FOMC meeting: Belated rate hikes with hawkish tone amid uncertainties

*The Fed commenced with its first rate increase of 25 basis points, dramatically raised its inflation forecasts, and signaled through its estimates of the appropriate path of the Fed funds rate that it will be more aggressive raising rates than it had earlier indicated. In his press conference, Fed Chair Powell said the Fed would soon announce the Fed’s strategy to unwind its balance sheet, emphasized the tightness of labor markets, and indicated that the economy was in good shape to avoid recession.

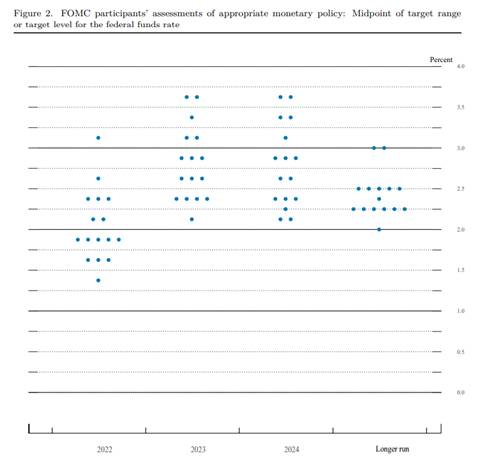

*The FOMC raised its policy rate 25bp, lifting the fed funds rate target range to 25-50bp. In his post-meeting press conference today, Powell intimated today’s move was likely to be the first in a series of interest rate hikes, reflected in the dramatic upward shift in FOMC participants’ assessment of the appropriate level of the fed funds rate, which, if the Fed sticks with 25bp hikes, would see the Fed lifting rates at every remaining meeting this year to 1.75% - 2% (see chart 1). The FOMC estimates four 25bp policy rate increases in 2023 that would leave the fed funds rate target range at 2.75% - 3% by year-end 2023.

Chart 1. FOMC Fed Funds Rate Dot Plot

Source: Board of Governors of the Federal Reserve System

-The median FOMC estimate for the year-end 2024 median fed funds rate is 2.8%, above both the Fed’s estimate of the long run fed funds rate, and well above the Fed’s inflation forecasts. In his press conference, Powell repeatedly characterized the U.S. economy as “very strong” and expressed his confidence in the economy’s ability to weather less accommodative monetary conditions. The Fed also lowered its assessment of the long-run neutral rate fed funds rate by 0.1pp to 2.4%.

-While the Fed does not want to surprise markets, Powell today and in prior public comments has emphasized that the Fed would like to retain policy optionality: in a Q&A session before Congress, Powell left the door open to one or more 50bp rate hikes later in the year. If inflation does not recede as the Fed projects, a more aggressive path of interest rate increases would likely be warranted.

- Jim Bullard, President of the Federal Reserve Bank of St Louis dissented, arguing that the Fed should have raised rates 50 bp. He and other FOMC members, including Governor Waller have publicly advocated for more aggressive rate increases to rein in inflation and are likely to agitate for a more aggressive path of rate increases at future FOMC meetings, particularly if inflationary pressures remain elevated.

*Balance sheet – in its March policy statement, the Fed elected not to provide any concrete details on the pace, timing, and composition of its balance sheet runoff, noting in its policy statement that the FOMC “expects to begin reducing” its balance sheet “at a coming meeting”. Powell did indicate during his press conference that balance sheet runoff would “play an important role in firming the stance of monetary policy”, and could begin as soon as May. Powell also strongly alluded that the details of the Fed’s balance sheet unwind discussions and framework would likely be reflected in the March meeting minutes.

- Amid the Fed’s more aggressive policy stance, it is perplexing why the Fed did not set out details of its strategy to unwind its balance sheet. It may reflect the Fed’s sensitivity to financial markets and uncertainties in the economic environment.The Fed’s current guidance in its January statement on balance sheet unwind principals suggests that it would be accomplished passively primarily through caps on reinvestments of maturing assets, and proceed at a predictable well telegraphed pace. The Fed has consistently stressed that the fed funds rate will remain the primary tool of monetary policy, with balance sheet runoff operating as more of a “background process”.

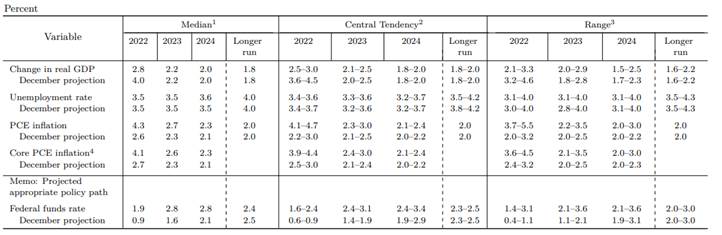

*Summary of Economic Projections – In the March SEPs the Fed made wholesale revisions to its inflation and economic growth forecasts, an explicit acknowledgement that its prior forecasts had been superseded by reality and that inflation will be trickier to rein in and far less “transitory” than earlier presumed (see Table 1). FOMC participants significantly raised their inflation forecasts for 2022 and also anticipate inflation will remain elevated in 2023-24, and remain above the Fed’s 2% inflation target in 2024. It is important to note that the SEPs reflect conditional forecasts, in which FOMC participants forecast the evolution of the economy conditional on individual FOMC participant’s assessment of appropriate monetary policy.

