Click here for full report and disclosures

â Downside risks: Responding to the spike in recorded COVID-19 cases, many European governments are tightening some restrictions on daily life again. Badly hit countries such as Spain, France and the UK are trying to bring the virus back under control with modest measures, such as stricter mask-wearing and social-distancing rules, combined with harsher local restrictions in hotspots such as southern Madrid. Recent surveys, such as the European PMIs and the German Ifo, suggest that consumer-oriented services sectors started to lose momentum in September. The economic recovery can only continue in Q4 if major economies avoid March/April-style national lockdowns.

â Reasons for cautious optimism: The US experience over the summer shows that a renewed surge in infections can be brought under control with modest measures that do not disrupt the economic recovery. Two additional factors support our cautious optimism: i) medical progress seems to continue month by month; ii) due to its much bigger export sector, Europe should benefit more from the ongoing recovery in global trade than the US. Whereas momentum in parts of the domestic services sector in Europe may now stall for a while, further gains in export demand from the US and China can sustain a continued of less rapid recovery of aggregate economic activity in Q4 – see the four stages of recovery.

â Our base case: Despite the recent surge in COVID-19 cases across much of Europe, serious complications such as hospitalisations and fatalities remain comparatively low. This may be partly due to the huge rise in testing – more non-serious cases are found – and the increased infection rates of young and healthy people as a share of total recorded infections. With more capacity and experience to deal with the serious disease than during the first wave, the risk that healthcare systems could be so overwhelmed that many countries are forced into nationwide âstay-at-homeâ lockdowns does not seem to be acute. We base our economic calls on the assumption that such harsh measures can be avoided.

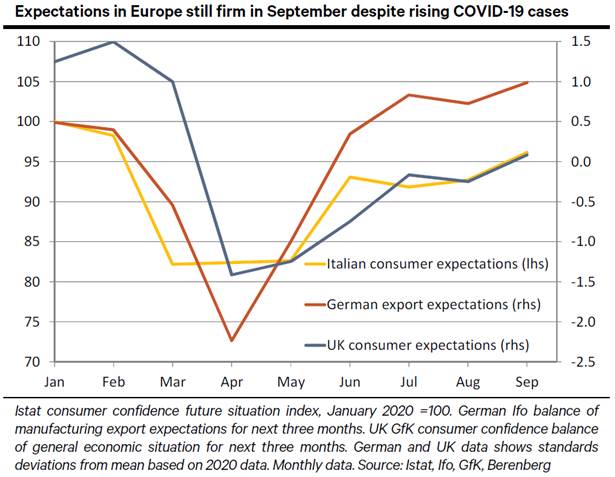

â Forward-looking data: Despite the rising risks, many expectation surveys remained firm in September. In Italy, which is recording only a modest increase in infections so far, consumers became more optimistic about the outlook in September. In heavily export-dependent Germany, export expectations advanced to their best level since mid-2018. And even in the UK, where the pandemic is currently worsening at a much faster rate than in Italy and Germany, consumer expectations still edged up in September – see chart. The second wave is less of a nasty shock than the first wave was.

â Forecast changes – mixed rather than just bad news: The rise in infections and the targeted measures to contain the spread of the virus will take a toll on growth in coming months. We shave our calls for the gain in Eurozone GDP in Q4 from 2.2% to 1.5% qoq. However, on the back of robust data for recent months, we raise our call for the Q3 snapback from the -11.8% plunge in Q2 to 9.0% from 8.4% qoq. These changes lift our forecast for the full year 2020 from -7.9% to -7.8% and lower our 2021 call from 5.5% to 5.4%. For the UK, which has more catch-up potential than the Eurozone due to a much steeper fall in Q2, we now project a Q4 gain of 2.5% instead of 3.6%, followed by a rise of 1.6% qoq instead of 1.2% in Q1 as restrictions can – hopefully – be lifted again. Of course, we also need to watch Brexit risks for the UK.

Chief Economist

+44 20 3207 7889

Senior Economist

+44 20 3465 2672

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: [email protected]

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659