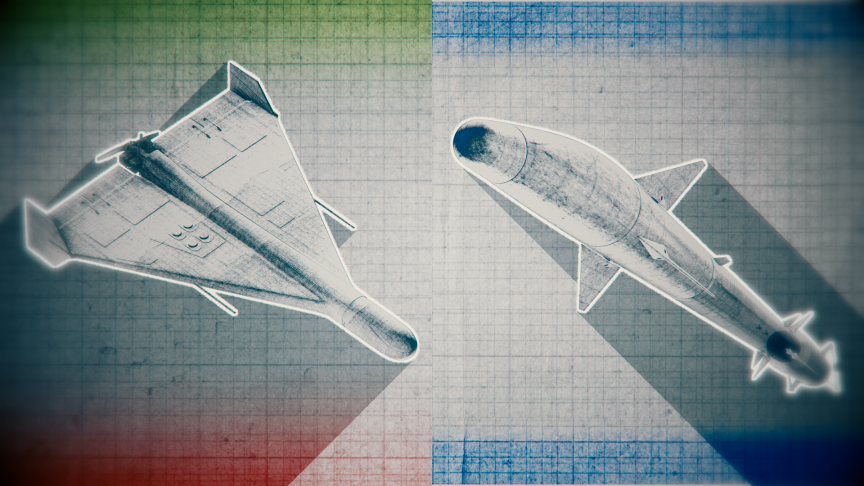

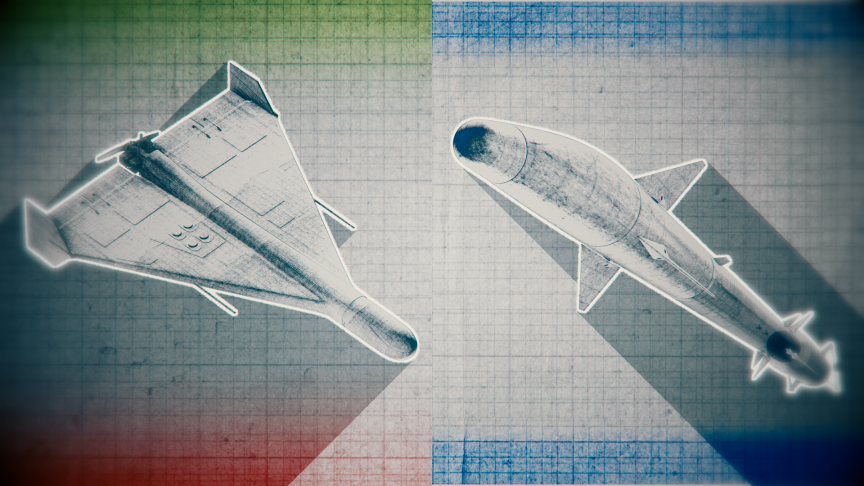

| When US inflation peaked above 7% back in 2022, the culprits were everywhere—spread across goods and services. Now, with inflation back below 3%,the problem is mainly about housing. Hotter-than-expected readings for the rental category in the first few months of the year are a big reason the Federal Reserve held back on those rate cuts Wall Street was whining for. “We thought we basically understood the mechanical, short-run model of how much housing inflation should be coming down,” said Chicago Fed President Austan Goolsbee. “And it hasn’t come down as fast as we thought it was going to have come down at this point.”  Even the rental inflation problem itself isn’t particularly broad-based anymore, geographically anyway. There’s a big difference between the situation in the Northeast and Midwest, where high inflation is lingering, and the West and South, where it’s moderating rapidly. The difference, it would seem, is all about supply. Apartment List housing economist Chris Salviati explains: “There’s really strong overlap right now between the markets that are seeing the biggest rent declines and the ones where there’s been the most construction.” —David E. Rovella The bumpy road to lower inflation may be about to get even bumpier. Vanguard is warning that the Treasury market is nearing levels that risk triggering a large selloff, pushing yields on 10-year bonds back to 5%. Investors had piled into Treasuries late last year, betting on a swift easing cycle from the Fed as it alluded to possible rate cuts in the first half of 2024. Now, with data pointing to a reluctance on the part of the US economy to be cool, the market has turned against them. “We are in a danger zone,” said Ales Koutny, head of international rates at Vanguard. Even a small move higher—past the critical 4.75% level—could force investors to abandon their bets on a rally, giving way to a wave of selling. For years, private equity executives across the globe called the shots when they met with prospective investors for their next big fund raise. Now, the tables have turned. The biggest backers of buyout firms are wielding ever-growing bargaining power to drive increasingly tough deals. The latest in a string of investor demands is this: If you want our money, put more of yours in first. As a result, some private equity executives are loading up on more debt and pledging personal assets to appease them. “The question of ‘how much are you personally putting into the next fund’ is definitely a discussion on the table,” said Reach Capital Managing Partner Jean-Philippe Boige. “It’s often the first discussion.” US aid to Ukraine, stalled for months by Congressional Republicans, may soon go forward as House Speaker Mike Johnson decided to change his position and defy fellow far-right members of the GOP. But he needs Democrats to help him push the package through. The House is expected to hold a series of votes Saturday on aid bills including money for Israel and Taiwan, with the Senate taking them up as soon as next week. The plan largely mirrors the $95 billion foreign aid legislation the Senate passed in February. Almost a year ago, Democrats similarly came to the rescue of House Republican leaders to help avoid a cataclysmic default. Still, whether Johnson’s pivot comes in time for Kyiv’s forces is another matter. Bolstered by its advantage in ammunition, Russia continues to advance, shelling infrastructure and population centers while killing scores of Ukrainian civilians, sometimes daily. But Vladimir Putin is unwilling to institute another draft and risk popular unrest, instead relying on more contract soldiers to fill the ranks.  