Click here for full report and disclosures

â Disinflationary shock: The COVID-19 pandemic and the associated mega-recession look set to dampen current inflation and lower expected inflation trends, at least for the next two years. While lockdowns cripple both demand and supply in roughly equal proportion, the subsequent recovery in supply – which is largely a function of the rate at which lockdowns are eased – is happening faster than the rate at which demand is rebounding. A large degree of spare capacity, most visible in rising rates of unemployment in the UK and elsewhere, puts downward pressure on the prices of many goods, services and labour. In the UK, this disinflationary shock will likely become most visible in H2 2020. Thereafter, we expect inflation to gradually edge higher in 2021 and 2022 as the slack is absorbed.

â VAT cut: On 8 July, UK Chancellor Rishi Sunak announced that the rate of VAT will be cut from 20% to 5% on food and non-alcoholic drinks from food service providers, as well as on accommodation and admission to attractions, from 15 July 2020 to 12 January 2021. The tax cut will affect 13.5% of the basket of goods and services included in the headline consumer price index. It will likely accentuate the expected pro-cyclical trend in inflation. The impact will be proportional to the extent to which firms pass on the initial cut in VAT and its return to normal thereafter.

â How much will firms pass on? This remains an open question. The sectors affected by the VAT cuts, such as hotels, restaurants, entertainment and bars, are also likely to be among those parts of the economy most negatively hit by continued social-distancing measures. Already facing acute cash flow shortages and a drastically impaired ability to meet their usual level of supply, firms may be inclined to absorb part of the tax cut to boost their own finances and pay for higher input costs, especially in restaurants subject to social-distancing rules. The high degree of uncertainty may add to firmsâ impetus to pocket the saving largely themselves.

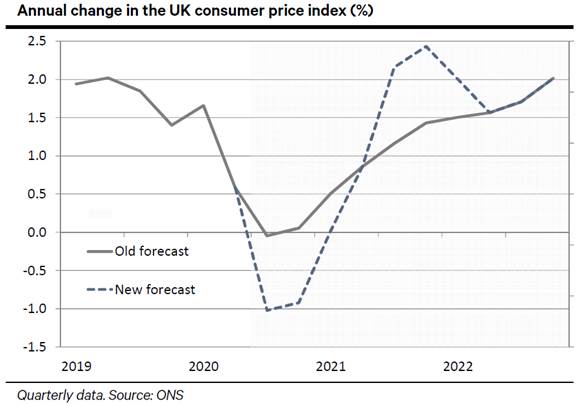

â Revised inflation outlook: Judging by the experience of the previous cut to VAT in December 2008 during the global financial crisis, and considering the current COVID-19-related challenges, we assume that firms will pass on half of the VAT cut in July before raising prices again in early 2021 once VAT goes back up. We thus reduce our inflation call for 2020 to 0.5% from 1.0% previously, with an expected low of -1.0% in Q3 versus 0.0% previously. We expect inflation to rise back to 1.4% in 2021 from 1.0%, before remaining broadly unchanged in 2022 (1.8% current versus 1.7% previously).

â Foggy outlook: The outlook for inflation and economic growth remains more uncertain than usual. Future inflation trends will depend on four key factors: 1) the rate of recovery in demand relative to supply and on virus developments, which could hit supply if lockdowns are reintroduced; 2) the extent to which firms pass on the inflation cut; 3) oil prices; and 4) potential major swings in sterling driven by the outcome of the UK-EU negotiations for their future relationship.

â Impact on consumption: The extent to which consumers will respond to the VAT cut depends upon: 1) how much firms pass on as lower prices; and 2) whether consumers buy more goods and services or whether they temporarily raise their saving instead. In conjunction with other fiscal initiatives, we anticipate a modest positive impact on consumption in 2020 that is offset in 2021 as VAT goes back up and the other policies are unwound. We now expect UK real GDP to fall by 8.3% in 2020 from -8.5% previously, before rising by 5.4% in 2021 versus 5.5%, and by 2.1% in 2020 from 2.2%.

Chief Economist

+44 20 3207 7889

Senior Economist

+44 20 3465 2672

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: [email protected]

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659