|

To investors,

Bitcoin is in a class of its own. That was my message during a recent conversation with a friend. This individual was asking me about the difference between bitcoin and various altcoins. After running through the different technical differentiation points (bitcoin is truly decentralized, bitcoin operates on proof-of-work, bitcoin has a finite supply, and bitcoin has no known founder), it struck me that my friend was looking for a financial argument.

So I dug deep into bitcoin, Ethereum, and Solana over the last few days. Here is what I found.

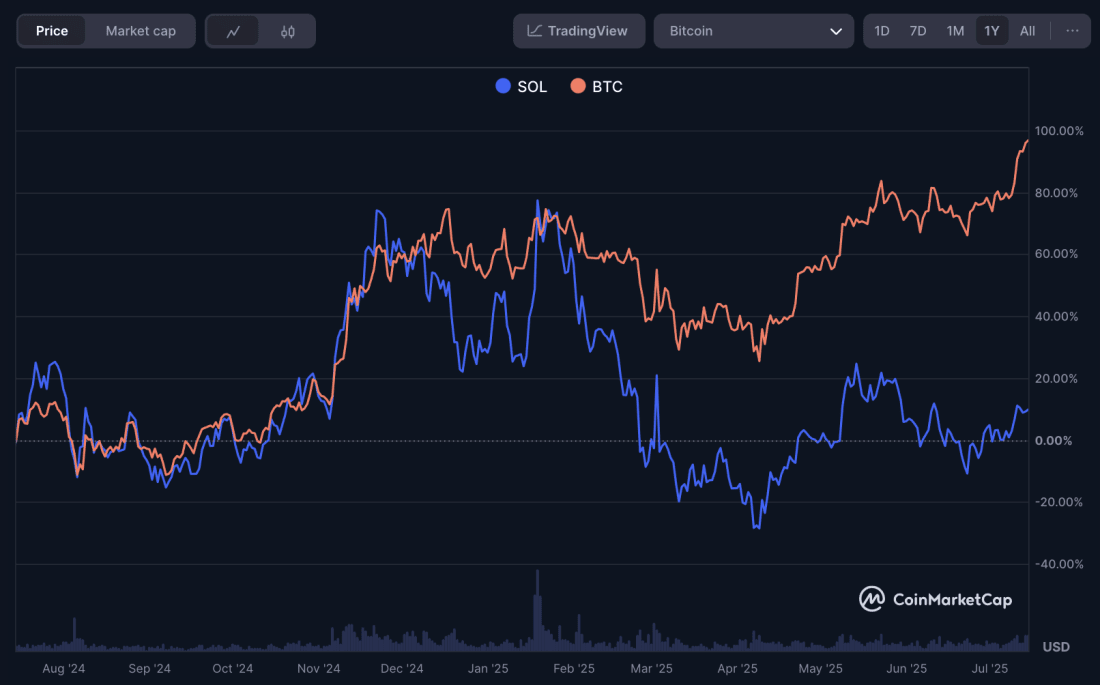

First, bitcoin has dominated the performance of the largest altcoins over the last year. Bitcoin is up about 96% in the last 12 months, while Ethereum is down about 10% during the same time frame.

Solana hasn’t faired much better — the 6th largest cryptocurrency is up about 10% in the last year, which is dwarfed by bitcoin as well.

Another way to think about these three assets is that bitcoin is hitting new all-time highs almost every day recently, while Ether is down 38% from its last all-time high in November 2021 and Solana is down 44% from its all-time high in January this year.

You could also look at bitcoin dominance for a data point. We watched bitcoin’s dominance fall from 2013 all the way through Q4 of 2022. Immediately bitcoin did a U-turn and has seen its dominance rise from a low of 38% to more than 63% today.

