Ghost Bites:

- Emira's offer for Transcend is now unconditional, unfair and unreasonable - but shareholders can accept it if they like!

- Finbond's losses have deepened thanks to ongoing issues in the US business

- Mpact has issued a preliminary response to Caxton's latest attack

For these stories and a summary of the latest director dealings on the JSE, read Ghost Bites>>>

Are schools good investments?

Well, it depends.

If you learn nothing else from Ghost Mail, I just want you to understand that investment success is always a function of what you bought and how much you paid for it. Even a business that seems solid and dependable (like a school) can be a poor investment if you overpaid.

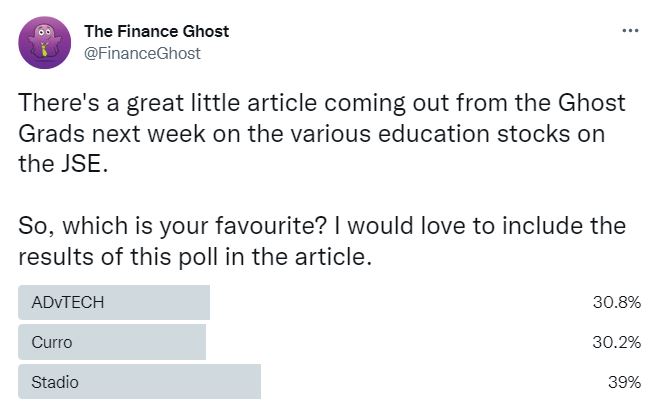

Investor sentiment is split pretty evenly in this sector. Take a look at the results of this poll I ran on Twitter:

To give you an overview of the latest results and a summary of share price performance over the years, Ghost Grads Kayla Soni and Kreeti Panday took on the challenge of researching this sector. You can enjoy their findings in this article>>>

The not-so-Great British Pound

In this week's column, Chris Gilmour focuses on the strength of the dollar and the stark contrast to the state of affairs in Europe and the UK. For those who somehow believe that South Africa is the only country in the world with problems, this is a particularly important read.

Enjoy Chris Gilmour at this best in this article>>>

Data volatility

In the latest update from TreasuryONE, we learn that non-farm payroll numbers on Friday were higher than expected. Unemployment printed better than expected at 3.5% vs. 3.7%. Although this is "good" news for the economy, it means that the Fed will not be deterred from its hawkish narrative. This led to further strength for the US dollar, pushing the rand to a high (or a low, depending how you think about it) of R18.16.

The non-farm payroll number was just the curtain raiser for the inflation data that will come out on Thursday. If it prints higher than expected, it will be a bad outcome for the markets. Of course, a reduction in inflation will be positive. Either way, volatility towards the end of the week is likely.

To make sense of it all, TreasuryONE is hosting a webinar this wee k Wednesday at 1pm. You don't want to miss this opportunity to learn about the macroeconomic drivers in the market. Best of all, there's the opportunity to ask questions at the end. All you have to do is register for free at this link>>>

Unlock the Stock recording: Growthpoint

Growthpoint is the latest company to use the Unlock the Stock platform to reach the retail investor audience. Of course, there were a number of professional analysts who were also on the call, taking advantage of the opportunity to engage with management. By giving investors the opportunity to ask questions alongside the pros, Unlock the Stock helps level the playi ng field.

To learn more about Growthpoint and the property sector in general, watch the recording of the event here>>>

Looking to the future with Magic Markets

When it feels like everything is against you, keeping a cool head in the markets is critical. After such a tough run for growth stocks, those who invest in this space need to learn from mistakes and maintain a healthy balance of skepticism and optimism.

Justine Brophy from AnBro Capital Investments joins us again to talk about why he feels good about the future. Of course, we couldn't miss the opportunity to highlight an interesting stock. Listen to the episode at this link>>>

Have a great Monday!