+ in 2021? See how it works in 1p Savings Challenge. Tesco fuel station card payments taken MONTHS late. Full info and help in Tesco delays. Want an MSE Charity grant of up to £7,500 for a project to help support the under-26s? Non-profit organisations can apply for a cash boost in our charity's latest grant-giving round, which this time is for projects for the under-26s, to teach and develop financial life skills. Check if your project qualifies now and apply via the charity's website from 9am on 1 Feb. The round closes once it accepts 40 applications, or on 26 Feb at the latest. |

| AT A GLANCE BEST BUYS

|

| SUCCESS OF THE WEEK: |

| CAMPAIGN OF THE WEEK Petition to keep extra £20/wk universal credit - Joseph Rowntree Foundation. The pandemic-based £20/wk boost is due to end in April, and a charity that works to solve poverty, the Joseph Rowntree Foundation, is calling on the Government to make it permanent and extend it to other benefits. If you agree, it wants you to sign its petition. |

| THIS WEEK'S POLL What financial support have you accessed during the pandemic? The coronavirus crisis has hit the UK economy hard, with millions struggling financially. The Government, councils and financial firms have put a variety of support schemes in place, though sadly not everyone's been able to access help. So this week, we want to know if you've had any Covid-related financial support. Two-thirds of MoneySavers now use less than 2GB of mobile data each month. Last week, we asked how much mobile data you use - 4,400 of you responded. Overall, 67% said they use less than 2GB/mth, up from 55% when we last asked in Jan 2020. Younger MoneySavers were more data-hungry, with 31% of under-35s using 5GB+ each month. See full mobile data poll results. |

| MONEY MORAL DILEMMA Should I return the 'free' sawhorse that arrived after I cancelled the order? I ordered a sawhorse from a well-known DIY retailer and it qualified for free next-day delivery. After two weeks it hadn't arrived, so I contacted the retailer which said it had problems with the courier and gave me a refund. I reordered it and collected the item from its local store, but two days later the original order arrived, meaning I had two but had only paid for one. I'm annoyed it arrived so late and I had to go to the store, so was going to give the second sawhorse away, but should I return it? Enter the Money Moral Maze: Should I return the sawhorse? | Suggest an MMD | View past MMDs |

|

| MARTIN'S APPEARANCES (WED 20 JAN ONWARDS) Wed 20 Jan - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Fri 22 Jan - BBC Radio Shropshire, Mid-morning with Jim Hawkins, from 11am, Guy Anker with MoneySaving shopping tips |

| 'I WAS THE NO. 1 BUYER OF 2L BOTTLES OF CAFFEINE-FREE DIET PEPSI' That's all for this week, but before we go... Sainsbury's Nectar app users last week got their '2020 in review' Sainsbury's shopping summaries. One fun feature showed where you ranked for frequent purchases at your local store. After we revealed MSE Kit had bought the most chocolate digestives at his nearest shop, you flooded our social channels with stories of where you too ranked top. MoneySavers led the way on items including Diet Pepsi, Chicago Town pepperoni pizzas and even balsamic vinegar & caramelised onion Walkers Sensations. One healthy MoneySaver also 'won' on fresh tomatoes. Let us know your 2020 shopping 'victories' in our Facebook post. We hope you save some money, stay safe, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin Lewis What is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email virginmoney.com, affordablemobiles.co.uk, barclaycard.co.uk, sainsburysbank.co.uk, santander.co.uk, moneysupermarket.com, confused.com, comparethemarket.com, gocompare.com, ratesetter.com, cahoot.com, tsb.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |