|

GM. This is Milk Road – the newsletter that turns its nose to sniff out market movements, so you get the alpha ahead of time. |

(*sniff sniff* …is that…a supply crunch?) |

Here’s what we got for you today: |

|

Grayscale is the asset manager with 30+ different ways to invest in crypto. Explore all the funds offered by Grayscale. |

|

|

$ETH SUPPLY CRUNCH: INCOMING? 🥊 |

Remember that time you got in a fist fight with your little brother over which one of you got the last peanut butter cup? |

Ok, good – so you’re familiar with the concept of a supply crunch. |

The difference is, when it happens in crypto, fists don’t fly – prices do. |

And it looks like we could be on the verge of an Ethereum supply crunch… |

Check this out: |

1/ Reports of major OTC desks drying up |

OTC trades = ‘Over The Counter’ purchases of crypto – i.e. it’s not being bought on a public exchange, so it doesn’t affect the asset’s price. |

Big dogs buy OTC so their billion dollar bids don’t push prices up before their trades confirm (which would result in them buying-in at a higher price). |

Problem is: OTC markets aren’t infinite – with enough demand, they can start to dry up. |

And when things dry up…they get crunchy. 👇 |

|

For context: |

Wintermute isn’t some small shop – they’re one of the world's leading crypto market makers, providing liquidity (aka: access to fresh tokens) to centralized exchanges looking to fill orders. |

2/ The $ETH premium is growing on Coinbase |

Coinbase is a major gateway for US investors (especially institutions), which can result in stronger-than-usual demand on their platform. |

When this happens, it often causes an asset’s price to be higher on Coinbase than those of other global exchanges. |

Translation: when the Coinbase premium is going up, it indicates that demand is outpacing the platform’s supply. |

|

3/ The Digital Asset Treasury (DAT) vacuum continues sucking up $ETH |

Remember yesterday when SharpLink Gaming ($SBET) bought $100M worth of $ETH? |

Yeah, well, they just announced plans to buy a further $5 billion (with a B)! |

|

On top of ALL of that you have the fact that: |

The BlackRock $ETH ETF sucked up another $500M yesterday (that’s now $1B, from 1 ETF, in 2 days) Bitmine ($BMNR) is still set to buy a further $1B in $ETH BlackRock is looking to bring staking to its $ETH ETF (the yield from which will likely attract even more institutional capital) BitDigital ($BTBT) just bought another 20,000 $ETH (that’s ~$72M at current prices) $SBET alone has absorbed all of the new $ETH supply hitting the market over the last 30 days

|

Side note, while we’re on the topic of $ETH treasury companies: |

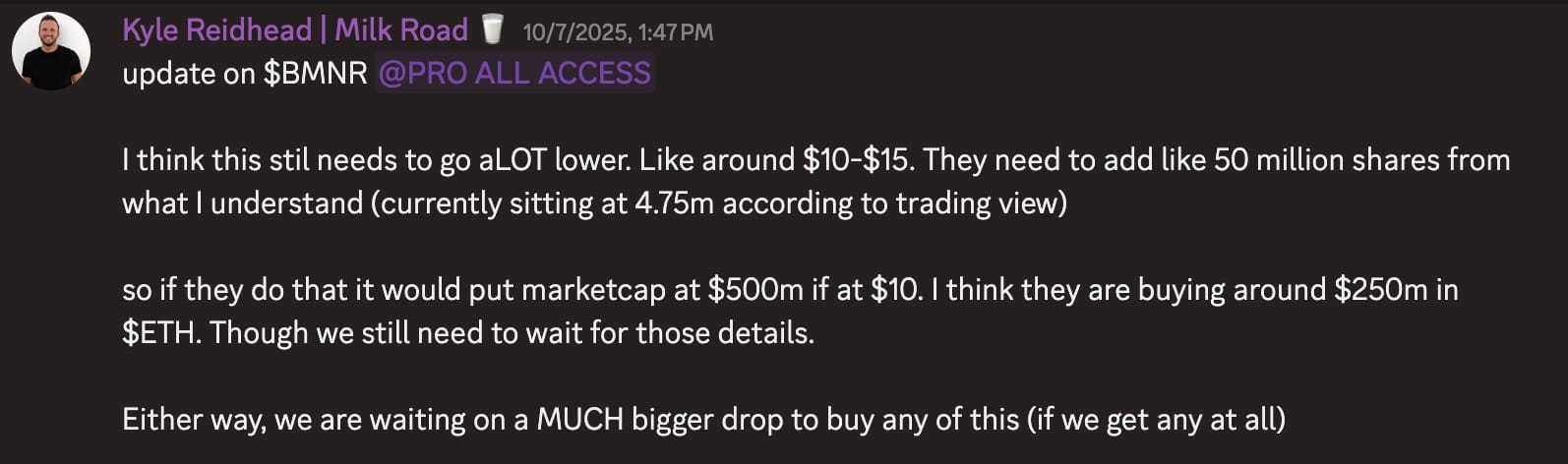

Our PRO Team called to buy $SBET a few weeks back at $10 (now over $30), $BTCS at $5.80 on Tuesday (which hit $8.40 today), and to hold off on buying $BMNR (down 18% since then — even though they just bought $1B worth of $ETH). 👇 |

| Source: PRO Discord |

|

(Cold take: it’s probably about time you go PRO.) |

|

|

Combine all of the above points together and what do you see? |

The fight for the last peanut butter cup is brewing… |

|

| | If you know crypto, you probably know Grayscale. | But did you know that Grayscale offers 30+ different crypto investment funds including: | Single asset funds (exposure to individual cryptocurrencies) Diversified funds (exposure to multiple cryptocurrencies in one fund) Thematic funds (exposure to themes like Bitcoin mining)

| The best part about Grayscale’s products? You can invest in many of them through existing brokerage and tax-advantaged accounts like IRAs. | Investors have chosen Grayscale since 2013 - now it’s your turn. | Invest in your share of the future. | Explore all the funds offered by Grayscale. | Disclaimer |

|

|

|

TWO CONSUMER CRYPTO APPS YOU PROBABLY HAVEN’T HEARD OF ✌️ |

This one’s for our intern, Archie. |

If he loves two things, it’s: |

Using the Milk Road X account to slide into famous investors’ DMs, requesting insights – and throwing a couple of “I told you so’s” at Tyler, our General Manager. |

Today, we’re looking at two apps speaking specifically to Archie’s interests (getting access to the big-dogs, and being proven right). |

…both of which have been shamelessly stolen from today’s debut edition of Degen PRO. 👇 |

1/ TimeFun ⏰ |

Creators mint “minutes” that you can buy to access group chats, calls, or streams – and these minutes trade freely, with market caps and all. |

So you can spend your minutes, or (if you think a creator’s time is going to be worth more in the future) hold on to them. |

It’s essentially the next evolution of FriendTech, which allowed users to buy permanent access to a creator’s group chat by purchasing their ‘keys’. |

The twist here is that TimeFun allots access in, well, time – so creators aren’t exchanging an uncapped amount of hours for a one-off purchase. |

(This should help to attract creators and push users to ask better questions.) |

|

2/ OpinionsFun 🧐 |

This one’s still in its early stages. |

The core mechanic: you can tokenize a hot take and let the market trade “Agree” or “Disagree” tokens (similar to Polymarket). |

E.g. tokenize a narrative like “Crypto no longer has cycles”, and let the market bet on whether that take will age well. |

(Which means the Archies of the world will soon have a quantifiable chart to point towards and say “See, most people agree with me that you’re wrong”.) |

|

If you want to get access to the full Degen PRO report, including which tokens LG is currently buying/selling/watching (along with real-time trade notifications) – you can get discounted access here. |

|

|

Alright, now go and enjoy your weekend! |

|

BITE-SIZED COOKIES FOR THE ROAD 🍪 |

The 11th edition of the European Blockchain Convention returns to Barcelona. With the EU opening up to crypto, you don’t want to miss this conference. Use code “MiLkROADebc” for a 20% discount on tickets.* |

This executive order could be huge for crypto. Trump is reportedly considering allowing 401(k) retirement plans to invest in crypto. |

People are still eyeing Injective? Seems like it as Canary Capital just filed for a staked $INJ ETF. |

Nasdaq just filed to add staking on Blackrock’s $ETH ETF. If approved, expect an explosion in inflows. |

Is spot trading a little too boring for you? dYdX lets you trade perpetuals onchain with zero gas fees.** |

*this is sponsored content.

**this is partner content. |

|

RATE TODAY’S EDITION |

What'd you think of today's edition? |

|

|

MILKY MEMES 🤣 |

|

|

|

|

|

|

ROADIE REVIEW OF THE DAY 🥛 |

|

VITALIK PIC OF THE DAY |

|