Emergency services at the scene of a Russian strike on residential apartment buildings on April 17 in Chernihiv, Ukraine. Russia killed at least 17 people and injured more than 60 in the attack, authorities said. Source: State Emergency Service of Ukraine Netflix posted its best start of the year since 2020, attracting more new customers than anyone expected. The company added 9.33 million customers in the first quarter of 2024, nearly doubling the 4.84 million average of analyst estimates. Netflix has rebounded from a slowdown in 2021 and 2022 to grow at its fastest rate since the early days of the coronavirus pandemic. That’s due in large part to its crackdown on people who were using someone else’s account. The company estimated more than 100 million people were using an account for which they didn’t pay. Another day, another crisis at Tesla. First, Elon Musk fired thousands of employees. Now it turns out his company low-balled their severance packages. “As we reorganize Tesla it has come to my attention that some severance packages are incorrectly low,” Musk said in a short email sent to employees Wednesday. “My apologies for this mistake. It is being corrected immediately.” A surprising thing is happening to some women on weight-loss drugs who’ve struggled with fertility issues: They’re getting pregnant. That’s leading to questions about the safety of taking such medications during pregnancy. “I thought I couldn’t have any more kids,” said Torria Leggett, 40, who had been trying for another child after her first was born in 2018. In 2022, the social worker from Whiteville, North Carolina, began taking Ozempic to treat obesity, then switched to Mounjaro. As the pounds melted off, there was soon another reason to celebrate. She was expecting. “The weight loss, that’s likely what jump-started it,” she said. “I couldn’t believe it.”  Torria Leggett Source: Torria Leggett Israel and the US along with the UK, France and Jordan almost completely disrupted last weekend’s massive airborne attack by Iran. The volley of 300 drones and missiles fired at Israel—retaliation for a deadly April 1 strike on an Iranian diplomatic compound—was telegraphed by Tehran in the days beforehand, leaving Israel and its allies time to prepare. Still, the attack’s unprecedented scale illustrated how inexpensive drone technology has changed the nature of modern warfare. In How Drones Are Revolutionizing the Economics of War, Bloomberg Originals shows how the relatively inexpensive but accurate technology has become what one expert calls the “AK-47 of 21st century warfare.”  Watch How Drones Are Revolutionizing the Economics of War Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Wealth Summit: Can prosperity and instability comfortably coexist? Join us in Hong Kong on June 5 as we gather leading investors, economists and money managers for a day of solutions-driven discussions on wealth creation. Speakers include Hong Kong Monetary Authority Chief Executive Officer Eddie Yue and CPP Investments Senior Managing Director Suyi Kim. Learn More. |