Table 1.

Source: Board of Governors of the Federal Reserve System

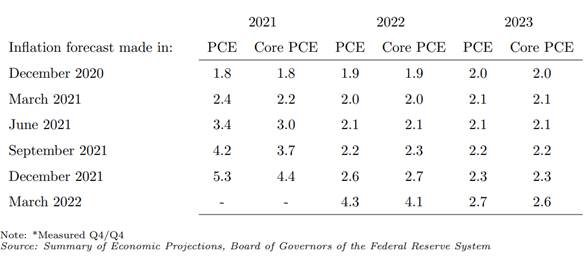

-The median FOMC participant’s forecast for year-end headline and core PCE inflation in 2022 rose to 4.3% and 4.1%, respectively, up from 2.6% and 2.7% in the December SEP (see Table 2). Projections for headline and core PCE inflation at year-end 2023 were raised to 2.7% and 2.6%, respectively, and raised to 2.3% for both headline and core PCE inflation for year-end 2024. While we welcome the Fed’s pivot to acknowledging that inflation will remain high, we worry that the Fed is underestimating the impact of services inflation, strong nominal wage growth, and rising inflationary expectations, and forecast that inflation will remain elevated above the Fed’s forecast.

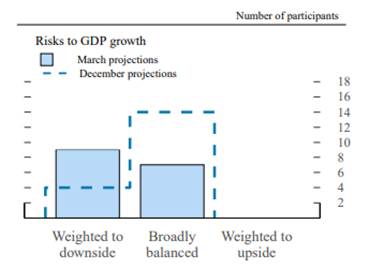

-Unsurprisingly, given heightened uncertainty around the outcome of the Russia-Ukraine conflict and the path of inflation, the dispersion of participants views increased markedly relative to the December SEPs, while the FOMCs assessment of risks to the economic growth outlook are firmly tilted to the downside, every single FOMC member now views inflation risks as tilted to the upside.

Table 2.

-The Fed’s March policy statement and Powell’s press conference indicate the Fed’s view that on net, Russia’s invasion of Ukraine is likely to boost headline inflation in the coming months, reflecting rising commodity prices, a further deterioration in supply chain conditions, and the impact of economic sanctions and “self-sanctioning”.

-Real GDP growth forecasts were revised down substantially for 2022, with the median FOMC participant forecasting real GDP growth of 2.8% in 2022, down from 4% in the December SEP, while growth projections for 2023-24 and estimates of long-run growth were left unchanged. Moreover, there was a shift in the assessment of the risks to GDP growth to the downside (see Chart 2), largely reflecting the impact of Russia’s invasion of Ukraine on commodity prices and further disruptions to supply chains. Despite the downward revision, Powell noted that real GDP growth of 2.8% is still a full percentage point above the Fed’s assessment of long-run potential growth (1.8%). Notably, the March Policy Statement removed any reference to the economy’s dependence on the course of the virus, reflecting broad improvements to the public health situation post-omicron and suggesting the Fed views the Russia-Ukraine conflict as the primary economic risk.

Chart 2.

Source: Board of Governors of the Federal Reserve System

-Reflecting the broad-based recovery in labor markets and robust payroll employment growth, the median FOMC member forecast the unemployment rate to be 3.5% (no change from the December 2021 SEP), well below participants’ estimate of long-run full employment. In his press conference, Powell characterized labor markets as “very, very tight … tight to an unhealthy level”.

*The Fed’s delays in beginning to raise rates has placed it between a rock and a hard place, and engineering a “soft landing” will be challenging. Headline measures of inflation have surged to four-decade highs, and price pressures have broadened further into services and “core” inflation categories. Consumer and market-based measures of inflationary expectations have spiked, and although measures of longer -run inflationary expectations have been relatively stable, they have drifted higher in recent months and the Fed cannot rule out a sudden jump in long-term inflationary expectations. Moreover, labor market tightness, rising inflationary expectations, and the desire for a ‘catch-up’ to elevated prices have contributed to accelerating nominal wage growth. While Powell in his press conference claimed the Fed does not see evidence of a wage-price spiral, it is clear current labor market conditions and inflationary expectations are influencing wage and price setting behavior, particularly in the services sector. Everything seems to have surprised the Fed.

*At the Fed’s January meeting, its path forward seemed relatively clear. However, Russia’s invasion of Ukraine and ensuing increases in energy and agricultural commodity prices has muddied the Fed’s calculus. A commodity price shock, the risk of slumping economic activity in Europe, and declining real purchasing power tilts economic risks to the downside, and raises the probability of a stagflationary outcome.

-Historically, at such moments, the Fed has preferred to move tentatively and cautiously. Our concern, and one that the FOMC appears to have realized, is that the Fed may not be afforded that luxury under present circumstances of elevated underlying inflation. Powell throughout his press conference stressed the Fed’s commitment to price stability, and the need to take action to ensure that higher inflation does not become entrenched, yet even with rate increases, rising inflation and inflationary expectations are likely to keep real rates deeply negative. High inflation is harming economic performance. The best way to avoid a hard landing is to take away monetary accommodation and quell inflationary expectations.

Mickey Levy, [email protected]

Mahmoud Abu Ghzalah, [email protected]

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.