| Dear Reader, ‘The bear market that has roiled stock investors for the past 12 months has renewed focus on safety and quality...stocks that pay reliable dividends.’ Real Money ‘In a world fixated on cryptocurrency and AI, buying dividend stocks — those of companies who have made years, if not decades, of steady payouts — may seem old-fashioned. But it is also extremely effective.’ Wall Street Journal ‘The best thing about a multi-year bear market? The bargains. Today we’ll talk dividend deals. Big payers.’ Forbes Dear Reader, For the first time in what seems like forever… Investment journos are gushing about income stocks. No surprise there. Clicks are revenue. And the click-hungry financial media is nothing if not a mirror to the investor headspace right now… - Stock portfolios in a holding pattern for two years. Massive volatility. But nothing to show for it. And no solid idea where the market’s going next …

- A country teetering on recession. ‘The dam has burst,’ reports the Australian Financial Review. ‘The long-awaited acceleration in the downturn is now fully underway.’ In mid-2023 some sectors are down 20%.

- Bank deposit rates at 10-year highs. That’s good though, right? Well…no. In reality, you need more than bank interest to keep up with inflation, costs of living and sky-high mortgage rates…

- A bunch of new high-yielding income opportunities to pull the trigger on. From dividend ETFs to property trusts…to industrials, banks and resources.

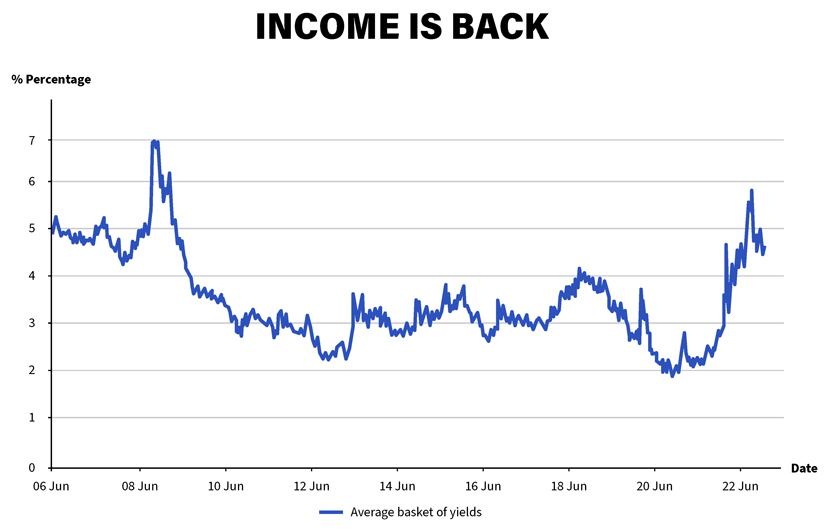

For income investors, it’s been lean pickings for a long time. But now the buffet is open. Forbes calls it: 'The Great Yield Chase' Trillions have fled traditional bank accounts looking for better returns since the end of 2022. A ‘bonanza’ in global dividend payouts soared 12% in the March 2023 quarter to a whopping $500 billion. Check it out:  | Source: Schroders |

Here you see the evolution of a basket of income-generating assets over time. Yields across the board are back at levels not seen in more than a decade. As Schroders says we’ve gone ‘from an income desert to an income oasis.’ Retirement savers are losing patience with bank safety. You need alternatives. And the buffet is plentiful right now. But you’ll get food poisoning if you make the wrong selections. The blind scramble for higher income will backfire on many investors in the next year or two. No disputing it, though: We’re at a cycle point where smart investors focus on getting paid by their investments…rather than pure growth. That’s probably why you’re reading this now. But what’s the best tactic? For several months, we’ve been wargaming this question here at Fat Tail Investment Research HQ. And we believe we’ve come up with a rather outside-the-box solution. It’s a portfolio of six unique ASX dividend payers. Each of them hits a very precise ‘sweet spot’. If income is a big priority right now…this could be some of the most important intel you get from us this year. Click here for ‘The Royal Dividend Portfolio’. Regards, James Woodburn,

Publisher, Fat Tail Investment Research |