Click here for full report and disclosures

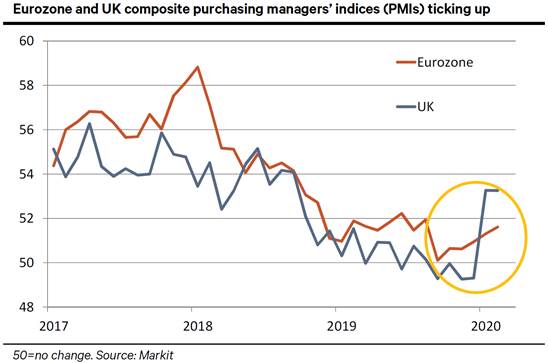

â Still on the up: The surprise uptick in the key European PMIs in February suggests that the disruption from coronavirus is not yet overwhelming the positive effects of lower political uncertainty following the Phase 1 US-China deal and the UK election. With a bit of luck, this will largely continue in the next few months. However, economic activity remains vulnerable to disruptions linked to coronavirus, which will take time to fully show up.

â Eurozone edges higher again: The composite PMI for the Eurozone rose for the third month in a row, to 51.6 from 51.3 in January, despite some modest impact from coronavirus on both services and manufacturing. Two factors drove the improvement: 1) the German manufacturing downturn – which had been at the core of the Eurozone slowdown last year – continued to ease (the manufacturing PMI jumped to 47.8 from 45.3); and 2) French services rebounded after the strikes against President Macronâs pension reform hit output in January (PMI rose to 52.6 from 51.0). All in all, export-oriented manufacturing is recovering while domestic-oriented services remain mostly firm.

â Sustained snap back in the UK: After rebounding sharply in January following the sweeping election win for Prime Minister Boris Johnson on 12 December, the UKâs composite PMI remained stable in February at 53.3. The slight dip in the services component to 53.3 from 53.9 was linked to a fall in foreign demand and a cancellation of orders from Asia while domestic activity held up well. Markit noted that âgrowth expectations across the UK private sector have edged up slightly since January and remained at the highest since June 2015â. A recovery in demand from the US and Europe lifted the UKâs manufacturing PMI to 51.9 from 50.0 in January – the highest since April 2019.

â Coronavirus – the impact so far: The continued improvement in the February survey data is good news amid fears of an immediate and significant hit from coronavirus. Of course, we have to brace ourselves for worse news in the next few months. According to Markit, lower demand for travel and tourism already weighed on services activity in February, while manufacturers face an increase in delivery waiting times linked to supply chain disruptions. In all likelihood, the hit from the virus on Europe will be greater than the hit from SARS (2003) when economic activity outside of China softened only a little. China now accounts for 16% instead of 5% of global GDP.

â Outlook: We continue to look for a sustained if gradual rebound in European economic momentum once the coronavirus impact begins to fade as long as two key trends remain on track: 1) no further escalation in trade wars (both US-China and US-EU); and 2) the UK and the EU avoid a disorderly hard Brexit. The epidemic may delay the rebound, but remains unlikely to completely derail it. We may see a U-shaped rebound rather than a mostly V-shaped one. For the Eurozone, we expect growth to return to sustained rates close to its trend (c1.5% annualised) from H2 2020 onwards. For the UK, which is turning on the fiscal taps, we expect growth to accelerate to c2.5% annualised in the second half of this year before edging back to below 2% in 2021.

Holger Schmieding

Chief Economist

+44 20 3207 7889

Kallum Pickering

Senior Economist

+44 20 3465 2672

Florian Hense

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: [email protected]

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659