|

|

|

Can You Ignore Alaska Silver Given Its $1,000/ton Deposit?

Kit Marrs, President & CEO of Alaska Silver, explains the upside thesis for Alaska Silver

Alaska Silver (until recently known as Western Alaska) has a 75 million ounce silver-equivalent deposit in Alaska. You might wonder “what’s the big deal about that? Lots of companies have 75 million silver equivalent deposits.” The big deal about that is that at current metals prices, the rock that hosts Alaska Silver’s 75 million silver- equivalent ounces grades 980 grams, or ~31.5 grams per ton. At current metals prices that rock contains metal that is worth about US$1,000 per ton!

Still, you might say, “But its only 75 million silver-equivalent ounces so it’s hardly large enough to justify capital costs of building a mine and mill to recover those ounces economically. To which I would respond that those 75 million silver-equivalent ounces are hosted on a very tiny fraction of the company’s 8-kilometer long carbonate replacement mineralized system which by the way, also contains ~500,000 ounces of gold located on the western end of that 8 kilometer long system. Yet the company has a current market cap of a mere US$32 million!

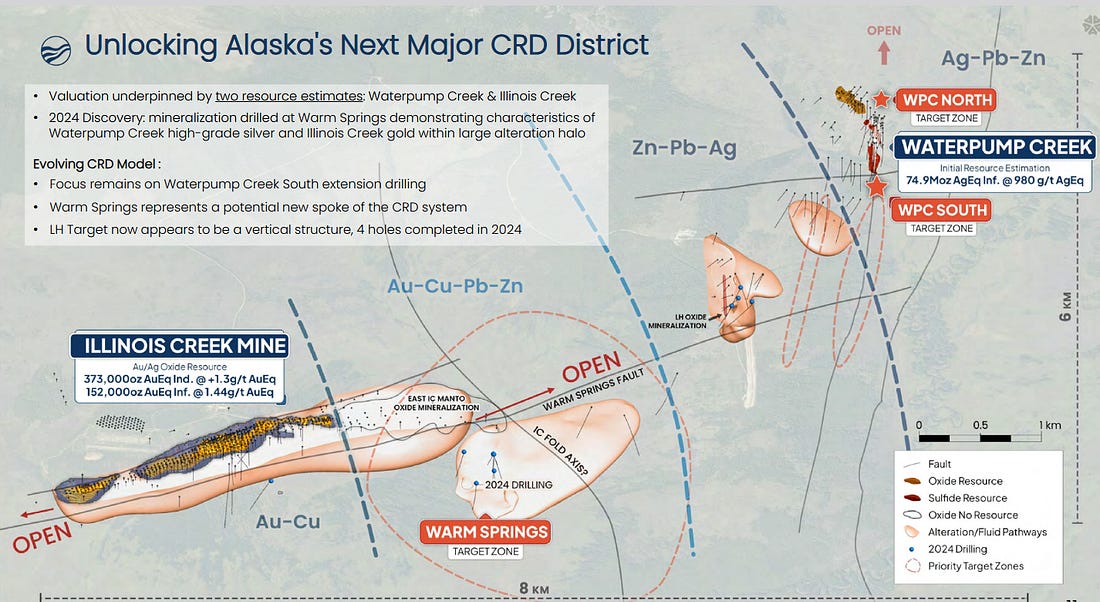

The following illustration puts into perspective the enormous exploration potential for Alaska Silver. Note that the current resource is located in that tiny area labeled WPC North. The company will be exploring WPC South and beyond this summer.

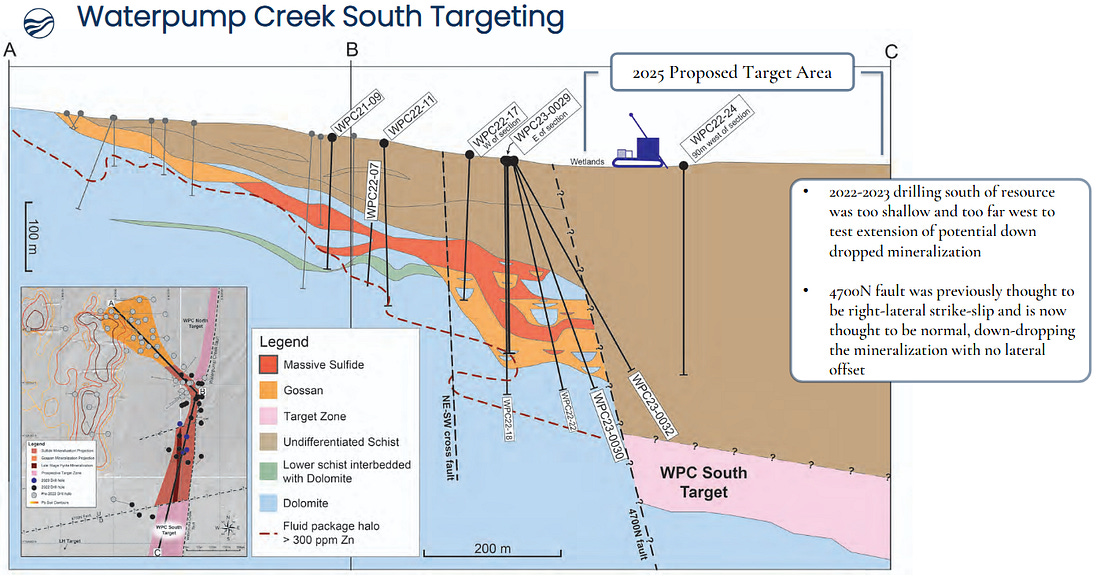

This summer’s exploration program will test management’s theory that the Waterpump Creek deposit (WPC North) that hosts those 75 million silver-equivalent ounces has been faulted downward and that drilling deeper will connect Waterpump South with the existing Waterpump discoveries as illustrated in the following cross section:

Time will tell, but in my interview with Kit Marrs, he suggests that he would need to see at least 120 million silver-equivalent ounces to justify a production decision. That could come this year if the company intersects the WPC South target with grades similar to Waterpump North. Quinton Hennigh said recently when I interviewed him that Alaska Silver’s project has the potential to become a world class deposit. And while other projects may be a lot larger, with a lot more ounces of silver, few have the kind of profit margin potential Alaska Silver has if it is able to expand its resource up to or beyond 120 million ounces of similar grades. With a 120 million silver equivalent deposit, Kit sees the the potential of a mine that could produce ~10 million silver equivalent ounces per year.

I hope you will listen to my interview with Kit to gain an understanding of the company’s Illinois Creek near term potential as well as its longer term potential to expand silver-zinc & lead mineralization in the northeastern end of the structure as well as gold and copper potential toward the south west end of the system. As well there is an indication of a mix of metals between the north eastern end and southwestern 8-kilometer long mineralized structure. You can listen to my interview here on Substack or watch my discussion with Kit on my YouTube channel here.

Alaska Silver’s shares trade under the symbol WAM in Canada and WAMFF in the U.S. There are 64.4 million shares outstanding. With a recent price of US$0.50 the company’s market cap is ~US $32 million.

Of course exploration investments always carry considerable risk. But when they hit their target they can be extraordinarily rewarding.

Best wishes,

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.