Federal Reserve maintains aggressive monetary ease and zero interest rate projection

Federal Reserve maintains aggressive monetary ease and zero interest rate projection

*At this week’s FOMC meeting, the Fed reinforced its commitment to sustain its current thrust of aggressively easy monetary policy. It significantly revised up its projections of economic growth in 2021 and lowered its unemployment rate forecast to reach 3.5% by year-end 2023, while the median FOMC member projected that it would be appropriate not to raise the Federal funds rate through 2023. The Fed perceives that any rise in inflation would be temporary, and inflation will stay close to 2%.

*The Fed underlined its guidance that its current policy of zero interest rates and its monthly net new purchases of $80 billion of Treasuries and $40 billion of MBS will be sustained until labor markets have achieved levels consistent with the Fed’s assessment of maximum inclusive employment.

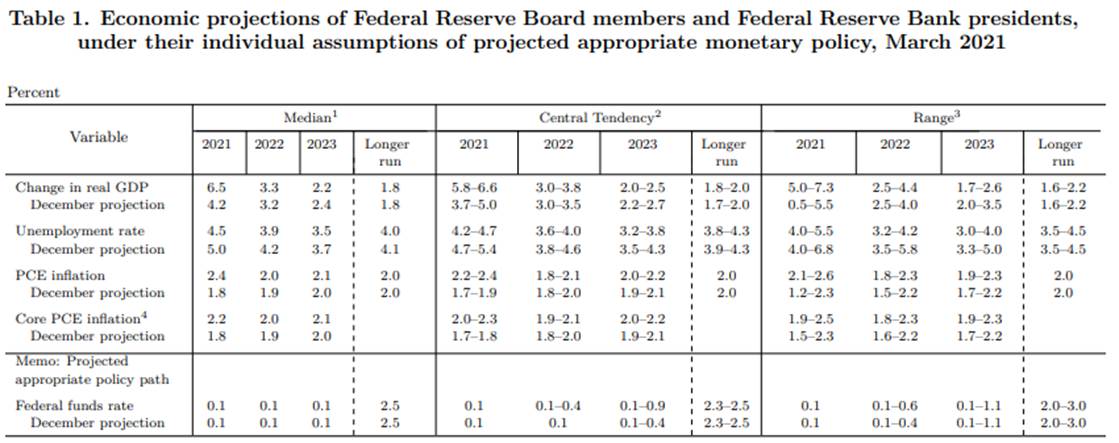

*In the Fed’s updated Summary of Economic Projections (SEPs), real GDP growth was revised up significantly to 6.5% in 2021, and revised down its unemployment rate forecast to 4.5% at year-end 2021, 3.9% in 2022 and 3.5% by year-end 2023 (See Table). Core inflation was revised up to 2.2% in 2021, 2.0% in 2022 and 2.1% in 2023.

*The median FOMC member projected the Fed funds rate to remain at zero through 2023, although seven members perceived that a rate hike would be appropriate in 2023, and three projected a rate hike in 2022.

The Fed gave the clear impression that it expects inflation will stay close to 2% and that it is comfortable keeping monetary policy “behind the curve”, lagging financial market and public expectations and joining efforts with the Biden Administration to pump up economic growth and employment in the short run.

This general observation is highlighted by the large divergence between the Fed’s sizable upward revisions in real GDP growth projections, while maintaining the projection that a zero Fed funds rate through 2023 is appropriate. The Fed’s projections of robust real GDP growth in 2021 followed by growth in 2022 and 2023 that is significantly above its estimate of longer-run sustainable growth would put GDP above its potential. This would contribute to an unemployment rate falling back to 3.5%, well below the Fed’s estimate of sustainable full employment of 4%. Maintaining a zero target policy rate is decidedly below the Fed’s estimates of the natural rate of interest (the Fed estimates real r* to be 0.5%, 2.5% in nominal terms).

This divergence highlights the marked change in the Fed’s reaction function that it adopted in its new strategic framework, and provides important guidance signaling the Fed’s plan to maintain aggressively easy monetary policy even as the economy operates at or above its capacity.

The Fed’s official Policy Statement acknowledged that economic conditions had improved, but restated its commitment to use its full range of tools to promote maximum employment and lift inflation moderately above 2%, while keeping inflationary expectations anchored to 2%.

The Fed’s upward revision in real GDP growth from its December SEPs reflects the two pieces of fiscal stimulus legislation enacted in late December and more recently. Since the severe collapse of the economy in Q2 2020, real GDP had recovered persistently faster than the FOMC projections (and even the high end of the FOMC members’ range of projections), while the unemployment rate has fallen significantly faster than the Fed’s projections.

The Fed’s ongoing sanguine outlook for inflation rests heavily on the experience of the last decade, during which inflation remained subdued despite fiscal deficits and accommodative monetary policy. Other than that one-cycle experience, it is clear that the Fed does not have any framework for forecasting inflation. Fed Chair Powell and other Fed members have emphasized that the Phillips Curve is flat—indeed, the Fed’s projections of inflation have been nearly invariant to dramatic changes in the unemployment rate--but it has not replaced the Phillips Curve with any analytic framework.

The Fed’s updated inflation projections are anchored close to 2%. Most likely, the Fed will continue to forecast that inflation will remain close to 2%, unless actual data forces it to extrapolate its inflation projection either up or down. While the Fed favors inflation rising above 2%, it has not provided any guidance for a range of inflation it favors—or will tolerate.

The Fed continues to emphasize that it wishes to keep inflationary expectations anchored to 2%. Currently, expectations are above 2%, and market-based expectations (break-evens on the TIPs) recently have risen materially above 2%, and bond yields have begun to rise. This may prove a pressure point for the Fed.

So the Fed’s message is absolutely clear: maintain its current monetary policy strategy, and deal with risks as they unfold.

Source: Board of Governors of the Federal Reserve System

Mickey Levy, [email protected]