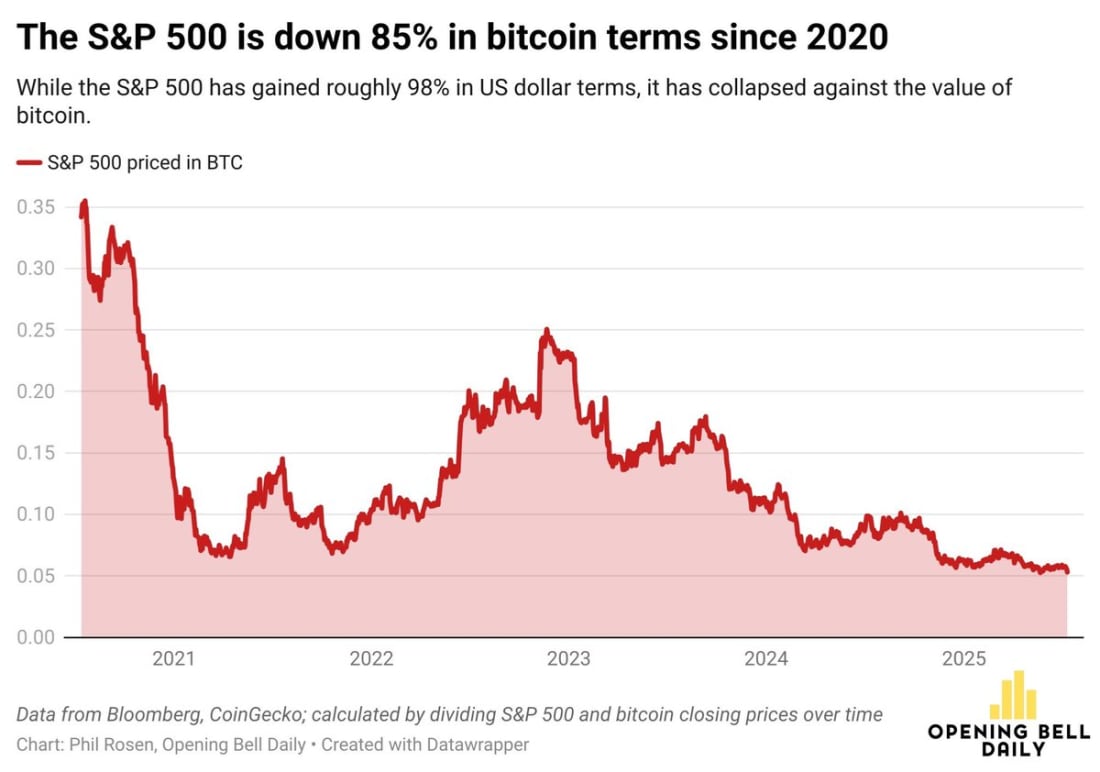

As I mentioned, bitcoin is in a class of its own. The decentralized, digital currency seems to have been intentionally created to serve as a reserve asset for billions of people. The store of value is doing an excellent job. As Opening Bell’s Phil Rosen pointed out yesterday, the S&P 500 is down 85% in bitcoin terms since 2020.

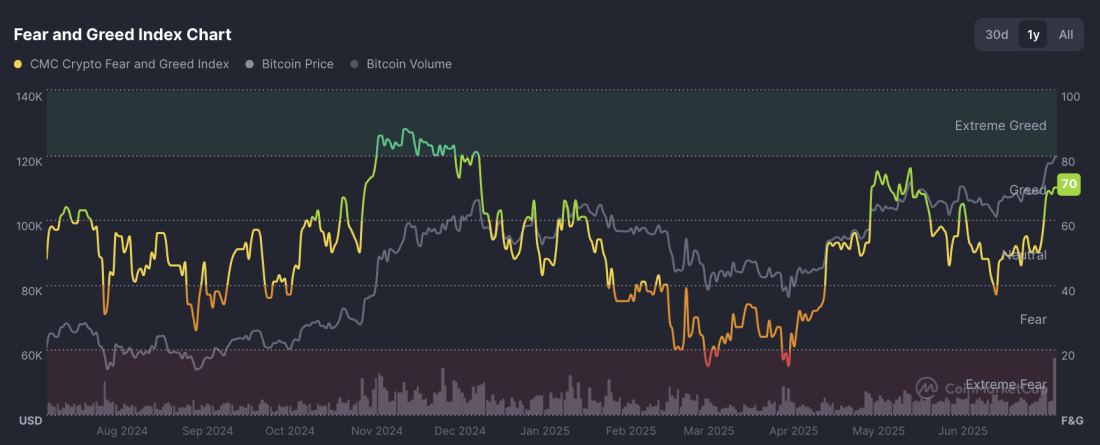

Bitcoin is the new hurdle rate. No other assets are able to keep up over the long run. And this is a big reason why we have seen the crypto Fear and Greed index go from a low of 15 on April 8th to a high of 70 for this year.

We are living through the good times right now. I am sure we will see bear markets in the future. But nothing feels better than holding on to an asset with volatility, especially when your contrarian trade becomes consensus.

And don’t let your friends make the mistake of confusing bitcoin and any of the altcoins. Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Everyone Wants Bitcoin On Wall Street

Anthony Pompliano joins Squawk Box to talk about bitcoin hitting all-time high, what is driving the price higher, inflows into bitcoin ETFs, and why everyone wants bitcoin.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.