|

| Fan Favorites |

|

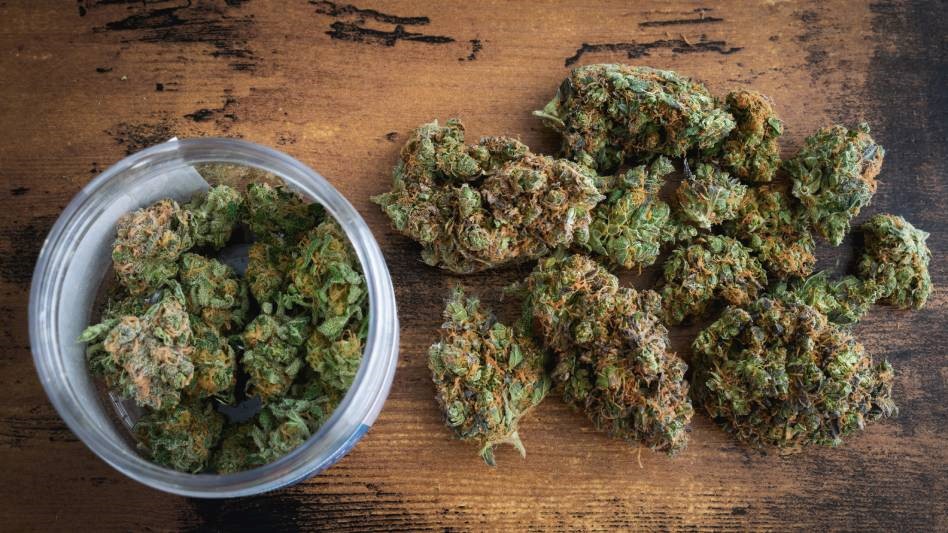

| The Top 10 Best-Selling Flower Strains in California in 2022 |

| Can you guess which sweet flavor profile is taking home the No. 1 spot this year? More >> |

|

| Planning for What? |

|

“Let’s just make it a game-time decision.” It’s not unusual for me to text those words to my 70-year-old mother, who often is just trying to make concrete plans for a family get-together. It probably drives her nuts, but I like to live my life very much grounded in the present—there’s less to worry about that way. But that doesn’t mean I don’t reflect on days gone by or anticipate what’s to come. In the business world, planning ahead is a must. But in the cannabis business world, sometimes planning for the future can result in a bust. I was thinking about that last week when New York regulators announced adult-use sales will officially inaugurate on Dec. 29, 2022, when one licensee will pioneer the retail marketplace via a “soft” opening in Manhattan. That sales launch will come 638 days after former Gov. Andrew Cuomo signed the state’s legalization bill. At the time, on March 31, 2021, it was expected to take upward of two years to roll out a commercial retail market. It still might take that long to fully implement the program with only 36 of 175 retail licenses approved by the state’s Cannabis Control Board (CCB) and without the needed capital available for the turnkey locations licensees were promised. Perhaps less expected were all the regulatory twists and turns that unfolded along the way, from CCB chairwoman Tremaine Wright saying in October 2021 that there would be no adult-use licenses issued until spring of 2023 to Gov. Kathy Hochul’s January 2022 announcement of a $200 million fund to support social equity cannabis businesses and a new law enacted in February that provided exclusivity for the state’s existing hemp farmers to grow for and supply the adult-use market. And in March, state officials announced the first dispensary licenses would go to those with cannabis-related convictions. As the program framework continued to unmask, New York, which could become the nation’s second largest cannabis market, became less alluring for multistate operators who saw dollar signs slipping years down the road. In August, Ascend Wellness called off its $88-million acquisition deal with MedMen New York. Ascend founder Abner Kurtin pointed to the “state of MedMen’s assets.” And in October, Verano Holdings terminated a $413-million agreement to acquire Goodness Growth Holdings. Verano CEO George Archos said eight months earlier that a New York entrance was a strategic move ahead of the state’s adult-use rollout, but then he said the termination was in the best interest of the company’s shareholders. Still in motion is a $2-billion M&A agreement between Cresco Labs and Columbia Care, which have overlapping footprints in New York, among several other key markets. But that transaction could be in jeopardy after stock prices took a tumble amidst SAFE Banking’s woes this month (Cowen downgraded both companies’ ratings). The companies now run into declining values for asset divestitures still needed in certain states to close that deal. Aborted business mergers are not necessarily a singular reflection of one state market or another but also of the current climate in the industry as a whole, where cash on hand has become a seemingly invaluable asset in 2022. Without SAFE Banking, perhaps the biggest question cannabis companies face is whether they have enough cash to sustain their operations for 2023. That’s because the market to raise new equity or debt appears quite choppy in the months ahead. -Tony Lange, Associate Editor |

| The Legalization Lane |

|

| 2023 Cannabis Legalization Roadmap: What, When and Where |

| A recent timeline of states that have legalized, those on the verge of legalization, and what’s ahead for the U.S. cannabis industry in 2023. More >> |

| Pricing Pressures |

|

| Cannabis Price Declines Intensify Inflationary Market |

| Consumers are paying more for goods, but that isn’t always the case with cannabis. More >> |

| Filling Out the Map |

| At Cannabis Business Times, we love shading our interactive U.S. cannabis legalization map gold (medical) and green (adult-use) when states reform their policies. And 2022 was a fun year with six states launching commercial adult-use sales—including New York’s pending Dec. 29 commencement—and three others passing adult-use legalization measures (Rhode Island, Maryland and Missouri). Only 11 states remain without a medical or adult-use designation. Will 2023 change that? |